Although the display industry is having a difficult year, the Advanced TV market continued to grow Y/Y in Q1 2022, and this segment of the industry continues to look promising. In this round of the battle between LCD and OLED technologies the two sides played to a draw, with both sides gaining volume and share largely unchanged.

This is highlighted in the latest update of the DSCC Quarterly Advanced TV Shipment and Forecast Report. On a brand level, Samsung has lost share in the Advanced TV market since early 2020, but managed to regain two points of revenue share despite losing a share point of unit share.

In this article, we will review the historical results of Q1 2022.

DSCC defines an “Advanced TV” (capitalized) as any TV with an advanced display technology feature, including all OLED TVs, 8K LCD TVs and all LCD TVs with quantum dot technology. The historical data in the report allows analysis by feature for Advanced LCD TVs, including:

- QDEF TV: TV using a Quantum Dot Enhancement Film; these TVs are sold as “QLED” by Samsung, TCL, and others;

- MiniLED: LCD TVs with a MiniLED backlight, as sold by TCL starting in 2019 and introduced by Samsung, LG, Hisense and others in 2021;

The historical data through 2021 for OLED TV includes only one product configuration, LGD’s White-OLED (WOLED) technology, but in Q1 2022 we saw the first volumes for Samsung Display’s QD Display or QD-OLED TVs and also the first sales of MicroLED TVs in very small volumes.

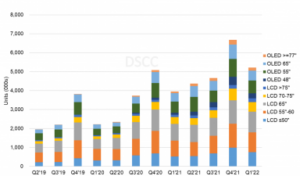

Advanced TV shipments in Q1 2022 increased by 32% Y/Y to 5.2 million units, as shown in the first chart here. In volume terms, the gains were spread equally as OLED TVs increased 33% Y/Y while Advanced LCD TVs increased 32% Y/Y. All screen size groups for OLED TVs increased Y/Y, with the biggest gains in 48”, up 258% Y/Y and 77” and larger, up by 85%. The 48” OLED TV models were introduced only in Q2 2021, but already represented 16% of OLED TV volume in Q1 2022. Similarly, 83” OLED TV sets were introduced in Q2 2021 helping to drive growth in 77”+. Within the LCD category, shipments increased by a double-digit % Y/Y across all screen size groups, with the biggest gains in >75” which increased by 58% Y/Y.

Advanced TV Shipments by Size and Display Technology, 2019 to 2022

Source: DSCC Quarterly Advanced TV Shipment and Forecast Report

Source: DSCC Quarterly Advanced TV Shipment and Forecast Report

Advanced TV revenue growth in Q1 2022 was higher than unit growth at 39% Y/Y, and for the second quarter in a row the revenue growth was driven by LCD. Revenues for Advanced LCD TVs grew 45% Y/Y driven by general price increases, a bigger screen size mix and the growth of MiniLED TVs at higher prices. Revenues for Advanced LCD TVs larger than 75” grew 150% Y/Y, the fourth consecutive quarter of triple-digit revenue growth for that category. OLED TV revenues increased 32% Y/Y and OLED revenue share decreased from 41% in Q1 2021 to 38% in Q1 2022.

In Q1’22, among all Advanced TV products, Samsung maintained its leading position but lost 1 point of unit share with shipments up 29% Y/Y, slightly less than the market growth. Breaking a streak of five consecutive quarters of Y/Y share gains, LG Electronics lost 2 share points Y/Y in Q1 2022 as shipments increased by 19% Y/Y and unit share fell from 21% to 19%. The #3 and #4 brands fared better: TCL’s Advanced LCD shipments increased 43% Y/Y and TCL gained share Y/Y from 7% to 8%, while Sony shipments increased by 84% Y/Y and Sony share increased Y/Y from 5% to 6%.

Samsung Held Revenue Share

While Samsung lost share on a unit basis, it held share Y/Y and regained 2 share points Q/Q on a revenue basis as revenues increased 40% Y/Y. LG revenues increased 15% Y/Y and share decreased from 28% in Q1 2021 to 23% in Q1 2022. Sony took the #3 spot in revenues with 9% share with 93% revenue growth Y/Y and TCL followed with 8% on 48% revenue growth.

