Every year for the last eight, Ericsson has conducted a big user survey on TV viewing and published the result and this year is no exception.

Every year for the last eight, Ericsson has conducted a big user survey on TV viewing and published the result and this year is no exception.

The survey included online interviews were conducted with 20,000 people from 16-69 in thirteen countries (Brazil, Canada, China, Germany, India, Italy, Russia, South Korea, Spain, Sweden, Taiwan, the UK and the US). 12 in-depth interviews were conducted with VR users. Over the year, Ericsson ConsumerLab conducts 100,000 interviews over 40 countries.

Key findings of the survey were:

- VOD will become more social as VR is used more often

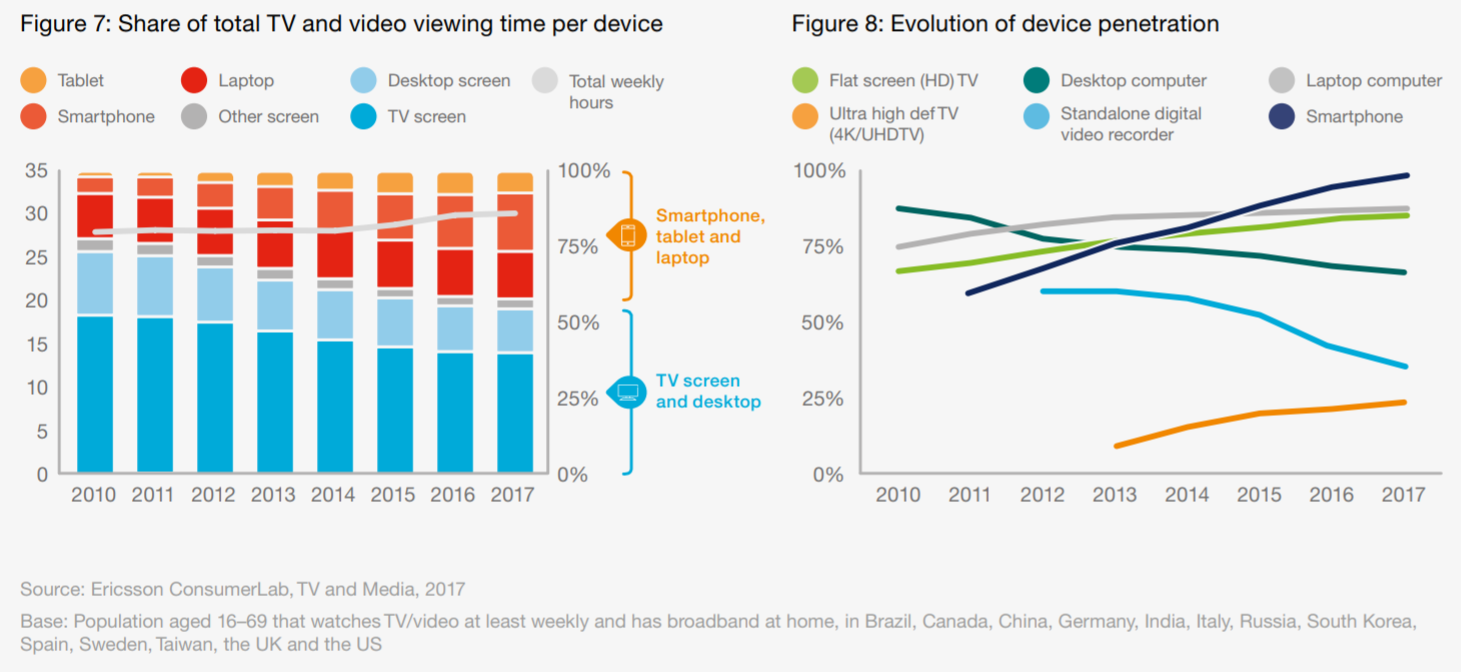

- Smartphone viewing is up at 70% – more than double the level of five years ago and with up to 6 hours per week spent watching on mobile devices.

