UltraHD TV shipments are rising extremely quickly, with IHS’ latest figures showing a 400% rise between Q1’14 and Q1’15. 4.7 million units were shipped worldwide in Q1’15 – barely down from the traditionally strong Q4. Growth was especially robust in China during the Chinese New Year period.

Despite strong UltraHD TV growth, the rest of the TV market did not perform as well. Overall set shipments fell 2% YoY, while LCD TV shipments alone rose just under 3%. There has been a significant reduction in both plasma and CRT shipments over the previous year.

Slowing set shipments have not affected the UltraHD TV market. These sets continue to perform well, thanks to falling price premiums, an expanded selection and rising content availability. Shipments to China alone rose 244% YoY, to 2.6 million units. These accounted for more than half of global demand. IHS’ director of TV research, Paul Gagnon, said, “This growth was driven by an expanded assortment of screen sizes between 40″ and 50″ that have recently become available from manufacturers, and retail premiums well below 50%, which is encouraging consumers to upgrade”.

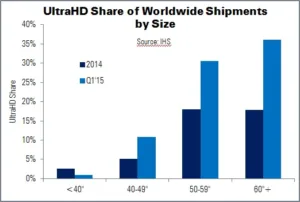

UltraHD TVs are currently limited to mainly 40″+ sets, where the benefit of the higher resolution is most obvious. They are also more common in regions where consumers are willing to pay a premium. Overall, 9% of TV shipments in Q1’15 were UltraHD sets. However, when looking at large sizes, that figure rises significantly: more than 31% of 50″+ TVs were UltraHD.

Samsung led the market in revenue terms, taking more than a 32% revenue share – slightly down QoQ. Chinese brands gained share, thanks to their country’s strong performance in the quarter. UltraHD TVs accounted for 16% of Chinese brands’ TV shipments in Q1, but only 11% of Samsung’s shipments.

LG was the second-largest UltraHD TV brand in the period, with a 15% revenue share, followed by Hisense, Sony and Skyworth.