The report divides worldwide shipments into eight geographic regions. Western Europe and North America have continued to be the largest regions for Advanced TV. These two regions represented a combined 63% of Advanced TV units and 59% of revenue in Q1 2022. Shipments to Western Europe increased 46% Y/Y in Q1 2022 and revenues increased by 26% Y/Y. Shipments to North America increased 24% Y/Y and revenues increased 49% Y/Y as sales of big TVs surged. China shipments increased 31% Y/Y in Q1 and revenues increased 77%.

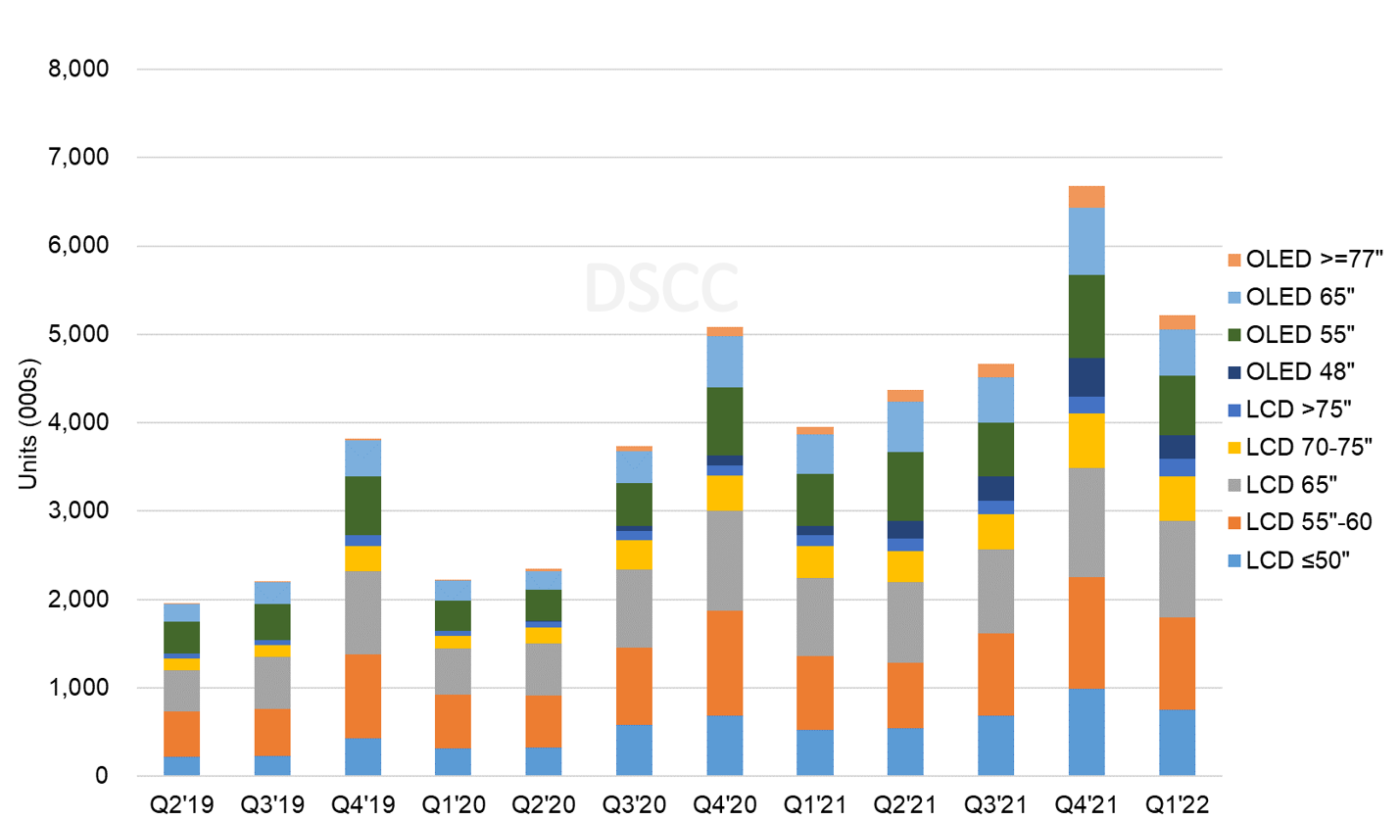

MiniLED has emerged as a competitor to OLED TV in the premium space. The next chart here shows MiniLED TV shipments by brand. While TCL introduced MiniLED in late 2019 and recorded some sales in 2020, the category remained tiny until Samsung and other brands introduced products with MiniLED technology in Q1 2021. From less than 100K units in 2020, MiniLED TV shipments grew to more than 1.7M units in 2021, and revenue grew from $73M in 2020 to $3.5B in 2021. Although it’s not a fair comparison because Samsung was just introducing MiniLED a year ago, shipments increased by an impressive 629% Y/Y to 753K in Q1’22 and revenues increased 533% Y/Y to $1.4 billion.

MiniLED TV Shipments by Brand, 2020-2022

Source: DSCC Quarterly Advanced TV Shipment and Forecast Report

Source: DSCC Quarterly Advanced TV Shipment and Forecast Report

In North America, Samsung enjoys a dominant position on the strength of its large-screen product portfolio but has seen its share erode as competitors in both Advanced LCD and OLED TV grow share. In Q1 2022 Samsung maintained the #1 position but unit share declined by 2 share points Y/Y to 49%. With a richer mix of MiniLED, though, Samsung revenue share increased by 5 points Y/Y to 49%. On the other hand, LG stumbled in the quarter as it lost 5 share points Y/Y in units and 9 share points in revenue. Both TCL and Sony gained share, but Vizio’s unit and revenue share decreased Q/Q and Y/Y and Vizio has lost 10 share points since peaking in Q1 2020.

In Western Europe, Samsung fared worse as it lost 3 points of both unit share and revenue share Y/Y. LG lost one point of unit share and revenue share Y/Y in the #2 spot. Sony fared better as it gained two points of unit share and three points of revenue share, and both Panasonic and Philips each improved their small share positions Y/Y.

