David Hsieh of IHS Markit has published a detailed blog post looking at the likely development of large area LCD panel pricing and has concluded that there will be falling prices for this quarter (not much of that left! – Man. Ed.) but that prices will stabilise in Q2. TV makers are optimistic that about the market in 2018 and believe that this may offset the ramp up of capacity in China. Q1, of course, is traditionally a weak quarter for TV set and panel demand (Chinese TV makers are 16% down this quarter compared to last, IHS says).

David Hsieh of IHS Markit has published a detailed blog post looking at the likely development of large area LCD panel pricing and has concluded that there will be falling prices for this quarter (not much of that left! – Man. Ed.) but that prices will stabilise in Q2. TV makers are optimistic that about the market in 2018 and believe that this may offset the ramp up of capacity in China. Q1, of course, is traditionally a weak quarter for TV set and panel demand (Chinese TV makers are 16% down this quarter compared to last, IHS says).

As we reported, BOE officially powered up its B9 Gen 10.5 fab in December (BOE to Start G10.5 Fab Early 2018) but IHS said that the company has only prepared photomasks for 65″ panels at the fab. However, despite this clear focus to keep things simple, it may take some time to ramp up to full capacity (a view shared by Korean panel makers), which is 90,000 substrates per month – a potential supply chain for 7 million 65″ TVs per year, which is bound to have a big effect on the large screen TV market.

CEC has two new fabs – a G8.6+ making oxide TFTs in Chengdu as CEC Panda and a 8.6 making a-si in Xianyang as CHOT. CEC Panda will start with 50″ and expand to 58″, while CHOT kicks off with 32″ before adding 50″ and both will start to produce in April, adding to oversupply in the 50″ segment.

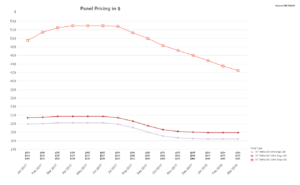

IHS Data shows panel pricing dropping,especially on 65″. Data:IHS, Image:Meko

Inventory Background

Of course, production is one factor influencing price, but the state of inventories is the other. Hsieh reports that some panel makers have very high inventory (1.8 to 2.0 million units) of 50″ panels at the moment, which they will want to clear. Smaller sizes such as 40″ and 43″ are not so bad as panel makers cut prices hard back in 2017 to keep product flowing, although TV buyers are cautious about buying while panel prices remain on a downward trend.

Inventory for 65″ panels, on the other hand, is mainly with TV brands as panel makers offered aggressive pricing in Q4 of 2017.

Foxconn a Factor

Foxconn a Factor

Foxconn has been strongly developing its Sharp-branded TV business and IHS said that it will have got close to 10 million global TV shipments in 2017. Foxconn is also exploiting the InFocus brand in 32″, 40″ and 50″ sets made by Innolux (also a related company of Foxconn). The firm’s target for 2018 is 9.5 million sets in China (up from 4.8 million in 2017) along with 2.5 million InFocus sets. Tactics to boost sales include consignment stocks for retailers to keep inventory off their books until sold. Hsieh reports that Foxconn may scale back its aggression in other regions.

All in all, Foxconn would like to sell 19 million TVs with its own brands this year (half using panels from Innolux) including two new brands in the US:

- Flying Eagle (65″ and 70″) with embedded Amazon Fire TV

- InFocus (50″, 60″, and 65″), likely with Roku

Koreans Recovering

IHS said that Korean panel makers are seeing demand as better than they feared for the first half and they will try to stabilise prices for 32″ and 55″ even though there may be too much inventory. They don’t plan to follow 50″ prices down, but will try to stabilise 49″ as demand for 55″ UltraHD panels is improving, so they will reduce allocations for the 49″. LG Display is reported to be seeing more 55″ demand.

However, the longer term trend has for the Korean makers to reduce their capacity as they switch to OLEDs. Samsung is also switching its Suzhou fab from 49″ and 55″ panels to 65″ + 32″ using MMG techniques. (MMG Getting More Interest) The firm’s T7-2 fab will also switch to making more 75″ which will reduce capacity for other sizes. LG Display will also switch to more 75″ using photo alignment for better contrast and response. The Guangzho G8 fab will also follow Samsung in switching to 65″ + 32″.

Hsieh believes that the TV businesses of both Samsung and LG have plenty of 65″ inventory, so are not in a hurry to switch to using panels from BOE.

Older Fabs Restructuring

The new capacity arriving means a change for older fabs and a number of ‘Gen-5-and-below’ fabs now slated for restructuring or closing, although the impact is not as significant as when one of the G8 fabs closes.

TV makers remain positive about the impact of the World Cup on demand.

Analyst Comment

I have always been somewhat sceptical about the effect of the World Cup and Olympics on TV sales. I have often thought that the real reason for the increase in sales is that, in anticipation of bigger sales, set makers build extra stock and offer special incentives to retailers. Retailers then have big promotions, which don’t make a huge difference. Both groups then see slow sales and dump the sets. That means that they get absorbed, but not at a price that makes brands happy!

Certainly, there used to be an effect that we saw when we used to track set sales in Europe, but the main effect was in pulling demand into Q2 from Q3, which is usually a stronger sales season in the years when there is no World Cup or Olympics. (BR)