Some of the topics that I have covered have been related specifically to the on-going pandemic. For example:

-

Although there seems to be little evidence of Covid transmission from surfaces, a lot of work has continued to try to develop ‘touchless touch’ technology. I still favour making it possible to use personal devices as the touch interface, but that is not suitable for everyone.

-

We started the year with presentations around CES and the developments in the US device market and NPD’s Stephen Baker highlighted a point he would keep presenting at other events during the year, that the premium TV market in the US now starts at $700, rather than the previous level of $1,000. The various presentations through the year also highlighted the dying down of any special impact on the PC, monitor and TV markets from the pandemic. (SmartTV Gets to an Inflection Point)

-

The pandemic-driven boost in demand for LCDs for TVs, monitors and other IT applications meant a very high peak in LCD pricing and panel maker profits which turned after the summer into a very rapid drop in pricing and revenues. Although there was talk at the Display Week Business Conference about a potential end to the ‘Crystal Cycle’, those ideas turned out to be premature. LCD Industry Stability Could Break Out…. Here We Go Again on the Crystal Cycle

-

One of the key markets for large LED displays has been the event and rental market. Covid has really hit that market, but the really high quality LED makers have been able to replace that business by selling video walls to be used as movie or TV backgrounds or ‘LED volumes’. Production companies have been able to reduce the time and cost of location shooting, despite the high cost of renting such facilities. (Virtual Production Comes of Age in Covid)

Turning to technology…

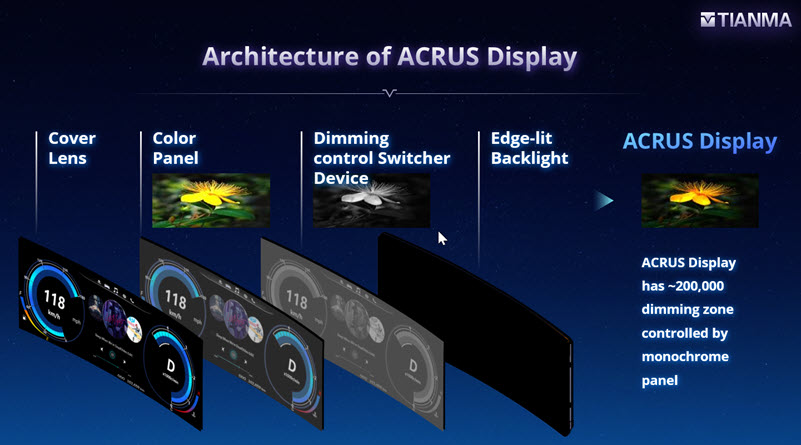

Dual Cell LCD

One of my technologies to watch over recent years has been dual-cell LCDs which use one to modulate the backlight and achieve high contrast. TV makers have pretty well abandoned the technology although it is still being developed for applications such as automotive by Tianma and Visteon. (Another Name for Dual LCDs in Vehicles). Hisense launched the U9DG TV in the US in 2021 (Hisense Finally Introduces Dual Cell TV in the US) , but the 75″ set cost $3,500, got not so great reviews and had its price dropped to $2000. JDI is also working on the technology and has published a paper at IDW on its work that I plan to cover in the future.

Microdisplays have really got a lot of traction and new microOLEDs with UltraHD resolution will be in the market in headsets next year, really boosting the image quality of head-mounted displays. Big improvements in optics (especially folded & pancake optics (3M & Pegatron Working on VR Headset with Folded Optics) and system designs are also boosting the realism of images. JBD, eMagin, Kopin and Sony have all boosted what they are doing this year and there is more to come.

We reported in March on the views of Mark Zuckerberg on AR & VR Mark Zuckerberg Talks on the Future of AR and VR and at the end of the year, he captured the imagination of the markets by renaming his company to ‘Meta’ and hyping up ‘the Metaverse’. (Metaverse – Meta and Drink for Critics)

LED & microLED

We started the year talking about the developments by Sony of its still stunning looking CLED technology (Sony Upgrades (and Downgrades) its Crystal LED and Sony Gives Details of the Crystal LED System) and big LEDs remained a topic for the year. Several times I have written about what I have seen as a key topic and that is the driving of LED displays. We’ve had a number of articles on that topic from me and from others. (most recently (Macroblock Talks Up Virtual Production and MiniLED)

Earlier in the year, it started to be getting clearer that unless microLED could solve the problem of falling efficiency with chip size, especially in red, it would not be able to realistically compete with OLED. So, during the year we heard and reported on several approaches that are claimed to fix this. (and Nanosys bought Gl? partly based on such an approach).

