Nakane-san is from Mizhuo Securities and, like Ross Young, the previous speaker, he is another veteran of the display industry. He had more than 150 slides – also with a lot of text! Not so much a deck, more a book.

Nakane-san is from Mizhuo Securities and, like Ross Young, the previous speaker, he is another veteran of the display industry. He had more than 150 slides – also with a lot of text! Not so much a deck, more a book.

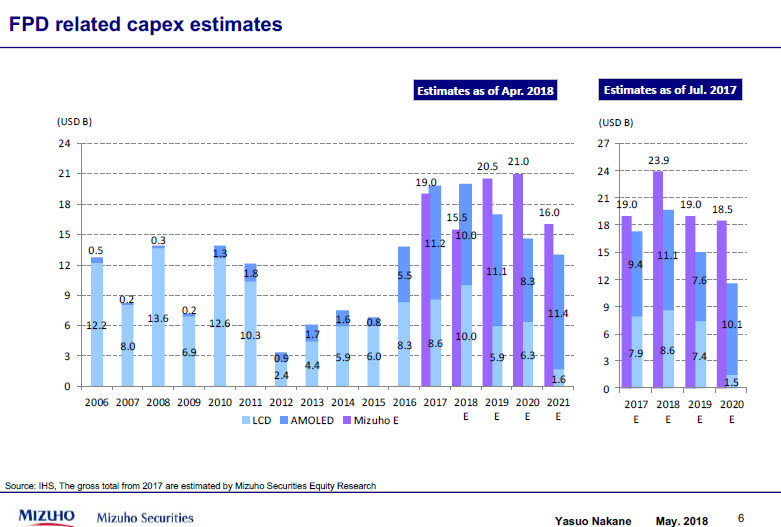

Nakane expects capex to be around three times the long term trend which he described as ‘a bit crazy’. AUO and Innolux are reducing their investments to create more free cash flow. LG Display is more or less at break even, but equipment and material providers are generating free cash flow.

Mizhou forecast capex as expanding to ‘crazy’ levels. Data Mizhuo/IHS

Mizhou forecast capex as expanding to ‘crazy’ levels. Data Mizhuo/IHS

Looking back to 2007, the demand for TV panels was around 120 million panels and Samsung was #1 supplier. At that point, all the Chinese TV brands were just buying 10 million or less. By 2017, BOE had gone from $1 billion to over $22 billion – twice the market capitalization of LG Display and more valuable, even, than Sharp.

Small Size Capacity Increasing

Small size capacity is increasing steadily and will double soon – capacity may be three times that of LCD by the end of the forecast period. Nine G10 plants are on the roadmaps of different companies and many G6 OLED plants. Demand is forecast for just 5% CAGR growth, but capacity is expected to rise by 10% to 12%, while small growth is forecast to rise by 15% to 20% per year – way beyond consumption growth.

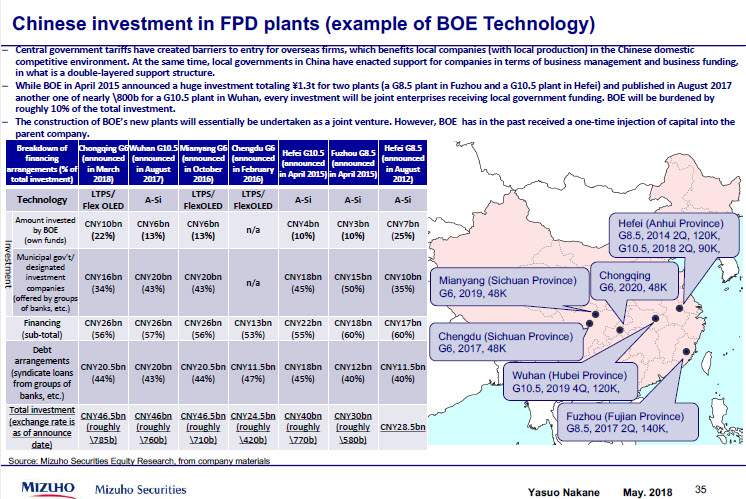

BOE has raised a lot of capital – more than its market capitalisation – usually 30% of market cap is the maximum that companies can raise, Nakane said. For one of its fabs, BOE has only put in 10% of the investment. Building LCD & OLED fabs fits the desire of local government – because the display investment is multiplied up because of the required supply chain for glass, filters, etc