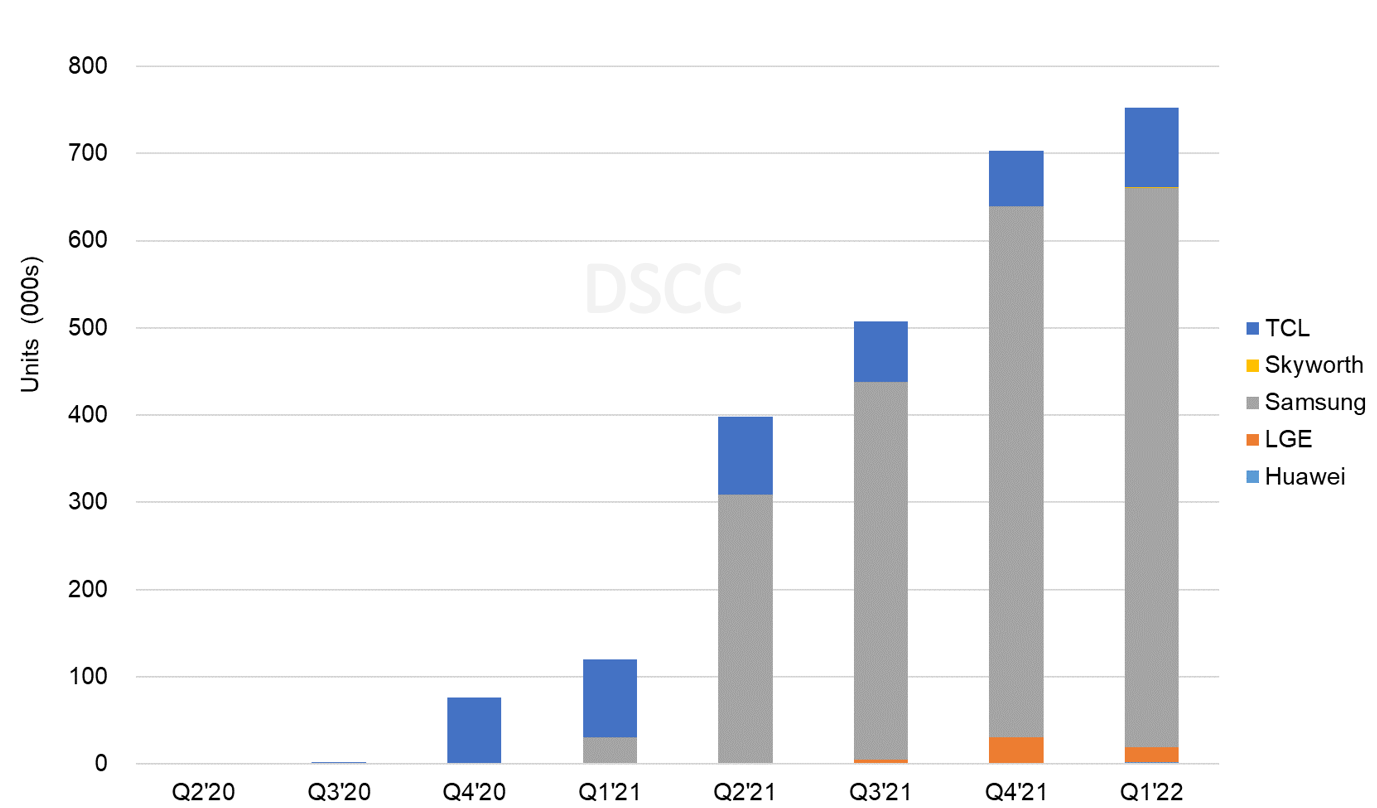

Advanced TV Revenues – Western Europe, 2019 to 2022

Source: DSCC Quarterly Advanced TV Shipment and Forecast Report

Source: DSCC Quarterly Advanced TV Shipment and Forecast Report

China remains a true battleground with four companies with double-digit % share in both units and revenues. Huawei has established itself as the leading player in Advanced LCD TVs and has taken the #1 position in units for five consecutive quarters. TCL is tied for the #2 position in units with Hisense but holds that position alone in revenue share.

The Battle by Screen Size

Another interesting cut of the brand data is the battle by screen size. In 55” worldwide unit shipments, Samsung continues to lead and increased its unit share by two points and its revenue share by four points Y/Y to 48% and 37%, respectively. LG faltered, losing five points of unit share and seven points of revenue share to 23% and 31%, respectively.

In the largest size category of 70”+, Samsung has seen its position erode from a near-monopoly in 2018 to 2019 to mere dominance in 2020-2021 as LG and Sony sales of 77” and 83” OLED and TCL sales of 75” and larger LCD have increased dramatically. In Q1 2022, Samsung still captured 54% unit share and 50% revenue share of 70”+ Advanced TVs, but these figures were down from 64% and 60%, respectively, in Q1 2021. Meanwhile, LG maintained its unit share Y/Y at 13% but lost three points of revenue share to 15%, while Sony, Huawei, Hisense and TCL gained share.

