In my last Display Daily (Covid Brings Harsh Reality to Display Industry (Part 1) I reported on what has happened to the display application and supply side. As we saw, after the last two big economic crises, there was some consolidation and that has started already. What else is there coming?

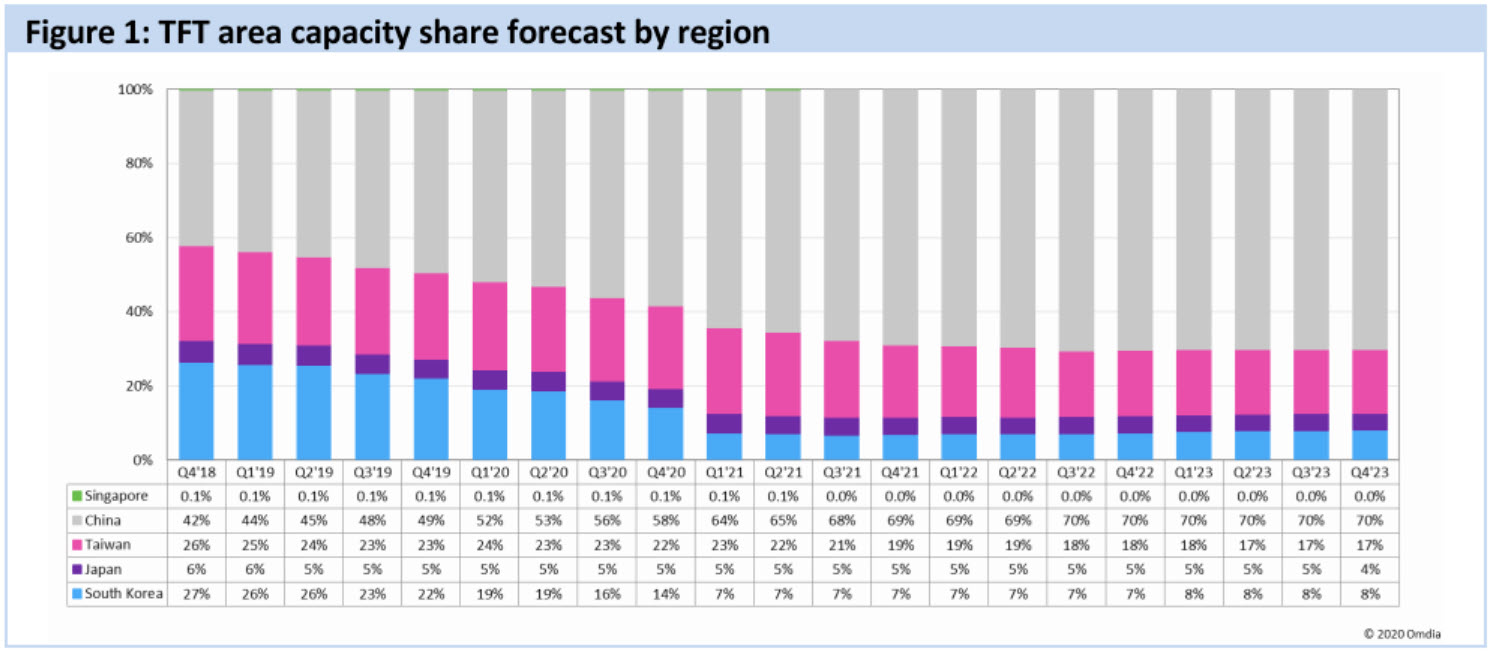

I was surprised to hear, during CES, that LG Display was planning to stop producing LCDs for TVs in Korea by the end of this year. Soon after, Samsung Display announced that it would get out of LCD production entirely by the same time. As a result, overall capacity of the LCD industry will actually decline this year. I exchanged emails with David Hsieh of Omdia (IHS Markit), a friend of many years and a specialist on developments in China. He said that his analysis is that South Korean LCD capacity will drop from 69 million m² in 2018 to just 6.8 million m² in 2022. Before we get back to the detail of what’s next, let’s look at how we got to hear.