Chinese panel makers only have to make partial investments – Click for higher resolution

Chinese panel makers only have to make partial investments – Click for higher resolution

Large Size Capacity Grows Too Fast

Only moderate growth is forecast as so many markets are getting mature, but supply growth is 10% to 12%, so as Young had said, there will be huge oversupply for the next couple of years. Even though G6/G7 and even G8 fabs may close, it’s going to be hard to be competitive if you don’t have a G10 fab. AUO, Innolux and Panasonic don’t have a choice, they have to keep their fabs going as that is all they have.

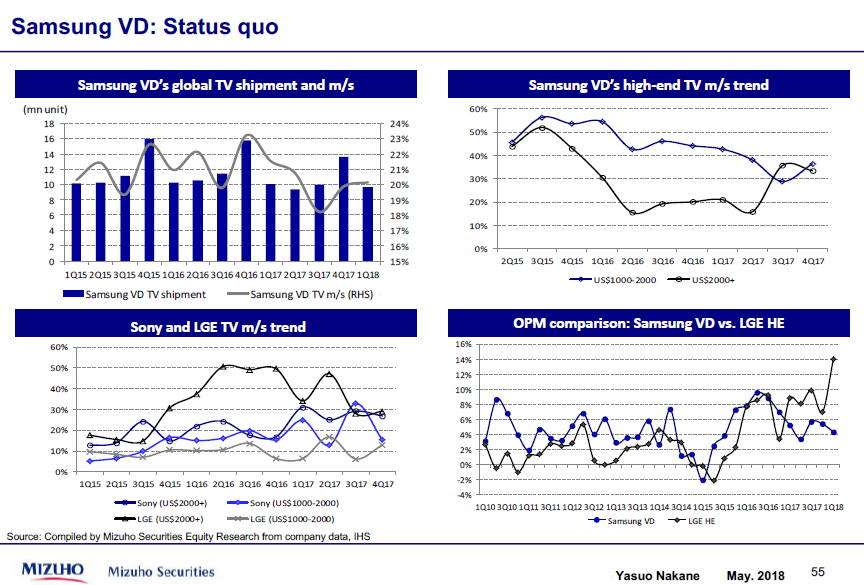

Samsung & LG have already given up “the volume attack” and Samsung is now focusing on high end markets, as is LG. Only Sharp is really pursuing volume growth now, among established suppliers.

Only four G10 fabs are really needed, but eight are very likely to be built out of nine possible fabs. (There seemed to be some convergence on this number among the analysts – Man. Ed.)

LG is doing well with OLED, Nakane said – LG Electronics is competing hard against Samsung’s Visual Display business and he said that LG is “beating them with OLED at the moment”.

Is Quantum Dot The Way?

“Maybe QDOLED is the solution for Samsung?”, Nakane suggested. QD on the Filter is difficult to make because of the in-cell polariser, he said. The best opportunity may be inkjet printing with QD OLEDs – perhaps by end 2019 (using blue OLED materials with QDs to convert the colour to red and green’.. Samsung may be able to come back with QDOLED, he believes. The Japanese are basically out of the business, but JOLED may be able to develop its technology and then sell it as it will find it hard to get the money to build a fab. Alternatively, the Chinese could align with JOLED.

Samsung VD is not having a good time against OLED. Click for higher resolution.

Samsung VD is not having a good time against OLED. Click for higher resolution.

Nakane believes that small panel growth is around 9.2% per year, including possible foldable applications.

It’s hard for others to catch up with Samsung in small OLED as the company can lower prices to boost loading, making it hard to compete. Smartphone makers have to turn to more cameras and 3D sensing, rather than depending on display type or performance to differentiate their products. Apple this year has two OLED-based phones and one LCD model and Nakane expects the same next year, with around 120m OLEDs being needed. Samsung will have capacity for 120 million or so and LG will have 50 million, so there is no problem to supply unless Apple goes for an OLED iPad which would absorb more area. Apple will try to launch using LG Displays then JDI and maybe even BOE later to reduce its dependence on Samsung alone.

Samsung remains three years or so ahead. Other smartphone makers would like to use OLED but don’t like the current single supplier situation.