I had got to Part 3 of my two part series on the developments in China with the changes in the industry and thought I was done. However, I got some updated information that seems to mean a Part 4 is worthwhile, and I know this won’t be the end of the story!

For those that haven’t read parts 1-3, here’s a quick summary.

-

The Chinese government decided to capture the value in LCDs that were going into TVs from Chinese brands, and keep more of that value in China, so it made LCD industry development a strategic national target.

-

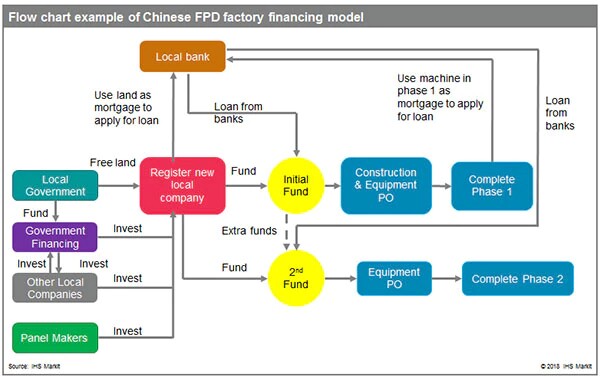

To support the development, local and national governments and state-owned enterprises started funding LCD fabs in China, with ‘almost free’ capital investments. This set of circumstances led to a flurry of announcements of big new fab construction products by Chinese makers. Not all of them happened, but plenty did (Building new display fabs in China to face financing challenges). As I have said many times, Bruce Berkoff’s maxim “Engineering beats science, economics beats engineering and politics beats economics” and this was politics writ large.

-

Panel makers outside China could take some advantage of these financial facilities, but not to a full extent, so, in a capital intensive business that has relatively few technical barriers to entry, they simply couldn’t compete and started to reduce their capital investments. Eventually, they have been forced to withdraw, with the Koreans getting out entirely of large LCD production for TV applications by the end of this year.

-

Despite the lack of capacity growth by Korean & Taiwanese makers, the Chinese have built too many fabs and some years ago Paul Gray of Omdia (IHS Markit) added a corollary to Berkoff’s maxim “but in the long term, economics beats politics” (evidenced by the fall of the Soviet Union). So even with the political will of the Communist Party, eventually, too many fabs is not supportable, so the weaker Chinese makers are having to be restructured.

-

CEC Panda and HKC are the Chinese companies that are having to change course.

After I posted part 3, I got some more information about developments from Ross Young of DSCC.

“We are now hearing that it is looking increasingly likely that CSOT/TCL Technology will acquire CEC Panda. One reason is that CSOT is interested in CEC Panda’s G6 a-Si LCD fab, while BOE is not. The CHOT G8.6 LCD fab in Xianyang would not be part of the sale. It would continue to operate independently. Included in the sale would be:

90K/month G6 Nanjing a-Si LCD fab

60K/month G8.5 Nanjing a-Si LCD fab

120K/month G8.6 Chengdu a-Si/oxide LCD fab

If this acquisition takes place at the end of 2020, CSOT’s LCD capacity share would jump from 12% in 2020 to 20% in 2020. Only BOE would be higher at 26%.”

What About the Samsung China Fab?

Samsung is getting out of LCD, but still has a mainstream (if not state of the art) fab in Suzhou, China, that represents a significant asset. Young added this comment:

“Regarding SDC’s G8.5 fab in Suzhou, our latest understanding is that CSOT/TCL Technology is not pursuing the acquisition of this fab. The fab reportedly has a contract with the local government that they must continue to operate until the end of 2022. If SDC chooses to shut down this fab before then or operate it at lower utilization until then, it will further depress LCD capacity and result in improved market conditions for the remaining players. Even if there was an acquisition, the fab would need to go offline for some time as the new company may change the process flow, change some tools, etc.”

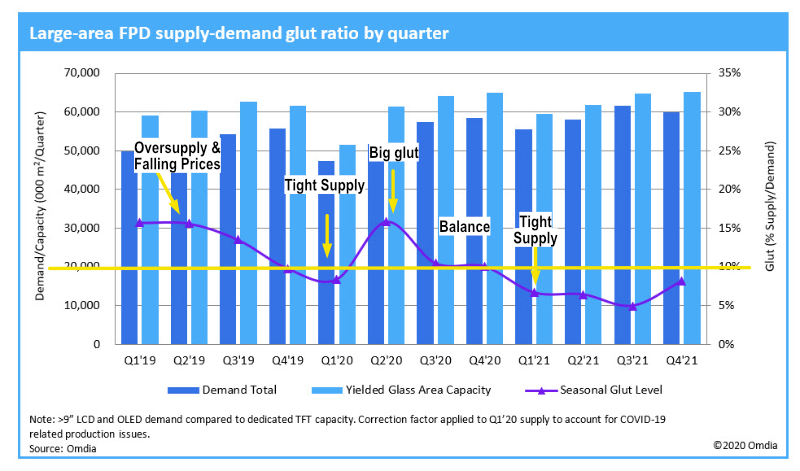

As we saw in yesterday’s DD from Charles Annis of Omdia (Large-area FPD Panel Availability Set To Tighten Significantly In 2021) industry capacity is scheduled to get very tight next year. It has long been the “rule of thumb” for the LCD industry that ‘balanced supply’ is around 10% over capacity. By 5% overcapacity, the market feels very tight with buyers unable to get what they want, when they want, from who they want. Conversely, above 10% over capacity, the industry is in over-supply and prices fall. The chart in his article shows swings from oversupply in Q1 2019, to some tightness in Q1 this year. This quarter sees a lot of oversupply, with balance for the second half, but with a shortage by early next year and a very tight situation by Q3 2021. If things do get that tight, then prices will be forced up and acquisitions may look more reasonable than they do today, if the price is right, of course.

The crystal cycle in LCD is well established but at the moment it’s more like a rollercoaster. Data:Omdia – Image:Meko

The crystal cycle in LCD is well established but at the moment it’s more like a rollercoaster. Data:Omdia – Image:Meko

The whole situation depends, though, on the impact of Covid-19 on demand in the TV industry, which absorbs around 70% of the LCDs made, so is the critical factor in the supply/demand balance calculation. Because of the long investment cycles and large amounts of money, supply is not so difficult to forecast in the short to medium term (of course, I say that as someone that doesn’t have to do it!). Demand, on the other hand, is another matter.

In normal times, TV demand is not too tricky to forecast. For developed economies, it is basically a replacement market, and in the developing world, it’s largely a matter of macroeconomics. However, these are not normal times, to put it mildly, so I reached out to Paul Gray of Omdia, a friend of Display Daily and one of the most experienced analysts I know in the world of TV and he said:

“For the first time Flat Panel TV has seen a simultaneous hit in all regions, with an annual fall globally of 10% in Q1’20. While developed regions’ demand is likely to recover rapidly due to diversion of other spending, emerging regions are expected to take longer to return to former levels as TV purchases are more tied to the broader economy.”

If things are worse than the current forecast, and that’s possible, then the big supply squeeze could turn into oversupply and then buying another fab would have looked like a stupid thing to do. Some days, I’m glad I don’t have to make these decisions! (BR)