After starting in Japan, the LCD business was taken up by Korea as a key future technology. When the Asian financial crisis took place, Taiwanese notebook and monitor makers got into a lot of trouble because panel suppliers were making very tough payment demands to ensure supply. That was very dangerous for Taiwan as these were seen as two strategic longer term industries, so the government supported the industry to develop an LCD supply chain. That is no different from what had happened in Japan and Korea.

Reality Means Government Support

The reality has been that no country has been able to develop an LCD industry without the support of the government. Even if direct financial support wasn’t given, support of R&D, land supply and infrastructure facilities (such as power and water supplies) as well as favourable planning decisions were essential.

Now, China took things a step further. I heard some years ago that the Chinese government had decided that flat panel supply in China was essential. Famously, an analysis of the smartphone industry some years ago that almost none of the value in an iPhone was left in China. Although the handsets were made there, most of the money went out of China for displays and touch panels, semiconductors, software licences and profits for the selling brands. Just a handful of dollars was left for simple components and materials and the cost of assembly.

Given that China had the largest TV market in unit terms and would continue to do so, that most of the value came from the panel and that Chinese TV brands were likely to get stronger globally, the government decided to seriously promote the development of LCD capacity in China. It wanted to ensure that the value of the business was captured in China.

That was done by supplying finance, directly or through state or local government banks and firms. Suddenly, in a capital intensive business, those wanting to get into the business in China had ‘almost free’ capital. At that point, there were huge plans developed for massive numbers of G8 and above fabs in China. At SID in 2017, I heard from multiple sources that only 10% of the capital needed by BOE to build its G10 fabs was coming from its own resources. Omdia has calculated that the investment by the Chinese government in display production factories between 2003 and 2020 will be $64.9 billion – a serious amount of money!