I said to somebody yesterday that when I joined the display industry in the early ’80s, LCDs were seen as ‘three to five years away’. That persisted for around 20 years! In the same way, high volume (at low price) large area microLEDs seem to have been 3-5 years away for several years, now. Are MicroLEDs Really Going to Happen?

OLED

OLED had a good year, with LG Display’s Chinese fab boosting output and increasing its share in the premium TV market. Apparently bowing to this success, there have been strong rumours recently that Samsung will buy OLEDs from LG Display for TV applications. If it is successful with its QD-OLED (and some production of panels is reported to have started), the combination of OLED and QD-OLED should give Samsung an increased share of the premium TV market.

OLED continued to take share in the premium end of the smartphone market and as Samsung Display released some UTG-based panels to brands other than Samsung Electronics, foldable OLED sales were boosted in 2020. They are still expensive, but widespread reliability issues don’t seem to have arisen, and that has been a cause of some nervousness.

The adoption of LTPO to allow variable refresh rates has been a big trend in smartphones and I was pleased to be able to describe what it is in June. LTPO is a Hot Technology – but What Is It

OLEDs have started to appear more widely in automotive applications as dual layer (tandem) architectures from LG Display have been able to meet the qualification requirements of auto makers. They are expensive, but very desirable. (and alleged to be desirable for Apple to use in tablets and elsewhere, but, also allegedly, too expensive).

As I wrote just a few days ago (OLEDs Getting Better Efficiency for IT Applications), OLED makers are still boosting the efficiency and lifetime of OLEDs and just this week, LG said that it has added 30% in brightness with new chemistry for its OLEDs. There are other technologies that could boost it again.

Improving brightness and lifetime is the next big target for OLED makers. If Samsung goes ahead with a G8.5 OLED fab for IT applications, that will introduce the technology to monitors and boost the share in notebooks and tablets. Having said that, just this week, LG Electronic’s 27″ high end ($3K) OLED monitor using inkjet printed panels from JOLED has just appeared in stores in the US after a long gestation period. (OLEDs Into IT – the Whys & Wherefores)

miniLED

MiniLED-based LCDs have continued to develop and grow partly because the Taiwanese have not been able to get a good share of the OLED market and need a competitive technology. Apple has been a prime mover in adopting the technology and it is edging into TV. Cost remains a challenge, but the supply chain is optimistic that it can see radical cost reduction over coming years to keep LCD competitive.

I was impressed with what Smarkem has been doing to use its organicTFT technology for driving miniLED backlights. (You’re Going to Hear About Smartkem Again)

