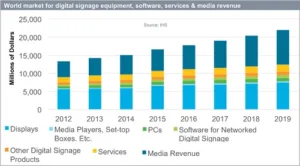

Digital signage revenues will rise 10% YoY in 2015, and 7% in 2016, says IHS. Total costs for installations are falling each year, and larger-scale deployments are becoming feasible in many industry sectors. In addition revenues are being boosted by added-value features, such as larger displays, narrow bezels, high resolutions and lower power consumption.

IHS’s Digital Signage Industry Market Tracker shows that software revenue had its highest-ever overall growth last year, rising 21% YoY to $431 million. Media players and STBs had the next-highest increase (up 19%), followed by DOOH media (11%).

“As the 4k ecosystem continues to mature, further revenue growth for media players, set-top boxes and PCs will be driven by the expansion of 4k digital signage solutions”, said IHS’ Sanju Khatri. “An increase in the availability of 4k media players, along with decreased costs for entry into the space, will help propel strong growth this year and in 2016”.

Analyst Comment

Most of the revenue growth is in software, services and media revenue in this forecast. The forecast CAGR for the displays is around 3.5% in revenue terms. Given the positive noise we hear about the developments of the market in China, the forecast would suggest little or no revenue growth in the Western markets. The established panel makers are looking for revenue in this area, so they will be hoping that IHS is too conservative!

LDM’s publisher, Meko, also forecasts the European market and is quite conservative on UltraHD in signage. The challenge in signage is usually content development and maintenance and we suspect that systems will stay at FullHD for some time until complete inventories can be in UltraHD. Of course, the panel makers could force this by switching their panel production – and that will be a temptation given the rate of switching in the large TV market. (BR)