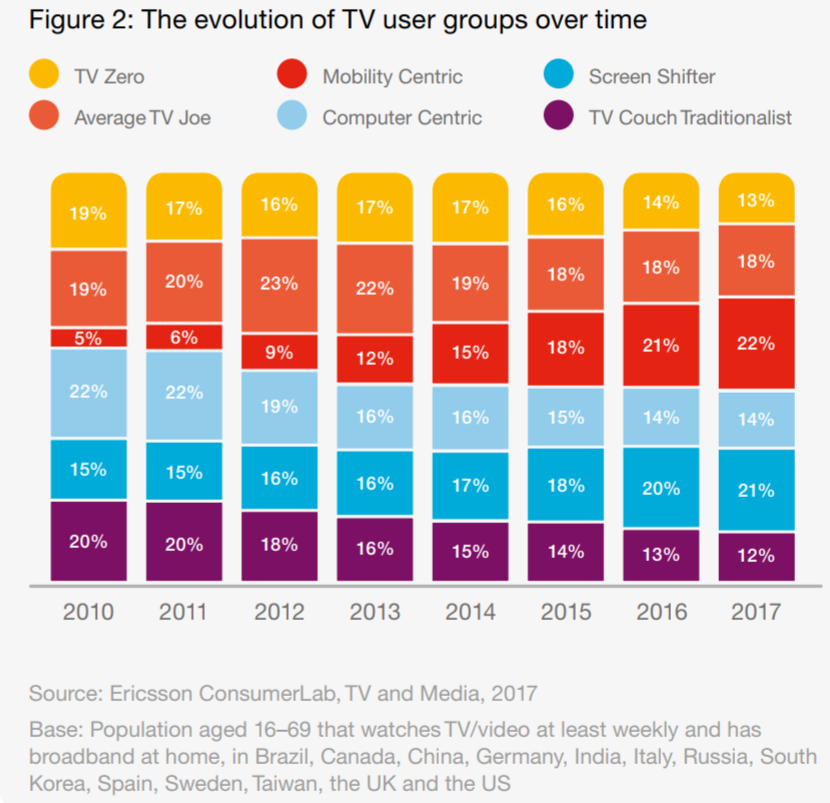

- By 2020 only 10% of consumers will be ‘stuck in front of the TV’, 50% down from 2010.

- The long term problem of searching for content remains a challenge – almost an hour per day can be spent on this and 70% of viewers would like a universal search feature

- 16-19 year olds watch more than half of their content with on-demand video, while 60-69 year olds watch linear TV 80% of the time

- By 2020, half of all viewing will be on mobile displays and half of that viewing will be on smartphones.

- By the same time, 7 out of 10 will prefer on-demand and catch-up services

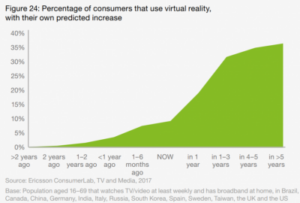

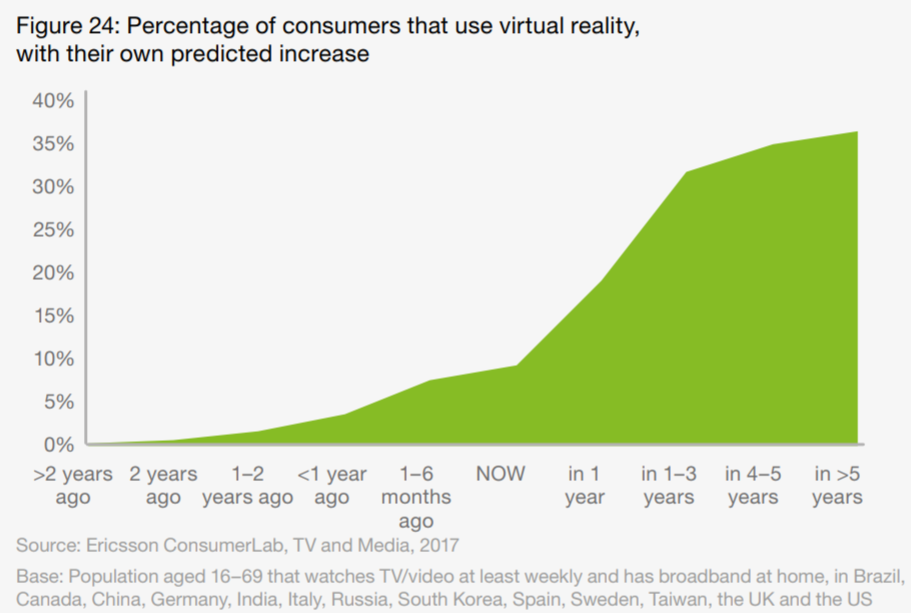

- A third of users are expected to be using VR by 2020

There is a lot of differnce in the way that TV and video is consumed.

There is a lot of differnce in the way that TV and video is consumed.

