Hanwha Solutions is poised to complete construction of its new fine metal mask (FMM) production facility in Asan, South Korea, by the end of this year. However, the company has yet to secure a customer for its innovative FMM technology, according to The Elec. FMMs are critical components in organic light-emitting diode (OLED) displays, defining the red, green, and blue subpixels that comprise an OLED panel’s overall image. Japanese company Dai Nippon Printing currently dominates the FMM market.

In October, 2022, Hanwha announced a substantial investment of 201.7 billion won ($164 million) in its new Asan-based OLED FMM facility. The company has highlighted that the use of OLED panels is extending beyond smartphones into larger IT products, and argues that its FMM product will provide cost-effective competition in the expanding market.

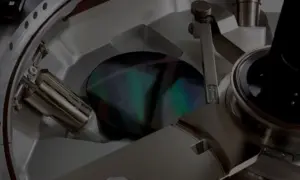

A significant point of difference for Hanwha’s approach lies in its planned manufacturing method. The company intends to use electroforming to produce its FMMs, rather than the etching technique employed by leading FMM suppliers. The electroforming process can create thinner FMMs, which are more suitable for high-resolution OLED panels. Despite this potential advantage, no company has yet managed to commercialize electroformed FMMs. Major OLED manufacturers, such as Samsung Display, LG Display, and BOE, continue to rely on etched FMMs, primarily sourced from Dai Nippon Printing.

Hanwha Solutions’ new factory is strategically located in Asan, where Samsung Display also has its principal manufacturing plant. This geographical proximity hints at Hanwha’s ambition to secure the display giant as a customer. However, reports suggest that both Samsung and LG Display are not currently considering the use of electroformed FMMs.

Hanwha’s WOS division, responsible for the FMM business, was previously a subsidiary of Wave Electro, providing FMM samples to Samsung Display. However, thermal expansion issues emerged during the testing phase. Hanwha purchased WOS for 60 billion won ($45.5 million) in July 2021. Another company, Philoptics, is also exploring the potential of electroformed FMMs but, like Hanwha, has yet to secure any customers, despite sampling its technology with Chinese panel companies.

The completion of Hanwha’s factory represents a significant investment in a novel approach to FMM production. However, whether this innovative strategy can translate into commercial success in the face of established etching-based FMM technology remains to be seen.