Over many years, one of the events that I tried to attend (and have spoken at several times) was the Electronic Displays Conference, chaired by Prof. Karlheinz Blankenbach in Nurnberg. It has often clashed with the Mobile World event in Barcelona, but as MWC was not on and the ED event went virtual, I have been logging on to see what was being said. The big topic this year was microLED.

Zine Bouhamri of Yole Développement was the first speaker at the event and his topic was ‘Are MicroLEDs Really Going to Happen?’. I have heard Bouhamri’s colleague, Eric Virey, speak several times (and have reported those talks which were very good) so was looking forward to the presentation. I see that a search for his name on our website returns 21 results. (by the way, in recent months, we have developed the search facility on the site, which is now very fast and useful as it gives access to several years of data).

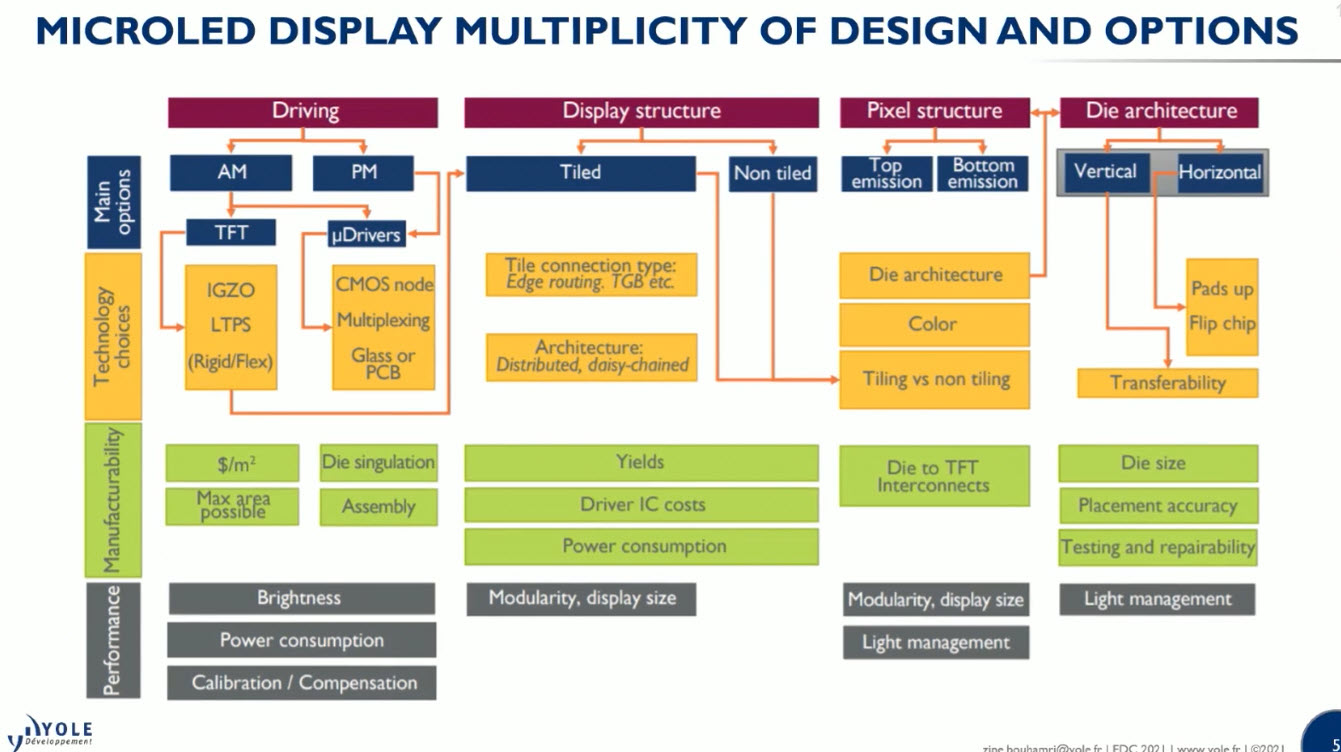

There are many issues and approaches to microLED and today there are no consumer products, so there are still many questions to be answered. Should you go for passive or active matrix architecture? Will you use TFTs or other microdrivers? If you go for microdrivers, you may cut out the traditional panel makers.