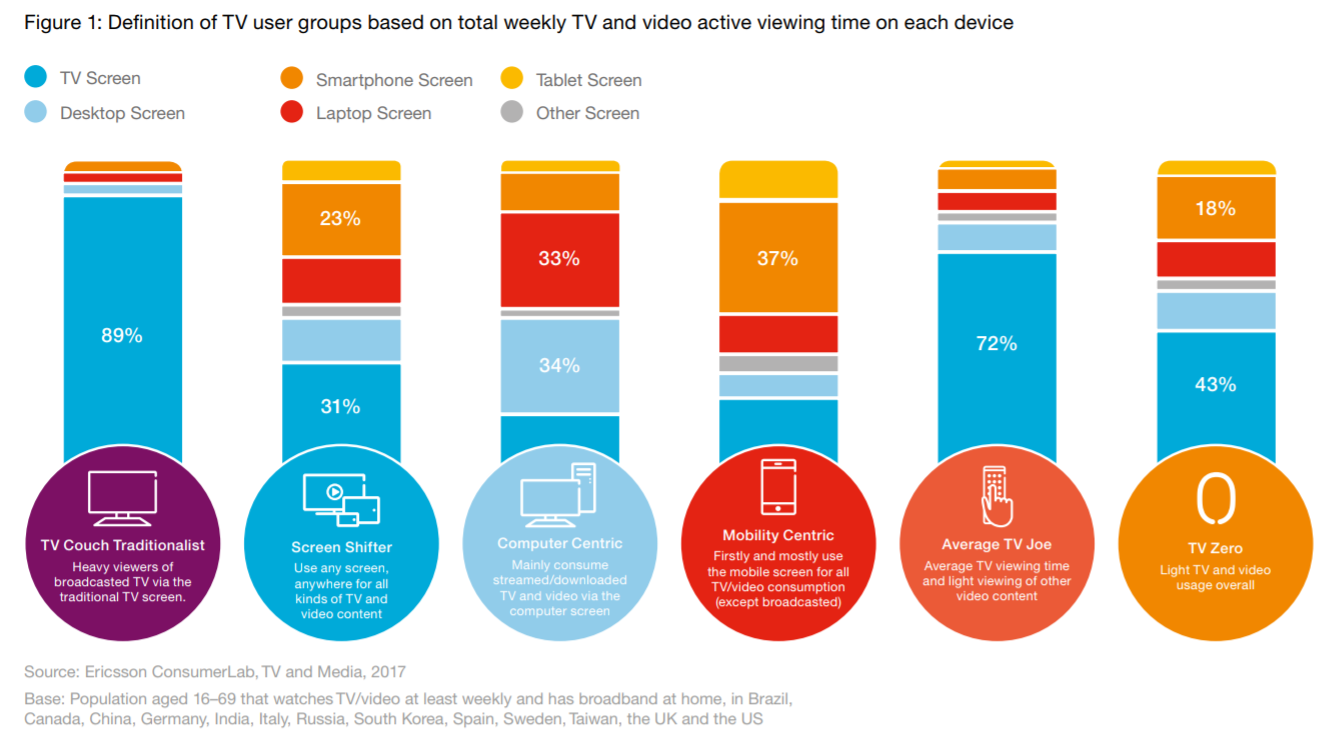

Ericsson has divided users into six groups that it defines as:

- TV couch traditionalist – watch via a TV set

- Screen Shifter – uses any screen anywhere

- Computer Centric – mainly streaming via computer

- Mobility Centric – mainly use a mobile device

- Average TV Joe – average TV viewing and light use of streamed content

- TV Zero – very light watcher of TV and video

The chart above shows how different in habit the different kind of users are. Over time, the trend has been strongly towards mobility which has increased from 5% of the market in 2010 to 22% in 2017.

The report reviews changing viewing habits and notes that they have changed a lot and 77% of viewers think that their habits will change again. It’s no surprise that binge watching has increased and 29% expect to use voice instead of remote controls in the future. 27% expect to watch more 360º video. Highlighting the problem in finding content, 12% expect to watch less on-demand material simply because they expect to get lost in the sheer variety of content.

The time spent watching video has increased, with teenagers doubling their viewing of on-demand video with an increase of almost 10 hours per week since 2010. Consumers typically watch 30 hours of TV/video every week and Ericsson looked at the kind of content being consumed, by age group.

Of course, the ownership of smartphones has now reached 95% and that has driven the viewing of video content on these devices.

VR is a big topic in the report and Ericsson said that 10% of consumers already have a VR device, with 25% planning to get one. 30% of respondents believe that they will use VR headsets for video in five years’ time, although they are mainly used for game playing, now. Ericsson believes that VR “can be the spark needed to reignite the social TV campfire”. Early adopters are very keen and believe that VR will be a fundamental part of TV and video viewing in the next five years.

A third of those planning to buy VR headsets expect to do so in the next year and over half believe that VR will be mainstream in less than three years. However, consumers would prefer VR headsets to be cheaper and almost half think therey should be more content.

We’re reported before on the ‘content discovery crisis’ there are a lot of problems finding anything to watch, not only on linear TV (which is an old story), but also on VOD. Last year, the average time spent searching was 45 minutes and it has increased to 51 this year, with all of that additional time spent on scheduled services. 60% of viewers see content discovery as a key issue when choosing a new TV or video subscription service. However, price and content remain the key drivers in that choice.

Views on advertising are changing and while most viewers still prefer free services, paid for by advertising, almost a third would be happy to pay a small fee ($5 to $10) to reduce or eliminate adverts.