Ericsson has been producing its Mobility Report for ten years, so this time the firm has taken a look back at the development of mobile electronics and data services in that period. Amazingly, mobile networks are carrying 300 times the data they did in 2011.

You can download the full report free of charge from here.

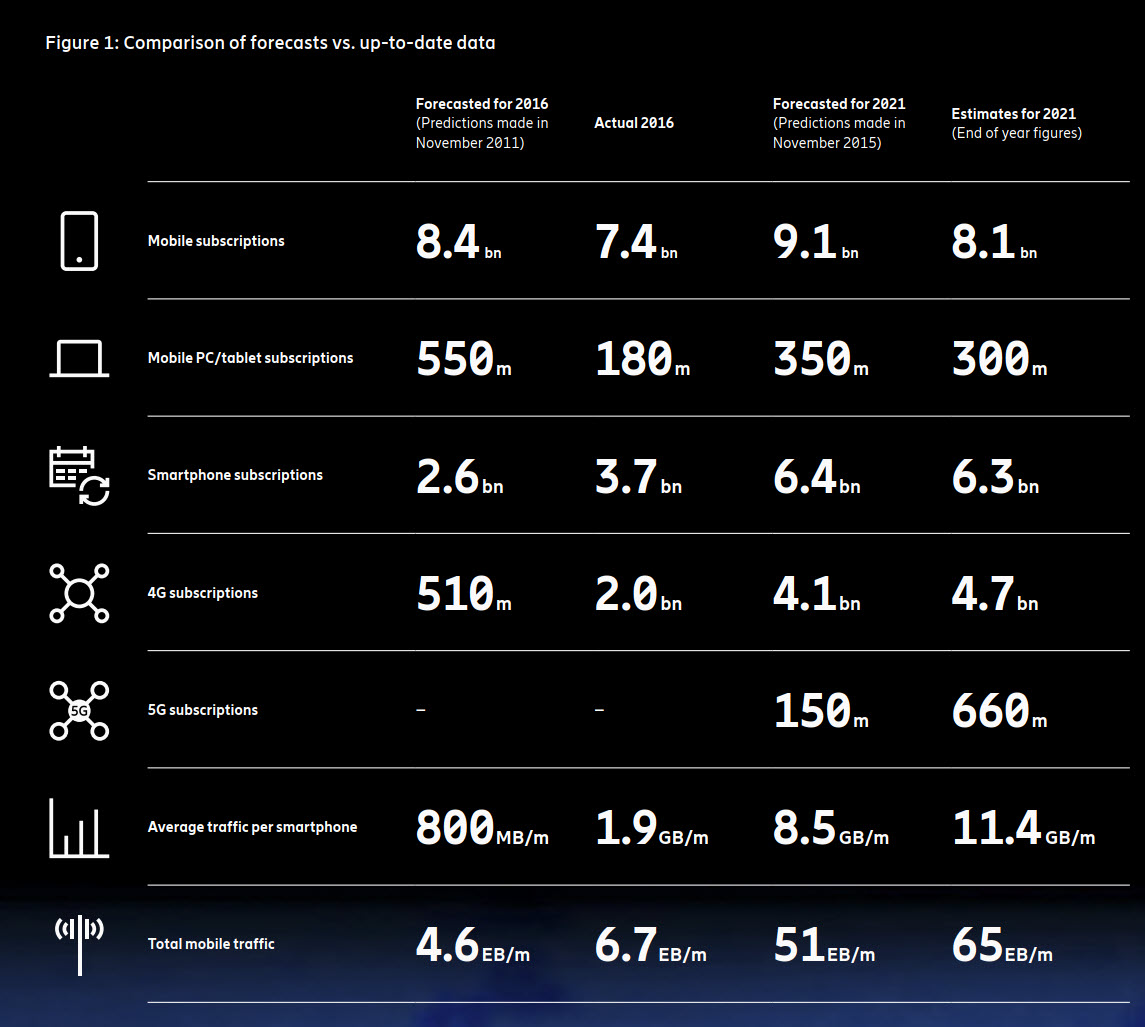

At that time, there was more data on the networks than voice data. That threshold had been passed in 2009, but mostly by a small number of notebook owners that were heavy users. It was also when 4G was launched (and I was surprised to see that there are now almost 20,000 4G devices on the market). The authors have been brave and compared their estimates of different market with the forecasts from 2011.

The forecasts for smartphones and subscriptions were mostly quite good, but the 2011 forecast heavily over-estimated the adoption of mobile accounts for PCs and tablets. While the forecast in 2011 was for 550 million connections by 2016, the actual number was just 180 million and by 2021, the number is still only around 300 million. To be honest, I was surprised that it was that high. I’ve never had a real problem using a smartphone as a hot spot for cellular access and am happy to avoid yet another monthly subscription.