There is no winner today or obvious candidate and nobody yet knows the best route to get the industry going.

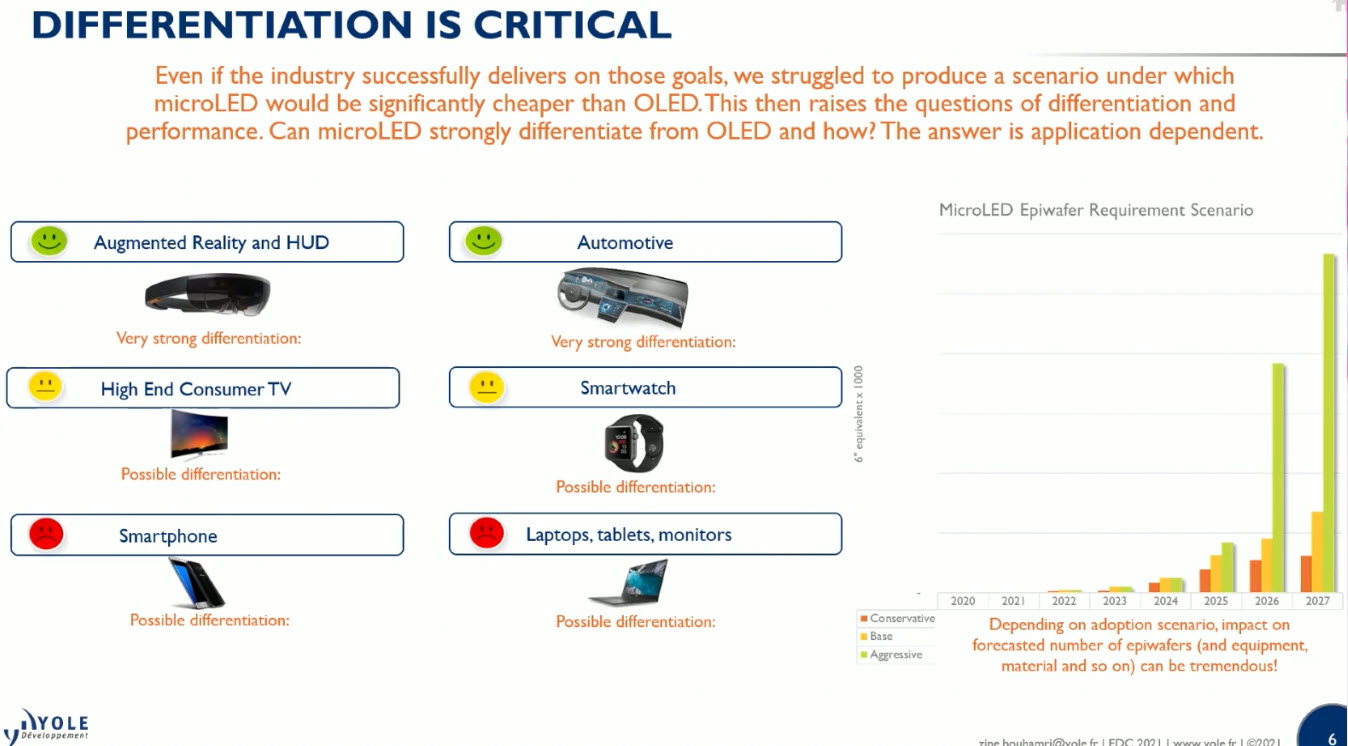

It will be critical for microLED to be able to differentiate from other display technologies. Why would you buy it compared to OLED and will it be differentiated in the future, Bouhamir asked.

In AR and HUDs, the high brightness of microLED really makes it the key enabling technology. In automotive, there is strong differentiation, again because of performance in bright environments.

In TV, a challenge will be that in LED applications cost scales with resolution, rather than area, so there is some possible differentiation at the high end, where very large sizes will not suffer the same premium as in LCD, as long as you don’t increase the resolution with size. Smartwatch also may allow some differentiation because of potentially higher brightness and lower power consumption, although OLED is improving all the time. Smartphone and IT applications such as monitors, notebooks and tablets are going to be difficult, because the LED dies will have to be very small and won’t happen in just a few years.

