This is the third of my two part (!) series on the state of play going forward in the global LCD business and the focus this time is on what may happen in the consolidation caused by Covid-19, especially in China. Once again, my thanks to David Hsieh of Omdia for help with this.

We know that supply will continue to be ahead of demand because of the impact of the virus. If the TV set market was to rebound rapidly and dramatically, supply could get tight again, but given the huge macroeconomic impact of the lockdowns around the world, that seems to me very unlikely. The decisions by LG and Samsung to get out of the business will have eased things a little, but for the smaller players, life has been tough for a while because of the low panel prices and is going to get tougher.

BOE and TCL CSOT seem big enough and stable enough to see out the current conditions, although they will, no doubt, be under some stress.

Two at Particular Risk

Two Chinese companies have been talked of as being particularly at risk, HKC (who have been relying on government incentives and subsidies to survive) and CEC Panda because of the low panel prices. Others such as Royole are also struggling with cash flow issues, but the focus of this article is large LCDs rather than the small OLEDs that they make. CHOT is not doing well, but the local government which has been promoting it has said that it wants CHOT to continue,

Over many years we have seen that simply combining two weak companies with older or less productive fabs never makes sense, but sometimes there may be a reason for a larger company to take over a smaller one.

CEC Panda Has Advantages

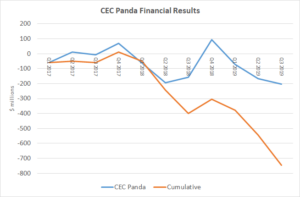

Uniquely in China, CEC Panda has oxide TFT technology (from Sharp) which is an advantage and it is part of CEC which is a state enterprise. The company makes TV, notebook and monitor panels in a mixed portfolio, but it has been challenged to become profitable. It has three fabs at G6, G8.5 and G8.6 in Nanjing and Chengdu. However, the firm has had operating losses in 8 of the last 11 quarters and has lost $746 million, cumulatively.

The oxide technology could be attractive to other makers as it should allow higher end products with higher resolutions and better performance, as well as being an enabler for large OLEDs so the company may well be a target for TCL CSOT or BOE. CSOT is interested in large area OLED using inkjet, while Hsieh told us that BOE may well be attracted by the chance to supply higher end IT panel products using oxides.

HKC Has Been Aggressive

HKC has had to be particularly aggressive in pricing as it is seen as a second tier supplier and it has kept investing to get cash from different local authorities. It has four G8.6 fabs, with different financial arrangements with external financing from 25% to 75% and its own equity is between 7% and 40% according to Omdia.

Hsieh told us that one of the challenges in any kind of takeover is establishing an appropriate and acceptable valuation of the assets of the companies. Politics are also important. He told me:

“If the selling price is too low, it will be criticized as selling the national assets at a cheap price to the private enterprises.”

It’s likely that if a purchase of CEC Panda goes ahead, because of tax and local/regional financing, it would be as a stock purchase, rather than as a fab. Again, that could be subject to political pressures and Omdia thinks the company could be valued at something just under $2 billion. BOE and CSOT have the cash, so either could be interested.

It’s less clear who would want to buy HKC.

What will happen to the Korean fabs?

Omdia does not expect the Samsung Suzhou factory to close, but to be sold, ideally within this year. It is a JV with local government and CSOT (which already owns 10%), so that company is widely seen as the most likely company to take it over. Because of subsidies received, it might be difficult for Samsung to simply close the fab. Hsieh thinks that AUO might also be interested and that might suit Samsung as AUO is not a direct TV competitor, unlike TCL. CSOT also makes VA panels and that would match AUO’s technology, while BOE mainly makes IPS TV panels.

My view is that AUO might have a challenge to raise the finance for this purchase as, historically, it has been difficult to raise investment money in Taiwan when panel prices are low. However, I’m not close to the deal, so that is just speculation and on the other hand, AUO is going to be challenged to invest in a new fab, so this might be a feasible way to boost production if it wants to do that.

