Ferdinand Kayser gave the SES press talkFor the last several years, this reporter’s IBC experience has started with the annual SES press event (and dinner) which is a great chance to network and talk to colleagues and analysts as well as getting an update on the SES business – which helps us to understand the developments in the very important satellite TV business in Europe.

The first speaker was Ferdinand Kayser, CEO of SES, whose topic was “SES’s new frontiers for growth”. He started by saying that there are differences in satellite use between developing and developed countries. Linear TV remains the key driver of viewing and is still increasing in some regions. There is still a CAGR of around 4% so there should be around 38,500 linear TV channels worldwide by 2024. The number of TV households is still going up all around the world and the number will increase by 10% to 1.5 billion – 16m more in MEA and 5M in Europe – by 2018.

The reach of SES’s satellites continues to increase to 154 million households in Europe, with 84 million in the US, 24 million in Latam, 7m in MEA and 44m in APAC. The reach in North America is via cable operators (SES broadcasts from its satellites to cable head ends which then transmit to the home). In the Middle East, Yahlive has grown from 76 to 146 channels, with 32 in HD and that’s the fastest growing DTH market for the Farsi, Kurdi, Afghan and North African communities.

Turning to the mature markets, the key development is the arrival of UltraHD and over the last four years a lot of work has been done to develop the technology. Phase 1 has started now, with Phase 2 expected in 2017 (WCG and HDR) and 2018 for HFR, in addition to the resolution improvement. UltraHD sets are selling well as prices are coming down as fast as they did with HD, but starting at a lower price. That means that the number of UltraHD screens will grow with a 190% CAGR. The low prices will encourage consumers.

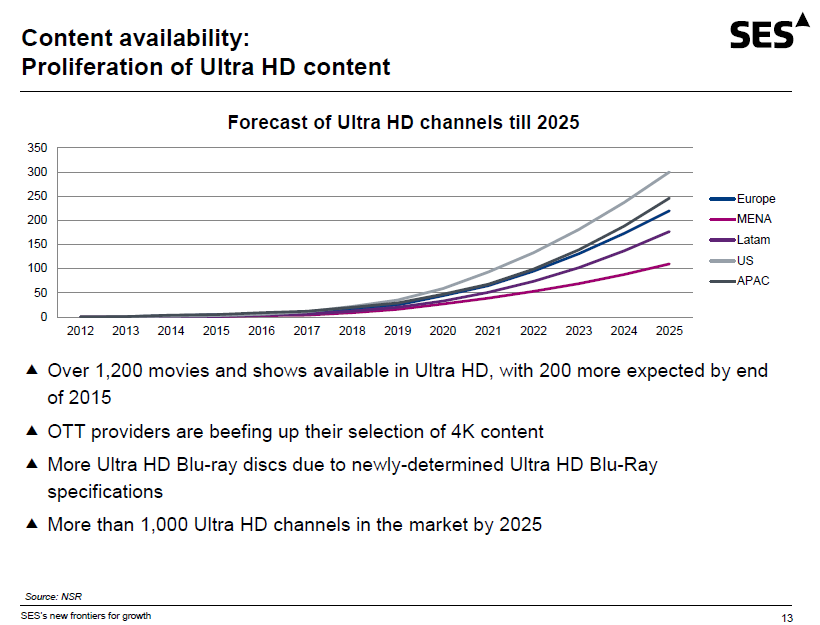

There is also a demand for better content as well as more. The PayTV market will shift to HD as a majority of channels by 2018. There are 1200 movies that are available in UltraHD, with 200 more by the end of 2015 and by 2025 there will be more than 1,000 UltraHD channels. SES remains confident about the continuing dominance of satellite for UltraHD because the point to multipoint distribution is unmatched and there is lots of capacity with high quality.

SES started Fashion One 4K in Europe, South America and the US as an UltraHD channel. Pearl.TV is a German shopping channel and has already launched UltraHD – Kayser said that when there was a switch to HD, shopping channels boosted their sales.

High4K is a new channel in 4K for the US and will be launched as a Free-to-air (FTA) channel – details are expected to be released at Mipcom in a few weeks. In 2025, there will be 300 UltraHD channels in the US, 220 in Europe and 250 in Apac. In the booth at IBC, there were HDR demos using LG’s OLED displays and also using Dolby Vision.

SES believes that it is its package of services as well as its capacity that is winning this business and Kayser said the firm will continue to expand in the value chain. Blu-ray will probably decline as streaming increases and by 2018, SES believes that streaming income will surpass DVD/Blu-Ray revenues. This is the driver for the development of SES’s “media toolbox” which allows a “one stop shop” offer for content distribution.

The first element in this toolbox is the “Fluid Hub” for media and metadata content storage and distribution. Lucid is a service that allows linear, catch-up TV and either subscription or transactional VOD for operators. Liquid VOD allows “real” VOD to allow SES to supply content to viewers that are outside broadband reach.

The HD+ platform is still growing well and at the end of 2014 there were 3 million households in Germany, with 1.65 million subscribing (the first year is free). As we have reported, UltraHD is also being broadcast with a channel on HD+. Technisat has a smart TV with a CAM for HD+ so no STB is required (or CI+). Kayser said that other brands are expected to take the same route, in collaboration with Nagra.

It’s clear to everyone that broadband is becoming a universal need and broadband capacity is being consumed at up to 20GB per person per month by 2020, a CAGR of 18% and by region the CAGR is 23% as the household numbers are also growing.

There are good opportunities for supplying maritime and aeronautical broadband from satellites. In the US, many planes now have broadband and the demand for capacity has increased massively since 2012. By 2025, SES believes that all planes will be equipped with broadband.

Governments have a big need for capacity to support UAV (drones) and each modern drone uses 10-50 Mbits of bandwidth – as cameras get better, capacity demand increases. Peace keeping is more and more about UAVs rather than spoldiers.

Satellites are getting heavier and 50% of the traditional mass of satellites are fuel, but SES is switching to electric propulsion. Communication capacity and digital processing is improving. At the moment, it takes around three years to design, build and launch a satellite and SES would like to see this reduce. SES is working with SpaceX to try to reduce the time to market for new satellite orders. Modular Construction and re-usable rockets are being worked on. SES has six satellites under procurement, which will boost capacity. Much of the capacity growth will allow coverage of Asia, Latin America and North America as well as the North Altantic and Europe. Spot beams can be controlled and the bandwidth can be channelled, for example, tracking the transatlantic flight waves as planes go in waves across the Atlantic.

Airlines have found that, for people using broadband on their flights, Amazon is the most popular site visited, so, evidently, passengers like to buy on board. Airlines can use this to allow purchase of duty free in air, with delivery as you leave the plane. This saves shipping bottles of alcohol around the world many times. Kayser said that a single piece of sugar, flying over a whole year, costs $500.

O3b satellites, which are nearer than the SES traditional geo-stationary fleet, is important for broadband connectivity, where low latency is needed, and will be used in combination with the traditional SES fleet of satellites.

As you get closer to the earth, the satellite will not be stationary, it rises and falls “like the sun, but faster”. To get continuous coverage, there has to be a handover between the satellites. The closer you are, the more handovers you need between different satellites. That will be a challenge for nearer satellites, SES believes.

At the show, SES published a white paper on UltraHD that you can find at http://tinyurl.com/p6lt8e2. Eutelsat said that it would work with SES to boost satellite, starting by supporting the SES SAT>IP technology although it will also develop its own system. (Eutelsat Says Viewers Ready for UHD Bouquets)