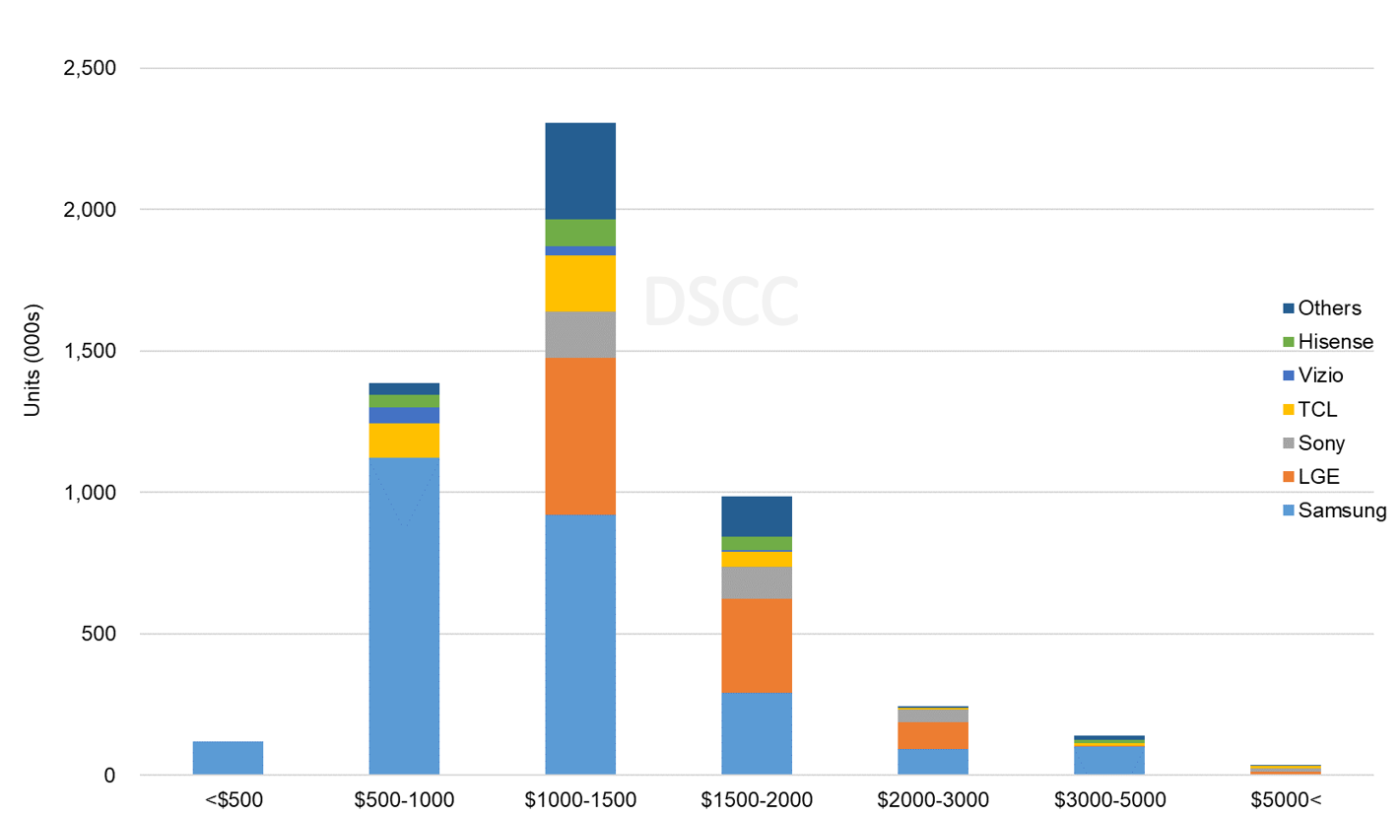

The last chart here shows one last valuable cut of the data, units by brand by price band for Q1 2022 and shows that Samsung’s leading position in Advanced TV is mostly a function of its dominance in Advanced TVs under $1000. Samsung’s strategy of pushing its QLED product line toward mainstream price points has allowed it to thrive, but LG, Vizio and TCL also appear as competitors at these lower prices. LG’s OLED TVs give it the leading position in the range of $1500-$3000, and Sony holds a solid #3 position in price points above $1000. Sales volumes at price points over $5000 form only a tiny slice of the market. (B O’B)

Worldwide Advanced TV Units by Price Band for Q1 2022

Source: DSCC Quarterly Advanced TV Shipment and Forecast Report

Source: DSCC Quarterly Advanced TV Shipment and Forecast Report

Thanks to DSCC for allowing us to re-publish this interesting article which was originally published on the DSCC blog. (registration required)

This article will not count as one of your two free monthly articles if you do not have a subscription at Display Daily