Over the years, I have watched Ross Young give display conference business keynotes many times. There are few people that can get as much information across as concisely as he does. I guess you would call it ‘Broadband market research & analysis’. Yesterday I listened in to his talk at the DSCC/SID Business Conference and he had some interesting news on the market development in the display business. It was very much a ‘big picture’ view.

Regular readers will have read my comments on the LCD ‘Crystal Cycle’ for years. I wrote about it in February, most recently, so won’t repeat that article here. (Here We Go Again on the Crystal Cycle). This time around, some people think that the cycle is broken and ‘next time will be different’. Hmmmm…. I first heard that around 15 years ago, I think, at least it feels that long ago! However, Ross Young suggested that there are good reasons why this time really could be different.

The Key Issues

The key issues in the cycle are the repeated capacity investments and the time lag between investment decisions (when pricing is high) and the arrival of the new capacity, some time later. These impact the critical supply/demand balance. So, how did we get to here?

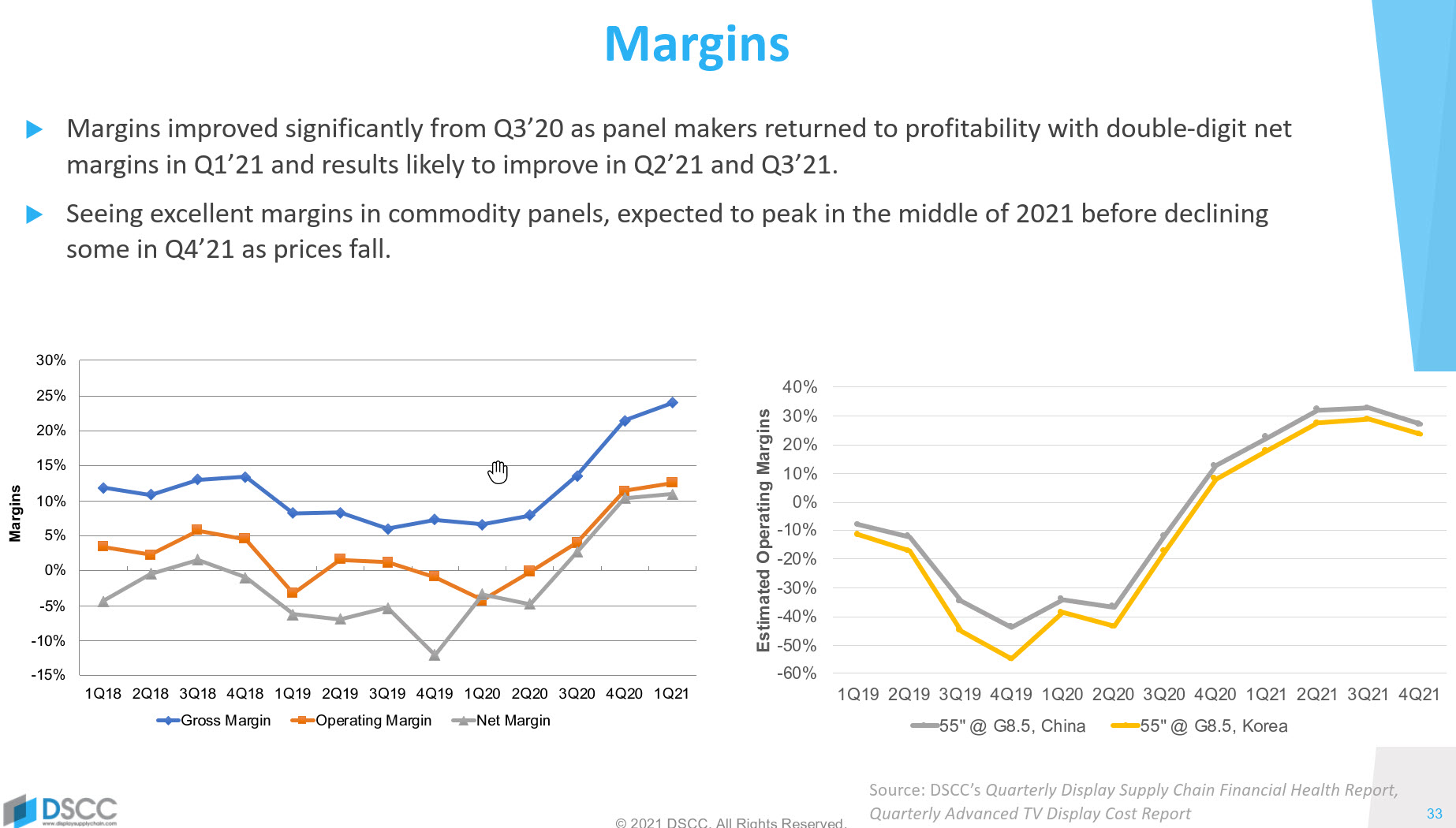

Panel Margins had been very weak until Q2 2020 started to see some easing

Panel Margins had been very weak until Q2 2020 started to see some easing

First, the LCD panel market was, in Young’s words, ‘Not very pretty’ for some time. From early 2017, continuous margin declines happened and the business and panel suppliers really suffered. This was mainly because of the strategic decision of the Chinese government to build a panel industry. Cheap or almost free money was a competitive advantage for Chinese makers that made future investments by those that weren’t so funded completely impossible. LG and Samsung, which had dominated the industry for years, were being squeezed out to the extent that they had announced that they would plan to get out of the LCD business.