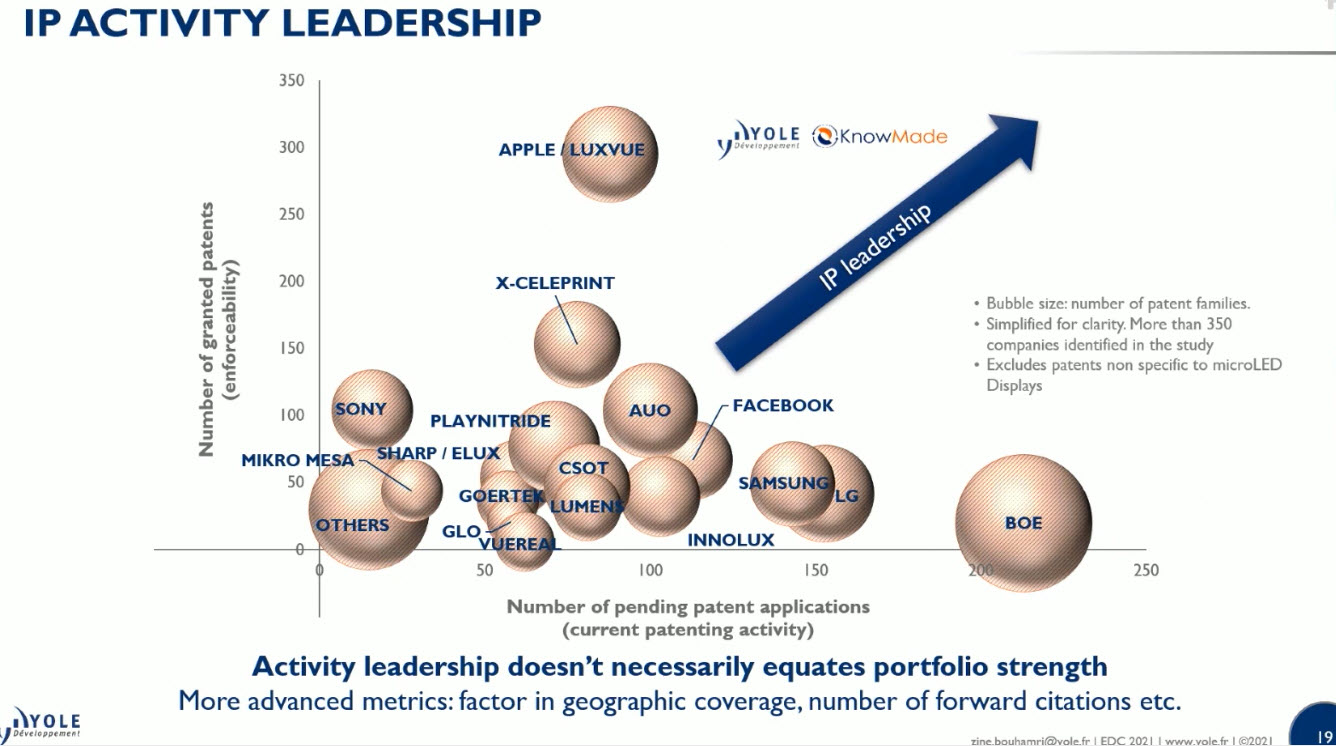

Looking at the development of IP such as patents helps to understand where things may be happening in the future, Yole believes. It can also help you to track who is trying to ‘stay below the radar’, so the firm looks in detail at this area. Yole defines a microLED as having a die size of < 50 microns. It includes display-related applications, but not backlights or other uses such as Li-Fi.

There has been a huge increase in the number of patents granted and pending in recent years. Current display makers were not well represented early on, but had 38% of the patents published in 2019. China is the largest geography for applications with BOE as the top company in terms of numbers of patents.

If non-TFT driving becomes the norm, the industry could be truly disruptive and cause the current display makers to struggle to stay in the business, Bouhamri said (I was reminded of Bruce Berkoff’s comment many years ago when he was at LG.Philips LCD – “I don’t care what kind of display you put on top of my transistors”. Originally established LCD makers were defensive but are now are truly aggressive in this area.

As well as tracking the number of patents, Yole uses other metrics including the enforceability of the patents and here Apple/Luxvue is in a strong position.