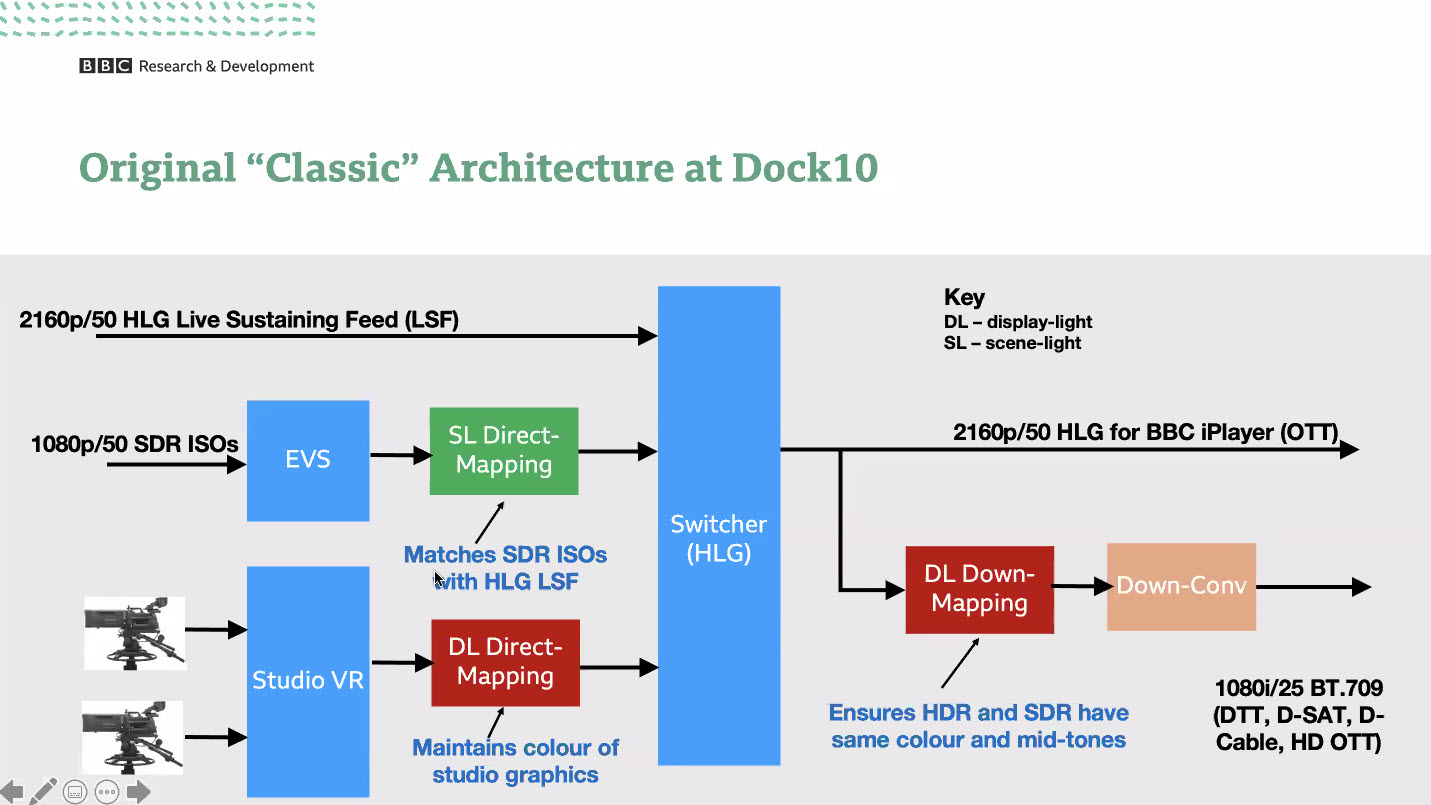

HDR

HDR content continues to develop and become more widely available – I admit to perking up when my TV recognises a PQ-based content item and the resulting images are sometimes spectacular. Still, the content industry is working through the processes and workflows needed for all the different types of SDR and HDR content that need to be supplied. (HDR Adoption Accelerating in Broadcasting) and (SMPTE Visits the BBC’s R&D for an HLG Update)

WCG

Wide Colour Gamut technologies continue to evolve and QDs have developed in LCDs, with OLED in Samsung’s QD-OLED, in microdisplays and Nanosys has successfully developed QDs that are more stable in air and said during Display Week that its QDs can be incorporated directly into diffuser plates, reducing the need for barrier films and moving the price point for TVs with QDs down towards the mainstream. Nanosys, QDs and Vacuums.

Although QD has got the headlines, phosphor makers have continued to develop the materials and GE has a new green that will help to get to 100% of DCI-P3 and AdobeRGB. There are also new architectures based on blue LEDs + KSF red phosphor combined with a ‘remote green’ which could be QDs or perovskites (WCG Heavyweights Slug it Out at Display Week)

Colour, of course has to be measured and I wrote first about Gamut rings – a method of characterising 3D colour in a 2D diagram – at the end of 2020. However, this year, release V1.1 of the IDMS standard added a standard to that idea. The standard has a lot more in it than just that and deserves to be widely used and adopted. (ICDM Has IDMS V1.1 and Other Acronyms)

Phew…. That turned out to be a bit more than I planned, still it has been an interesting year!! (BR)

This article has been made publicly viewable, so will not count towards your free DD allocation if you do not have a subscription.