The biggest advantage of miniLED Quantum Dot TV is that it takes LCD performance to a new height not possible before. MiniLED display technology can enable LCD to achieve high brightness, very high contrast, better HDR (High Dynamic Range), thinner form factor and higher power efficiency to compete directly with OLED.

QD enhancement film (QDEF) enabled LCDs to have better color purity, wider color gamut (WCG), and offer a brighter and more immersive HDR experience while maintaining power efficiency. MiniLED Quantum Dot TV combined with higher capacity and more efficient production of larger size LCDs (65-inch and higher), higher resolutions (4K, 8K) and broader price points can drive replacement demand. With top brands like Samsung and LGE joining TCL this year by adopting miniLED QD TV, 2021 is expected to be “the year of MiniLED”.

Higher Adoption – by Top TV Brands

Top consumer brands Samsung and LG Electronics joined TCL in introducing miniLED-based LCD TV products combined with Quantum Dots (QDs) at CES 2021. Samsung, Vizio, TCL, Hisense, Konka and Xiaomi were already offering QDEF-based LCD TVs. QD TV set prices have reached below $1,000 enabling higher adoption, larger market share and stronger growth rates in 2020 in spite of market slowdown. The growth in the use of miniLED backlights combined with QDs will lead to higher picture quality enabling further growth driving an expansion phase in 2021.

The biggest news at CES was LG Electronics (LGE) embracing both QD and miniLED technology this year by introducing what it calls ‘QNED’ miniLED TVs after years of being the biggest proponent of OLED TV. (not to be confused with what the industry calls QNED. LG had its trademark application for the term rejected – editor)

The company combines Quantum NanoCell color technology with miniLED backlighting. LGE’s 2021 Quantum Dot TV line-up will include miniLED backlights in both 4K and 8K resolutions spanning sizes from 65 to 86″. Samsung the top TV supplier in the world and most successful supplier of QLED TV introduced “Neo QLED” miniLED backlight-based technology to its flagship 8K and 4K models in a variety of sizes (55 to 85″), with a range of features, performance and price ($1,600 to $9,000) range.

TCL launched its ultra-slim TV third generation miniLED TV “OD zero”. By reducing the optical distance between the miniLED backlight layer and the LCD display layer (diffuser plate) to 0 mm, it created an ultrathin backlight module. (TCL Offers Cool Display Innovations at CES 2021) TCL offers a broad range of miniLED QD TV products. Its lowest price model is below <$1000 for 65-inch. Hisense launched its first 8K TV with miniLED and QD technology. More brands are expected to introduce miniLED QD products in 2021.

Bigger Share – Premium TV Market

According to industry data, more than 90% of the TVs sold in the world market are priced at <$1,000. Also the vast majority of the products on the market are sold at <$500. Massive LCD capacities, over-investment, fierce competition and lower panel prices (during over-supply) and low set prices have commoditized the TV market with low revenue and low profitability.

The premium TV market is generally considered to be at $1500 price. Even though it captures less than 10% of the market in terms of units it has significant share in revenue terms. Profitability is also higher. OLED has secured a strong presence in the premium TV market because of high picture quality, design differentiation, perfect black and an infinite contrast ratio.

LG Electronics is the most successful brand using LG Display’s OLED TV panels. Samsung has been gaining share with super-sized screens (65 to 98″), better features and better performance (higher luminance and color volume) with QD technology. The advanced TV technology of MiniLED with QD can provide higher display performance (very high contrast & WCG) with product differentiation (thinner form factors, no bezel) gaining higher shares in the premium market. It will also help panel suppliers and TV brands with higher revenue and profitability.

Samsung NEO-QLED TV with QD MiniLED

Samsung NEO-QLED TV with QD MiniLED

Drive – TV Replacement Demand

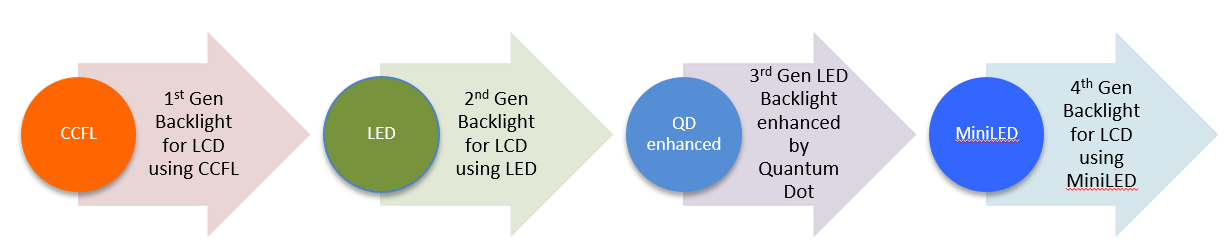

In recent years TV replacement cycles have been increasing to 7 to 10 years. MiniLED QD TV could drive more replacement demand with more advanced technology, differentiated product and visibly higher picture performance. In the past few years, resolution shift, curved form factors,WCG and HDR have not driven strong replacement demand. Historical data has shown that the TV market went through a major growth period when LCD backlight shifted from CCFL to LED offering thinner and better displays.

MiniLED backlight has the potential to offer stronger growth in future by offering thinner form factors and higher display performance in future years. Cost is still a major challenge. The technology is still evolving and the supply chain is still developing. If cost can significantly improve in future years it could trigger faster replacement cycles although low end miniLED QD TV has reached <$1000 price.

