Although Quantum Dots (QDs) often get the headlines on extending colour gamuts, the market reality is that phosphors have often been the materials that have allowed wider colour coverage, usually for reasons of cost. GE and Nanosys are the heavyweights of marketing phosphors and QDs and each landed punches at Display Week.

I wrote about some of the news that Nanosys released around Display Week (Nanosys, QDs and Vacuums) and now I’m catching up with the talk during the DSCC/SID Business Conference by General Electric (GE) on its progress in phosphors. The talk was in two parts – the first covering the market by Dr. Rachel Cassidy and the second on technology developments by Dr. James Murphy.

GE’s PSF/KSF red phosphor has been very successful since 2014 in boosting the red gamut to P3 and beyond. The material is said to have been used in 40 billion LEDs in display applications. By 2017, Yole was reporting that the material was the leading source of red in WCG LCDs.

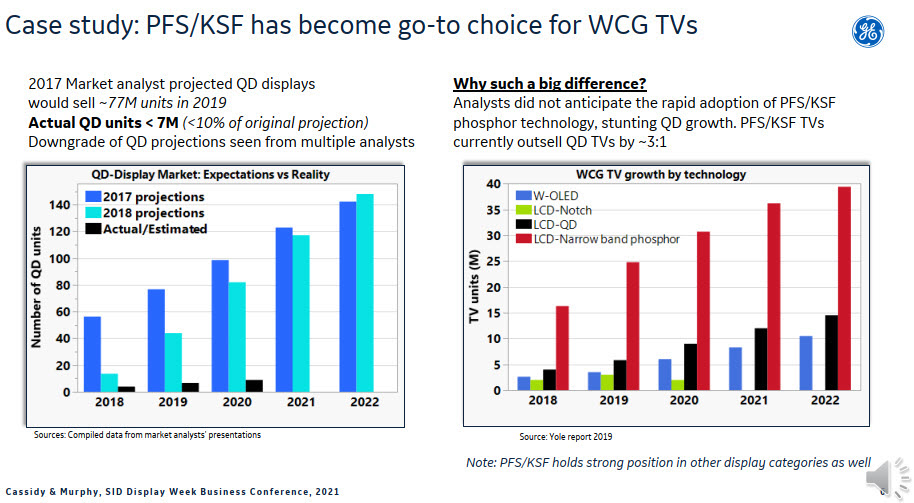

GE couldn’t resist pointing out that QDs had got nowhere near the level of forecasts by some analysts four or five years ago. GE claims that KSF is outselling QD sets in the TV market at a ratio of around 3:1 and at Display Week Nanosys said that QDs had been put in around 35 million TV sets – which is pretty close to the number that GE expects to use narrow band phosphor this year alone.

GE compared forecasts from 2017 to the actual volume of QD TVs sold (although it didn’t identify the analyst!)

GE compared forecasts from 2017 to the actual volume of QD TVs sold (although it didn’t identify the analyst!)

KSF is also used in smartphones, notebooks and desktop monitors. Cassidy showed a slide with a long list of leading brands using the phosphor. Although GE supplies companies further back in the supply chain, the distinctive spectral power distribution of its phosphor is easy to recognise, so simply by going into a few retail stores and measuring the sets, it can see where it’s products are used.

GE is confident that this dominance will continue – although the announcement of air-stable QDs at Display Week by Nanosys will significantly reduce the cost and make QDs much more competitive.