Despite the terrible pricing conditions, Chinese companies continued to expand their capacity, based on decisions made some time before. (for more on this topic, check out the series of four articles that we published a year ago on this topic. We’ve listed them at the end of this article. They are a year old, so do not use up your free article allowance)

Along Came Covid

However, along came Covid and that caused a boost in demand for LCDs for IT products, for work from home and education from home and also helped to slow down the drop in the TV market demand as US consumers (and others) bought TVs instead of going out or travelling. (Americans weren’t the only ones; just yesterday the UK’s DTG group reported record sales of TVs in the UK – up 17% in revenues on 2019). Anyway, this boost in demand meant that panel makers could finally push up prices, which had been below cash cost for all makers – that is, panel makers were paying money for the privilege of making each of their panels.

The increasing demand and a slow down in the growth of capacity allowed panel prices to start to rise. That process of price increases has meant increasing profits and in turn has meant delays in the restructuring of the Korean panel makers. Samsung has sold its capacity in China to CSOT, but LG, which had planned to close a lot of its capacity has kept it going. Most importantly, Young said that although most LCD makers were trying to squeeze a bit more production out of existing fabs, he has not heard of any new plans to build capacity.

That really is different this time! Further, if prices do start to fall, Young pointed out, LG could go back to its plan to close its LCD capacity for TV use (TV is still over two thirds of the market by display area) and as it represents 9% of the supply, that would be enough to tighten things up on the supply side, even with a drop in market size for IT and TV after the effects of Covid on market demand wear off.