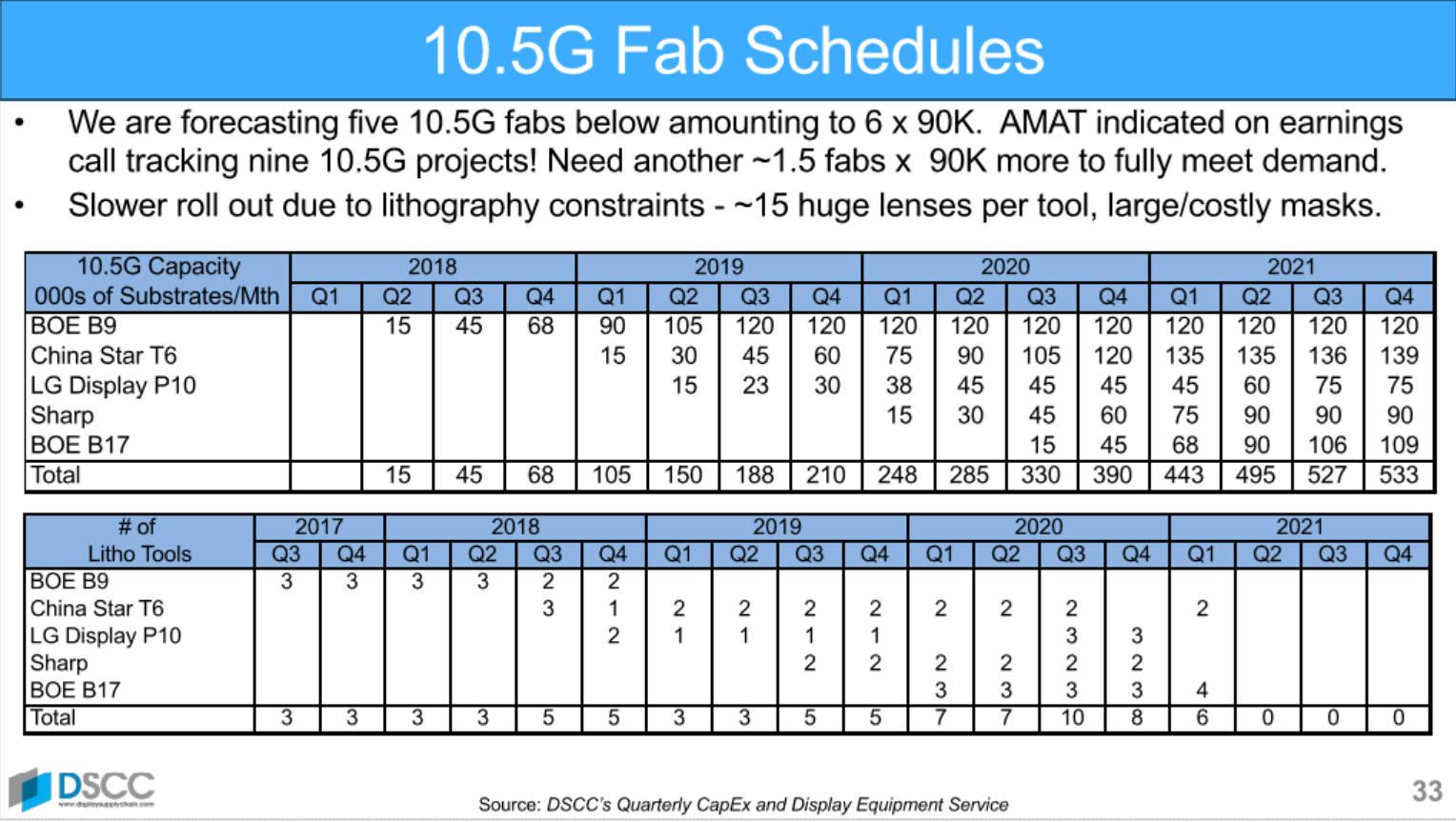

In 2017, at Display Week, we reported that there was a ‘Tidal Wave of Capex’ coming (BC01 DSCC Business Conference is Successful). At that event, DSCC said it knew of five G10 or G10.5 fabs to be built, and Applied Materials said it new of potentially nine and, if I remember correctly, one supplier said they had heard of possibly 13 G10 fabs. Even the five looked like too many, but nine looked wild while 13 would have struggled to find applications.

DSCC Presented this slide at the SID Business Conference in 2017. In the end, only these five fabs were built. Click for higher resolution.

DSCC Presented this slide at the SID Business Conference in 2017. In the end, only these five fabs were built. Click for higher resolution.

Reality started when the Crystal Cycle turned down and panel prices started to go down last year. By the start of this year that cycle looked as though it might have turned as investments had been slowed or delayed, but now Covid-19 has hit the demand side and pushed prices down.

Hsieh summarised where things are with the G10 fabs in China (and, of course, Sharp (SDP) has the first G10 in Japan)

-

BOE is ramping up its B17 fab in Wuhan – its second G10.5 fab

-

TCL China Star is building its second G10.5 fab which should operate from early 2021

-

Sharp is ramping up its G10.5 fab in Guangzhou, China and Samsung will be a client (as Samsung’s TV business will still need panels)

-

HKC (3) and CHOT (1) between them have four G8.6 fabs being expanded or starting.

So, in China, the five G10 fabs total seen in 2017 will come to fruition, but talk of more capacity is now off the table as China dominates the LCD industry. Hsieh highlighted that China now has more than 50% of all LCD capacity and that will rise to more than 60% in 2021 and in 2021, that will rise to 70%.

The question is now, what will happen to the Korean fabs and what will happen to the smaller panel makers in this next round of consolidation. I had planned that as part of this Display Daily, but it will have to be in the next one. (BR)

See Part 1 (Covid Brings Harsh Reality to Display Industry (Part 1))