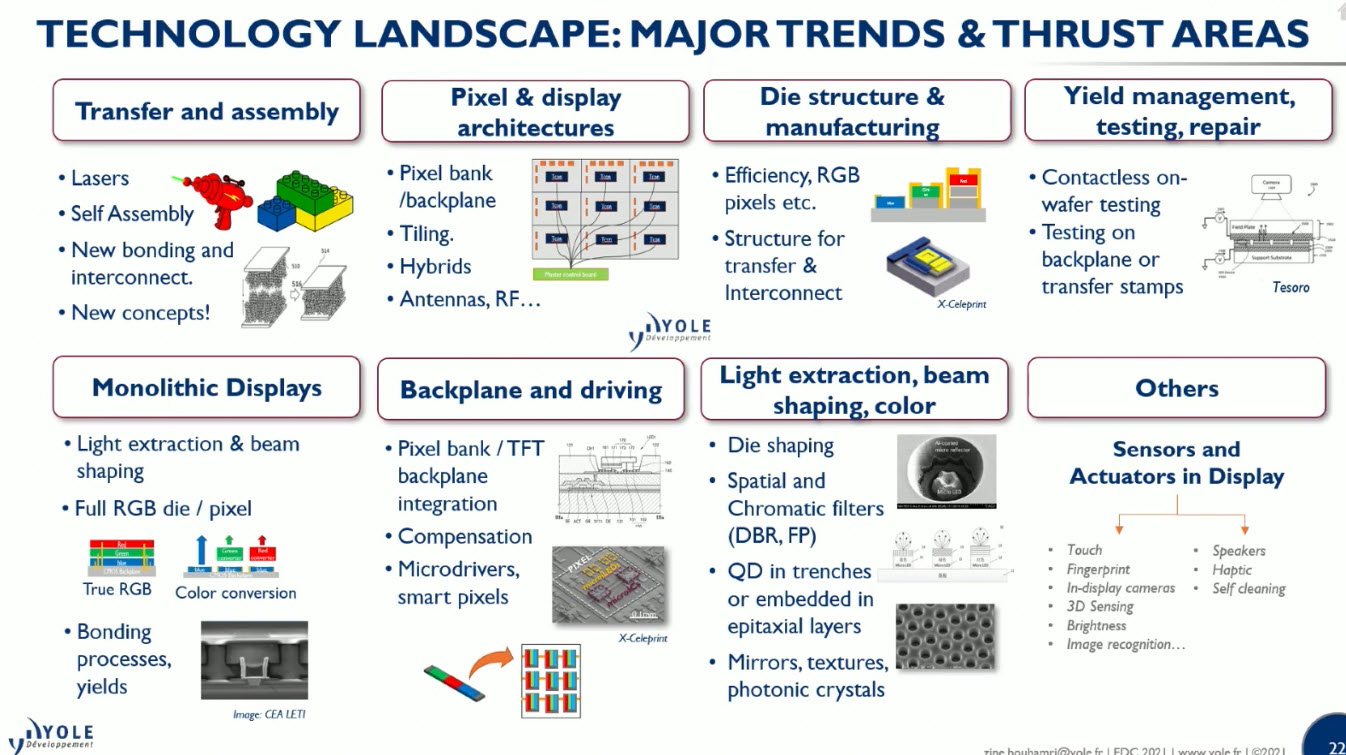

BOE has tended to focus on driving as well as transfer and assembly, the ‘elephant in the room’ in terms of developing the microLED industry. That area provides the bulk of the patents along with pixel and display architectures, while some areas were a little neglected at one time. Light extraction, defect management & repair and testing are big topics, but with less activity in patents.

Major ‘thrust areas’ & trends are in the chart

QNED started development as long ago as 2010 but is “not ready for prime time yet”, he said.

Overall, equipment and material suppliers are getting into the game, which means we are getting closer to industrialisation. Apple and Sony have been ramping down their activity, which could mean that they are broadly happy with where they have got to in terms of their patent portfolios and development. They may have settled on what they think their best approaches are.

Although Bouhamri didn’t directly provide an answer to his question, it’s clear from the activity going on that the answer is “Yes”, even if “When?” and “In what application in volume first?” may not be quite so clear, yet! (BR)