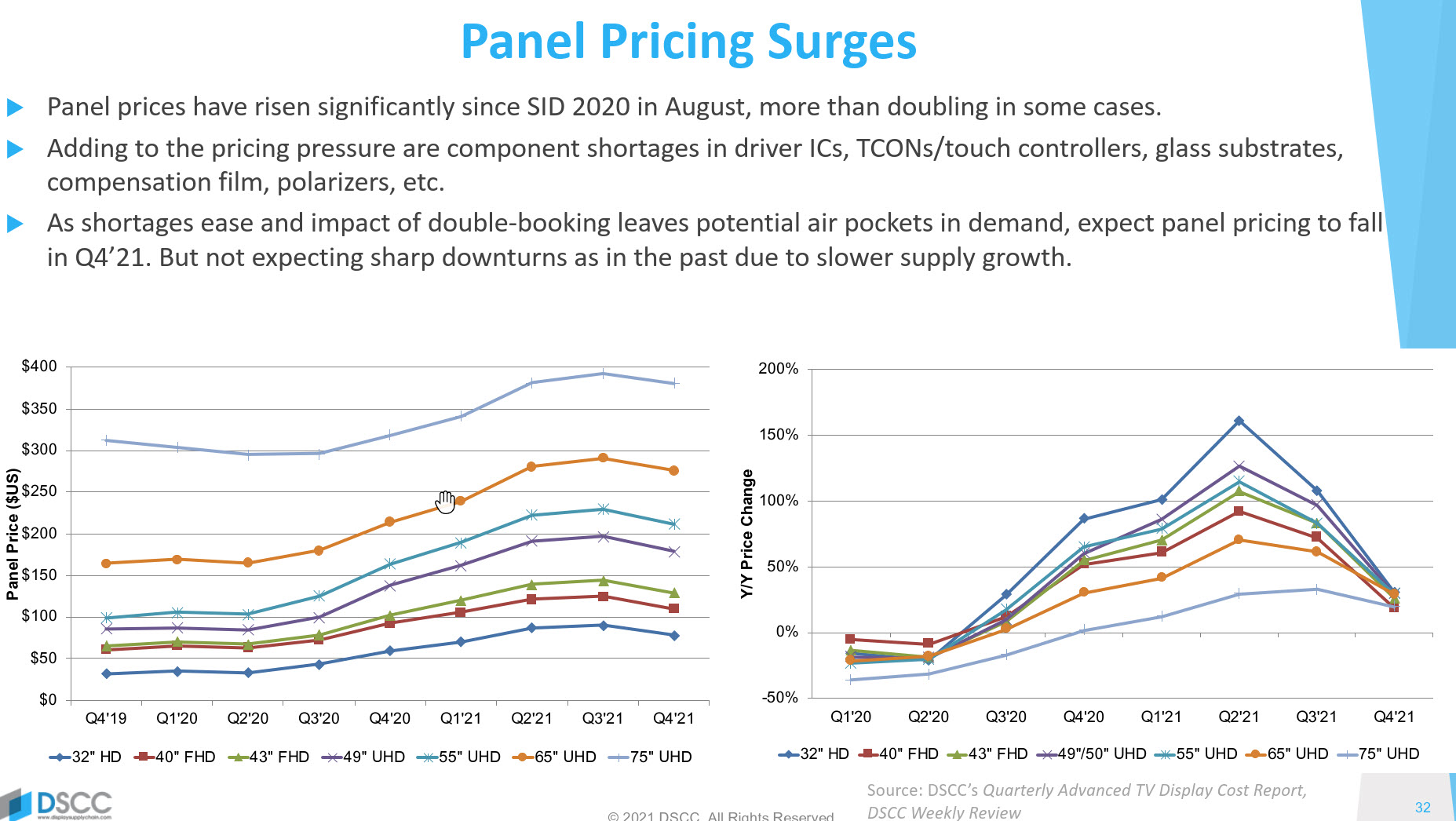

Panel Pricing Keeps Rising

Panel pricing has kept rising to a surprising degree and the supply/demand balance issues have been made worse by component and material shortages. In a blog post yesterday, Bob O’Brien of DSCC used the title “LCD TV Panel Prices Keep Going Up with No End in Sight”. It’s a good headline, but Young forecast that prices would start to decline in Q4 2021 as component shortages start to ease and some over-booking of production gets sorted out. However, he said that there would only be a small decline in prices, not the drastic drop we have seen many times over the years as the industry has gone around the Crystal Cycle.

As Young talked, I was reminded of a talk that I heard some years ago about the hard disk drive market. While the market was growing and growing, everybody chased share, boosting capacity, it was really hard to make money. Once there was a realisation that the technology was going to be very threatened and perhaps superceded by flash memory, companies stopped the crazy level of investment and they started to actually make money! In the same way, the beginning of the end of LCD’s dominance and growth will mean that, finally, the cycle has been broken.

Makers are now focusing, as, for example, AUO has done for a while, simply on revenue maximisation to boost revenues, rather than chasing share and growth. MiniLED is a real opportunity to develop a wider range of higher value LCDs and that could really help to develop revenues even as growth stops or turns negative. Of course, if growth were to really crash, or some other government suddenly wanted to own the panel business, all bets could be off! (BR)

Covid Brings Harsh Reality to Display Industry (Part 1)

Covid-19 Forces Sanity on the LCD Industry (Covid Brings Harsh Reality to Display Industry Part 2)

Financial Sanity in China (Covid Brings Harsh Reality to Display Industry Part 3 of 2!)

More Fab Moves in China (Covid Brings Harsh Reality to Display Industry Part 4 of 2!!)