The first speaker was Ross Young, who talked about the year and introduced DSCC which is now two years old and has eight employees. The company now has four OLED reports, two display cost reports, four equipment reports and a new report that looks at equipment orders.

The first speaker was Ross Young, who talked about the year and introduced DSCC which is now two years old and has eight employees. The company now has four OLED reports, two display cost reports, four equipment reports and a new report that looks at equipment orders.

Panel prices rose in the second half of 2016 because of higher demand and then fell as demand fell in the second half of 2017. There is a long list of fab closures of older factories as a result. The financial results of panel makers dropped sharply in Q1 2018. After a period of strong margins, already some companies are in negative revenue territory. Those that supply Apple are often the most extreme in their swings because of the seasonality of Apple’s supply chain. The industry generated cash flow during the better pricing period, but capex was higher, so, overall, free cash flow was negative.

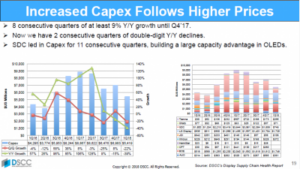

Capex was growing for eight straight quarters of at least 9% year on year, but there have now been two quarters of decline in investment. Samsung was a big spender to boost its OLED capacity and was the top investor for eleven consecutive quarters. (Although we noted in the data that Samsung’s capex fell sharply in Q1 2018, with BOE leading, just marginally ahead of LG Display).

Capex has been led by Samsung up to the last quarter. Image:DSCC

Capex has been led by Samsung up to the last quarter. Image:DSCC

Young thinks that there will be quite a long period of downturn, because capex is continuing despite falling prices, although eventually investment will slow down. The markets are very elastic – the cheaper the panels, the more are sold in TVs and monitors. Reducing costs drives pricing and volume. Stock prices have almost given up all the gains from last year, because of the current panel price drops.

Market Caps Have Been Falling

BOE and CPT are down in market cap although they did very well and only AUO is up. Equipment stock values grew a couple of years ago, but have been flat this year. The Korean equipment makers are doing less well this year as they are being beaten by Japanese companies in China, and at the same time, the Korean panel makers are cutting back. UDC and Coherent had great stock gains last year, but have fallen back because of the less than hoped for sales of the iPhone X. Samsung was ramping capacity – Apple and Samsung seemed like a ‘match made in heaven’. OLEDs were a big part of Samsung’s production, but Apple’s sales fell off after Q4.

“Why did Samsung build so much capacity?”, Young asked.

LCD makers have reacted and there is little difference to the user between the types of display used. However, the flexible OLEDs do cost a lot more and that makes their use a challenge as it’s very hard to differentiate. “Is Samsung leading the industry off a cliff?”, Young asked. Prices will come down and that will drive more volume. There is not a lot of competition in flexible OLEDs, but what there is will help put pressure on the industry and so will better productivity.

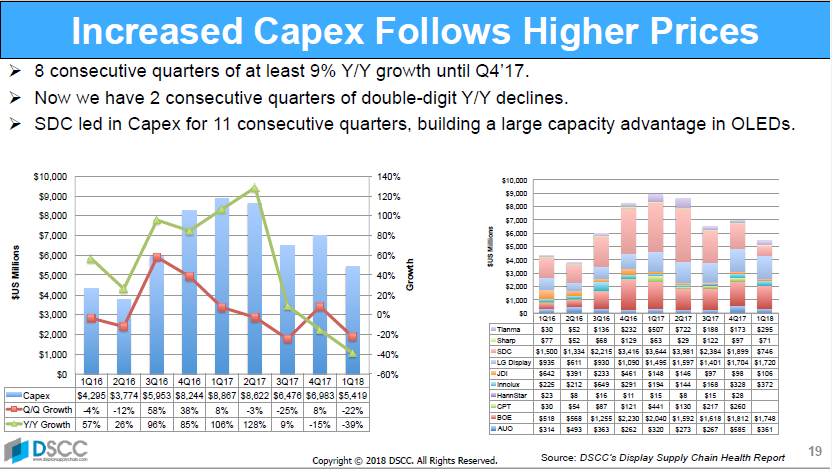

Foldable displays could be very important with the tablet/phablet potentially taking off. However, they are very hard to make and there is a lot of stress, with infold and outfold posing different problems. Going thinner is better in both cases as this reduces the differential in the stretching between the two sides. Young showed a long, long list of challenges to be overcome. (a later speaker had a much shorter list, but we wouldn’t argue with those that Young presented – Man. Ed.)