Enable – Higher Display Performance

By the use of multi zone blinking backlights (>10,000 zones), miniLED can enable LCD to have higher brightness (>1000nits), very high contrast (>10,000:1), excellent HDR, better color rendering, ultra thin form factor, superior power efficiency and display performance close to OLED. Due to miniLED’s small size, it can enable curved form factors and narrow bezels. MiniLED with multi zone blinking backlight can achieve better HDR with >100000:1 contrast ratio and higher peak brightness.

There are new requirements for Energy Star 8.0, which measures energy consumption in a dynamic display content mode, which can help to highlight the energy efficiency of miniLED backlights. MiniLED-based TV used less efficient passive matrix driving technology in 2019. With an increased number of zones, companies are shifting to active matrix driving technology in 2020, which is more efficient and cost effective. Panel suppliers such as AUO, Innolux, BOE and CSOT are all developing active matrix-based products, which will help adoption rates.

Smaller size miniLED chips, better die bonding and more efficient production, combined with lower open cell LCD TV panel prices could enable lower cost TV. Currently the TCL 75-inch 4K miniLED QLED TV price is lower than similar size OLED products. Many brands will pursue multiple TV technology strategies with LCD, OLED, QD and miniLED-based LCD TV together. With the right price/performance strategy MiniLED can drive better growth.

Improved – Supply & Supply Chain

Suppliers are now starting to increase capacities and investments. Major LED chip companies are increasing capital expenditure to increase capacity and installing equipment for high-speed transfer, die testing and sorting to improve manufacturing yield. The development of tools to increase throughput efficiently and handle smaller dies (<100 micron) can reduce manufacturing costs.

As miniLED technology uses a large number of small size LEDs, the process of testing and repairing is very important to reduce repair costs and improve yield. Driver IC companies are focusing on miniLED products this year. Higher miniLED capacity is expected to come in 2021. There is more collaboration among suppliers within the miniLED supply chain: substrate, LED epitaxial wafer, packaging, driver ICs, display suppliers and even consumer electronic companies.

Panel suppliers are collaborating with their LED subsidiaries: MiniLED supply chain companies such as BOE, China Star, AUO, Innolux, Epistar, Sanan, Lextar, Macroblock, ASM Pacific Technology, Nationstar, Refond, Yenrich, and many others are all working to develop better solutions. Consumer electronics companies are also joining in the collaboration and development.

Lower Cost – Still a Challenge

Cost reduction can be realized through advanced chip production and higher throughput for the transfer and assembly process and PCB and driver IC enhancements. Chip production can be improved through a reduction in chip size, improvements in uniformity and boosting luminous efficiency. Upgrading transfer and assembly efficiency and accuracy can also improve manufacturing yield. Panel suppliers are switching backlight connection backplanes to use glass with active driving solutions to reduce costs. Panel suppliers and component suppliers are expected to focus more on cost reductions in 2021 to support brands’ product introduction of miniLED-based displays to drive growth and expansion plans.

At the same time TV panel price increases in Q4 2020 and also the expected increase in 1H of 2021 can create challenges for brand manufacturers, reducing their ability to offer more attractive prices. Strong TV demand combined with higher IT demand due to work from home trends has resulted in supply constraint. Also shortages of LCD components and raw materials, including polarizers, driver ICs and glass substrate are expected to continue in the 1H 2021, impacting supply and prices. Top TV manufacturers also have aggressive plans for 2021 in expectation of sales around the Olympics and further market recovery.

Recent panel price increases have resulted in increased Capex and expansion plans from LCD panel suppliers such as BOE, ChinaStar and others. Samsung and LGD have also delayed their plan to shift away from LCD production. These factors could all help to improve supply in 2H of 2021. Currently low end MiniLED QD TV set prices are lower than similar size OLED TVs and high end TV prices are higher than similar sized OLEDs.

The addition of QDEF film to MiniLED backlight improves performance as well as costs. According to Nanosys, “Quantum dot has been a low cost adder for TV companies. Cost is about $15/$16 for a square meter”. Adding QD to miniLED enables higher performance especially 100% color volume, expanded range of color, peak brightness and contrast capabilities, which are very important for the premium market. This is leading to very high rate of attachment of QD with MiniLED.

Source: Dash-InsightSummary – MiniLED QD Growth Opportunity

Source: Dash-InsightSummary – MiniLED QD Growth Opportunity

Recent developments can help drive miniLED QD LCD TV to higher success.

- Adoption of miniLED QD technology by top TV brands at different size, features, performance and price levels.

- Need for higher specs and differentiated product to drive TV replacement demand

- Need for higher value products to avoid commoditization to increase revenue and profitability.

- MiniLED QD technology enables LCD with significant higher performance.

- Enables ultra thin form factor, superior power efficiency and display performance close to OLED.

- Development of cost effective volume production process with high-speed transfer, higher yield, integrated with better testing and repair

- Higher collaboration, higher investment & increased supply for MiniLED

- Higher competition and production from many suppliers can lead to price and cost reductions, helping adoption rates.

- MiniLED backlight shift can drive higher replacement demand like the shift from CCFL to LED

(SD)

Sweta Dash is the founding president of Dash-Insights, a market research and consulting company specializing in the display industry. For more information, contact [email protected] or visit www.dash-insights.com