Aggregating all the publicly traded equipment suppliers results for Q1’20 in our Quarterly Display Supply Chain Financial Health Report revealed a sharp decline in display equipment spending and a stark contrast in the fortunes of a number of the market leaders. We saw healthy growth at AMAT and TEL at the same time as seeing large reductions at Canon, Nikon and V Technology.

We also saw Korean equipment suppliers outperform Japanese equipment suppliers in most categories.

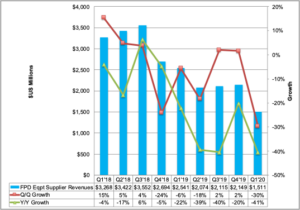

In our survey of 29 publicly traded display equipment suppliers, we saw their combined display equipment revenues down

30% Q/Q and 55% Y/Y. These 29 companies have averaged 58% of total display equipment spending from Q1’16 – Q1’20. Equipment spending fell sharply as multiple fabs in Wuhan were installing equipment in Q1’20 and were forced to delay installations on lack of overseas engineers. Other fabs in China were also impacted as overseas engineers were being quarantined upon their arrival. However, not all companies were impacted equally.

Display Equipment Revenues for 29 Publicly Traded Suppliers

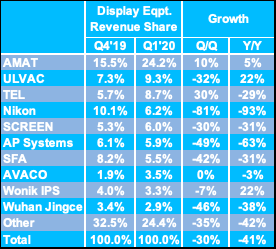

AMAT remained #1 in display equipment revenues for the 4th straight quarter, boosting its share in this survey to 24.2% on 10% Q/Q growth. This was the highest share we have reported in any quarter for any company as most other companies saw declines. ULVAC climbed from #5 to #2 on a slower decline than the companies ahead of them, falling 11% Q/Q, enabling them to reach their highest share since Q1’16. TEL rose from #8 to #3 on 7% Q/Q growth. Canon’s share fell from 7% to 2% while Nikon’s fell from 10% to 6% as they only recognized revenues for a combined 5 litho tools due to the logistical challenges from COVID-19. Canon fell from #4 in Q4’19 to #16 in Q1’20 . Nikon fell from #2 to #4, SCREEN rose from #9 to #5 and AP Systems rose #7 to #6. Rounding out the top 10 was SFA at #7, down from #3, AVACO at #8, up from #12, Wonik IPS at #9, up from #10 and Wuhan Jingce at #10, up from #11.

Top 10 Publicly Traded Display Equipment Supplier Revenues

In total, only 6 companies reported Q/Q growth in display equipment with 9 reporting growth on a Y/Y basis. Sequentially, SEMES, Philoptics, AVACO, Toptec and AMAT experienced double-digit growth with 20 companies reporting double-digit Q/Q declines. On a Y/Y basis, the 8 fastest growing display equipment companies were based in Korea while 5 of the 6 worst performers were based in Japan.

One reason for the mixed results was that AMAT, TEL and Korean equipment suppliers tend to recognize revenues for most of their tools when shipping their equipment through an internal factory acceptance test or when moving-in their equipment. On the other hand, exposure equipment suppliers tend to recognize their equipment upon completion of the install process or sign-off. We also believe that the large non-litho equipment companies like AMAT and TEL can rely on well-trained local engineers to install their equipment. On the other hand, exposure suppliers tend to rely on Japanese engineers to install their equipment. While video support is available, we are still hearing that exposure tools won’t get sign-off until Japanese engineers come to complete the installation. As a result of this situation, Nikon had to delay revenues for 5 exposure tools in Q1’20 and was only able to recognize 3. Canon was only able to recognize 2 tools in Q1’20, down from 15 tools in Q1’19. A number of equipment companies also experienced large delays such as V Technology which reported >70% Q/Q and Y/Y decline in revenues as they prevented their engineers from travelling to China from February.

In fact, engineers at a number of companies are still not travelling, essentially unable to service their customers for as many as 5 months. These engineers would be quarantined in China for 2 weeks upon arrival and another 2 weeks upon their return to Japan. Thus, the gap between when the first tools are moved-in and the last tools are signed off is widening. To make matters worse, it can take up to 6 months to complete installation for exposure tools and China visas are only available or 3 months. So, multiple engineers are required to complete install for the same tool and the exposure tool sign-off schedule is unpredictable right now. Hence, while AMAT could recognize revenues in Q1’20, Canon may not be able to recognize revenues for the same fab until Q3’20 or even Q4’20. With new fab ramps potentially delayed beyond current expectations due to the exposure tool install delays, it could lead to potential supply constraints as new China supply is delayed, Korea LCD capacity is shut down and demand rebounds in 2021. At the least, it could lead to some companies gaining or losing share depending on when their tools are installed leading to a battle for the Japanese engineers.

In addition, Applied Materials executives have discussed the logistical challenges in getting some of their tools from the US to Asia due to the limited number of flights available which has led delays and higher costs. While this is most likely focused on semiconductors, there are also fewer flights from Japan, Korea and other Asian countries to China and there have been transportation restrictions within China as well, so display equipment companies have also faced some logistical challenges getting their tools to customers in time to make the quarter.

Why are Korean companies seeing faster growth? One reason is because they are more focused on OLEDs and more of the recognized spending in Q1’20 was in OLEDs. Another reason was some of the equipment was less sophisticated such as module equipment and can be installed faster or by local engineers.

Despite the weakness in revenues, OPMs for display equipment businesses were flat rising slightly from 7.7% to 7.8% due to gains at some of the larger participants. SNU led in OPMs followed by AMAT.

Other highlights include:

- Display equipment bookings for 13 companies were up 19% Q/Q and 23% Y/Y as 2H’20 and Q1’21 look strong. Viatron, Charm and AP Systems had triple digit bookings growth with AP Systems enjoying the highest booking total at $290M followed by ULVAC at $133M and Philoptics at $77M.

- Display equipment backlog for 15 companies rose 12% Q/Q and 20% Y/Y to $2.5B, the highest since Q2’18. Backlog rose at least 30% at Viatron, Charm, SEMES and Toptec.

- Debt/equity levels worsened from 22% to 30%, the highest they have been since Q1’17. Philoptics, Invenia, Wuhan Jingce, AP Systems and YAC all have debt/equity values over 100% although Invenia, AP Systems and YAC improved in the quarter.

- Free cash flow fell 46% Q/Q while rising 10% Y/Y to $1.2B, the lowest value since Q2’19. AMAT remained #1 with TEL overtaking Canon for #2 and 13 companies experiencing negative free cash flow.

- Display equipment supplier inventories were up 2% to $19.2B consistent with delayed shipments for some companies.

While Q1’20 was weak and delays are extending into Q2’20 and Q3’20, we still see 2020 as a positive year for the display equipment market on a move-in basis, up over 30%, with >66% of the revenues in 2H’20. On an install basis, we currently show 2020 flat at just 3% growth and it could decline if overseas engineers cannot catch up to demand leading to longer delays than currently predicted.