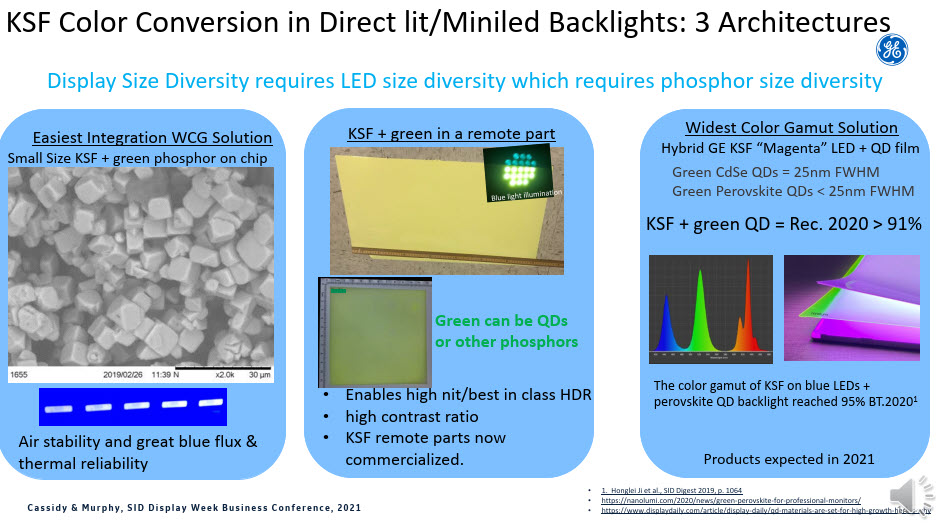

Up to now, the narrow band phosphors have been for red, while green phosphors have been based on Beta Sialon which is a relatively broadband green. (Very briefly, white LEDs use blue LEDs to create light and then convert some of that to white. Most white LEDs use YAG yellow phosphor to create very broadband white, and the ‘next step up’ is to use separate red and green phosphors). However, GE is developing a narrow band green phosphor that is better than beta-sialon. Like the KSF material, the new phosphor is said to have good reliability in high temperatures and humidity. The high temperature performance is critical to on-chip applications.

The new green, which can get displays to 100% of DCI-P3 and AdobeRGB is said to be sampling to customers. It’s not as narrow band as QDs but GE has discussed in the past the option of magenta (blue LED + red KSF) LEDs with ‘remote’ conversion to green. That green could be a QD solution or it could be a perovskite film. GE said that this combination can reach 95% of BT 2020 and will be in products in the market this year.

GE highlighted the versatility of phosphors on-chip and ‘remote’

GE highlighted the versatility of phosphors on-chip and ‘remote’

One of the apparent challenges for phosphor was that the particles were quite large (relative to QDs). That meant that it was hard to see how they would work well with miniLEDs and, especially, microLEDs. GE has been working on this and said at Display Week that it has a new KSF formulation for sub-micron particles that is now customer sampling and is also said to be suitable for deposition by ink jet printing.

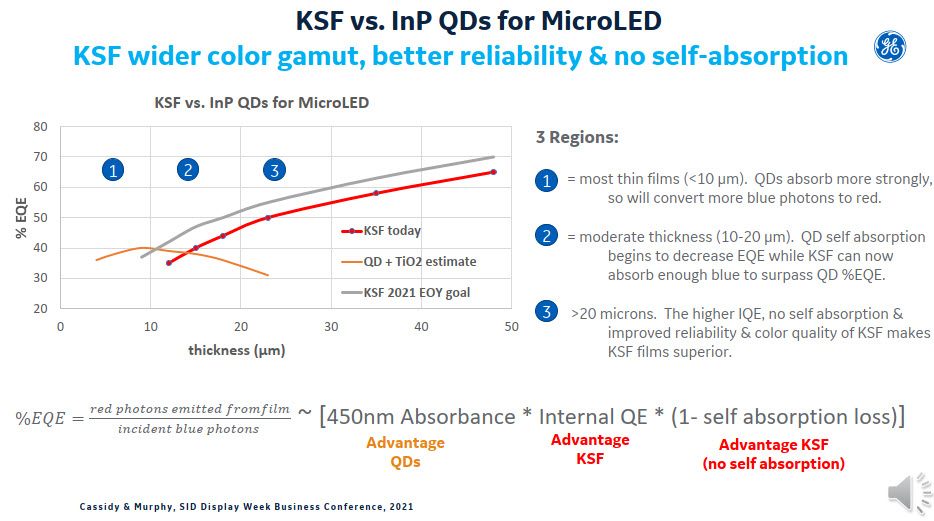

Murphy accepted that QDs have good absorption of blue light, but said that they also suffer from self-absorption compared to phosphors. Where the films are thin, that is not such an issue, and QDs have an advantage but in thicker films QDs can see a drop in efficiency. He expects this to be a challenge for QDs in microLED applications.

One advantage that QDs do have is that they do have a faster response time compared to phosphors (and Nanosys has convincingly shown the effect of ‘colour trails’ in demonstrations privately at CES in the past). My view is that most users would not spot this effect, and wouldn’t pay a lot to eliminate it.

My summary is that KSF has been incredibly successful over the last few years, based on its substantial cost advantage over QDs and because it can be used ‘on-chip’ on LEDs. However, the new materials from Nanosys that are better in air will reduce that advantage a lot. If the new green phosphor does allow 100% of DCI-P3 and if it is low cost, that should continue to mean a real advantage for phosphor in mainstream TVs. Although, as we have reported, there is plenty of movie content available that goes beyond DCI-P3 (So, There’s no Colour Content above P3 Gamut, is There? (Part 1) – not counted as part of your two per month free article allowance), the marketing advantage of a tick next to 100% is likely to be useful for GE, but cost will be a big, big factor.

Anyway, the competition between phosphors and QDs continues to drive better colour in displays with less and less of a premium. Whatever happens, display viewers and buyers will be the winners. (BR)

This article was independently produced by the author, without input from GE, but we are grateful to the firm for ‘liberating’ it from behind the paywall. It will not count as one of your two free monthly articles.