Y-Octa Will be Important

Y-OCTA is Samsung’s OLED touch technology (So What is Y-OCTA? and Samsung Electronics to Use Y-OCTA Displays for Galaxy S9) and this adds some extra processes which is good for the equipment industry and DSCC thinks it will catch on. Apple is expected to get to around 220 million OLED unit purchases eventually, but Samsung will not have to add much capacity to meet it. OLED doesn’t overtake LCD until 20201 but there will not be much growth in LTPS. OLED revenues will grow at 25% CAGR to a total market value of $57 billion and the value of flexible panels goes past rigid because of the pricing.

What about subsidies? They are dependent on regional government finance, but the policies change every year. For example, HKC had to go to three different regions to find a supporter and panel makers are having to put more investment in themselves – BOE only made a limited investment in its latest capacity booth.

BOE & CSOT have real fab plans, but there are a lot of plans in the ‘long list’ that are not likely to happen because of financial pressures. Young showed a list of 36 possible fabs, but only 18 are identified as ‘Real’ by DSCC. The rest have only a reduced chance of happening.

LCD Spending is Growing

LCD spending is up this year, but OLED will be down in equipment spending – there needs to be a slowdown in capacity growth to tighten things. In 2018, 90% of equipment spending will be from China and with BOE having more than a quarter.

China will get to 51% of the capacity of the industry in 2022 – so the industry is moving to China. BOE will be top in capacity from next year, although Samsung will dominate mobile OLEDs.

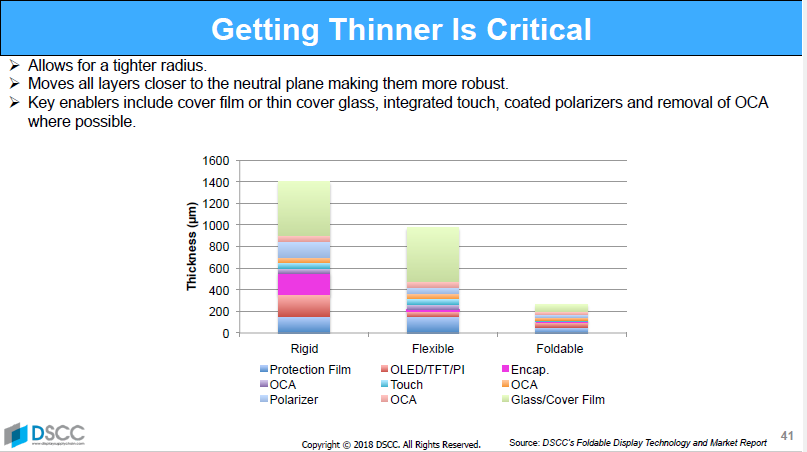

What share is OLED? LG should take the lead on a square metre basis because of investments in larger panels.

Young showed the “Oledization” of the panel supply industry. Image:DSCC

Young showed the “Oledization” of the panel supply industry. Image:DSCC

There is going to be a lot of high end TV capacity coming – it will be good for set makers, but worrying for panel makers. However, most of the capacity is aimed at the high end of the set market, but Young pointed out that the over $1500 TV segment is only 3% of the market. Despite this, Samsung Electronics has 16 quantum dot LCD models.

The move to larger TVs will absorb a lot of glass and an increase in share of 65″ sets will increase LCD area. It would be great for set makers and retailers if prices stayed high, but panel makers need prices to fall sharply to drive demand to absorb glass for larger sets.

As always, the trends in the industry are good for consumers, Young said.

In response to a question, there’s potential in sets using Quantum Dots, but they will probably decline slightly this year, Young believes.