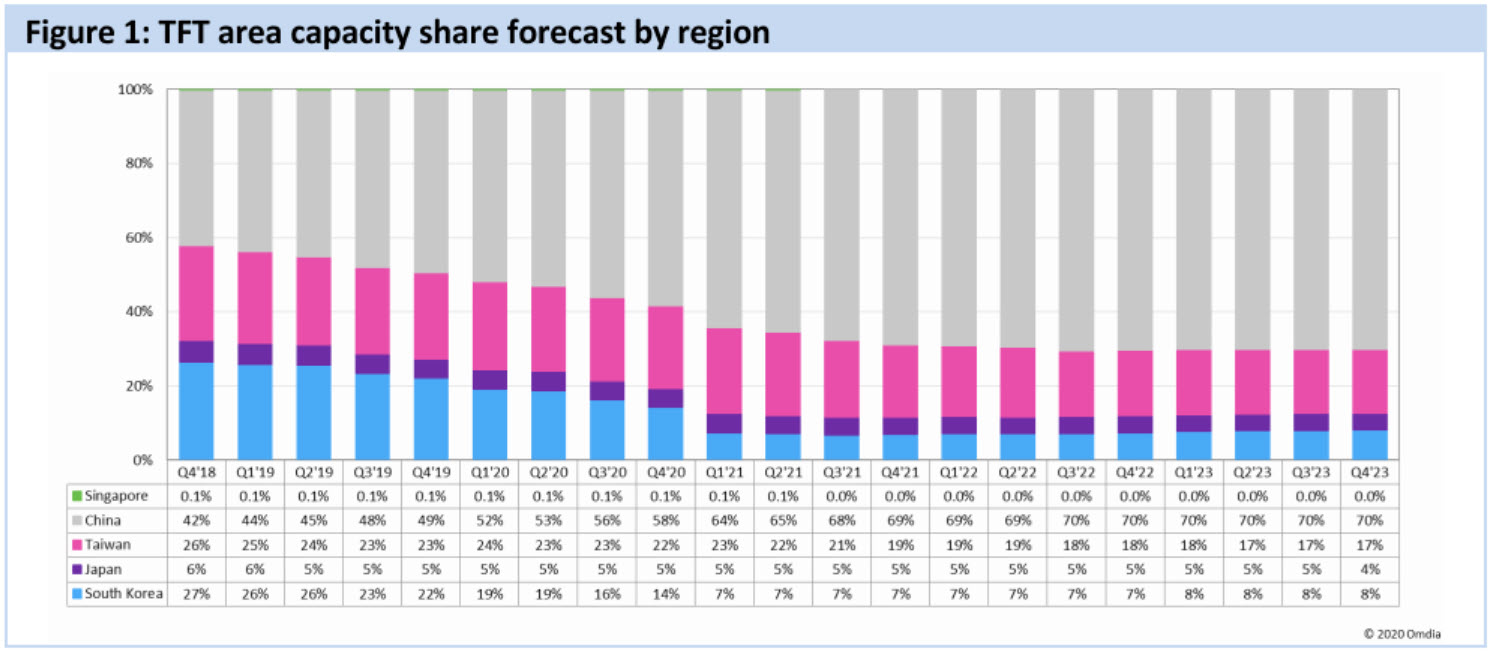

TFT LCD Area by region – Source:Omdia – Click for higher resolution

TFT LCD Area by region – Source:Omdia – Click for higher resolution

LG Display is likely to keep its fabs in China at least through to 2021, although some change could happen after that.

The result of all this is the chart above, which shows that China already has more than 50% of TFT LCD capacity, but will get to almost 10 times the capacity of Korea in a couple of years. How times have changed!

Thanks again to Ross Young of DSCC for his information that helped with Part 1 of this series (Covid Brings Harsh Reality to Display Industry (Part 1) and David Hsieh for his information for this one.

Part 2 Covid-19 Forces Sanity on the LCD Industry (Covid Brings Harsh Reality to Display Industry Part 2) (BR)