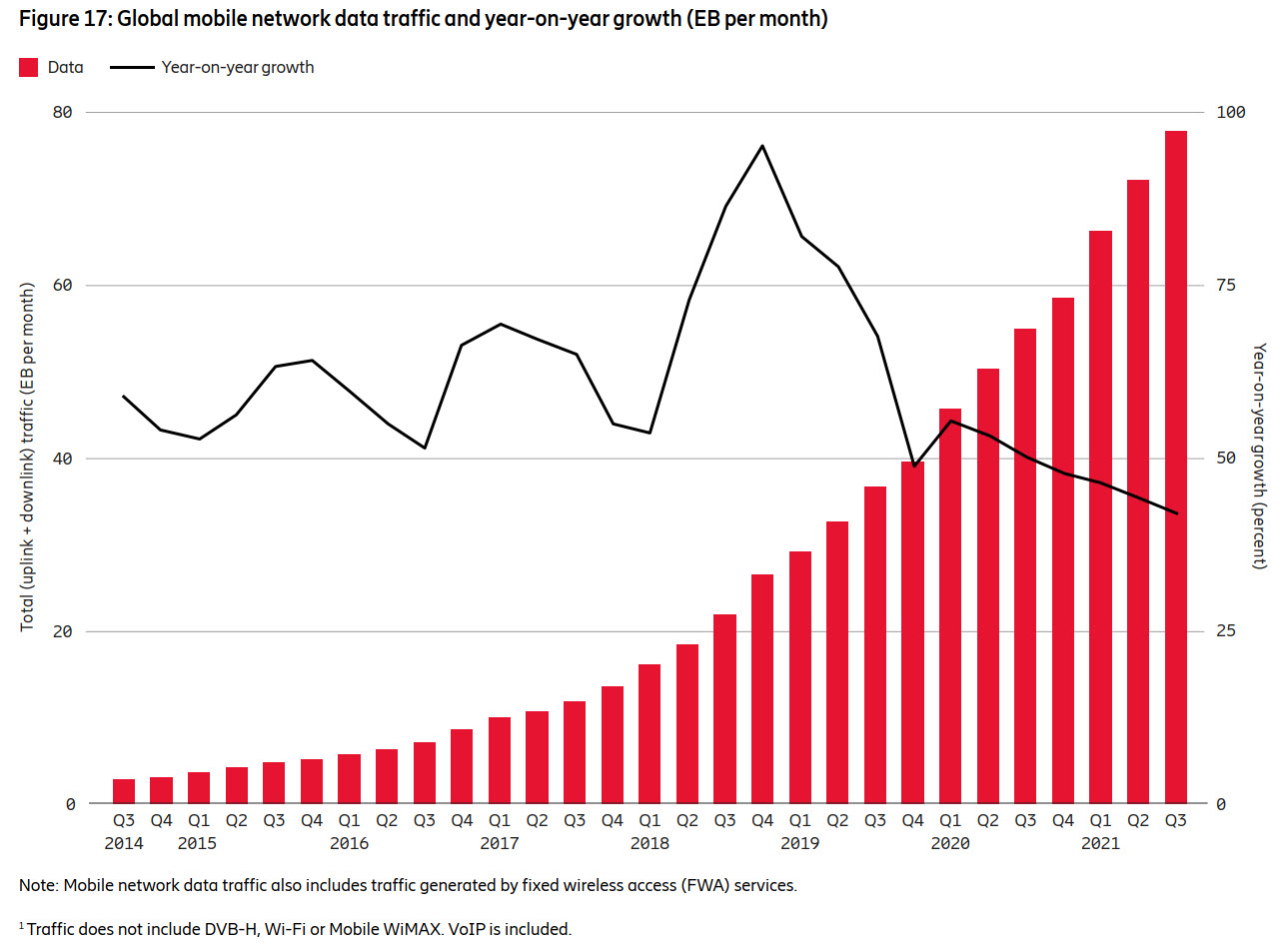

Turning to data, 4G rolled out much faster than expected and the level of data was substantially more than forecast. Revised forecasts in 2015 also underestimated the actual level for 2021. The report suggests that the average traffic per smartphone is as much as 11.4 GB/month in 2021, up from 800 MB/month in 2011. India has the highest rates at 18.4 GB per month (with 1.2 billion subscribers) based on a very competitive market. Globally, the rate of growth in percentage terms has been slowing but occasionally there have been events that have impacted the growth level.

5G is on the Way

5G is still in its early days, but Ericsson believes that the roll out of 5G will be faster than 4G and there will be 660 million accounts by the end of the year, with 98 billion in Q3, bringing the total to 570 million. Over 400 5G smartphone models are already on the market and market share of 5G handsets after 10 quarters is 23%, whereas after the same time, 4G handsets were just 8.7%. By the end of 2025, the forecast is for 4.4 billion 5G subscriptions, 49% of the total at that date. However, the spread of 5G will not be the same everywhere globally. North America will be 90% 5G while Sub-Saharan Africa will still be at just 10%. As William Gibson said

“The future is already here, but it’s not evenly distributed”.

Overall, in mobile there are already 6 billion unique subscribers globally, but that will still grow to 6.7 billion by 2027. Smartphones account for 77% of all mobile subscriptions now at 6.3 billion, with 7.7 billion (86%) by 2027.

5G Fixed Wireless

One area that the report looks at in detail is in Fixed Wireless Access (FWA) where users have dedicated and non-mobile routers or gateways to access the networks as their main broadband services. Most do not offer specific performance and are typically priced on volume of data per month, but about 12% offer tiered performance at different prices. That number rises to 40% in the US. Virtually all the growth after 2022 will be in 5G services and although there will only be 230 million connections by 2027, as many as 800 million people will gain access to the internet that way as each connection will typically support a household of three to five people.

(Here I should point out that although I live in a comfortable and, certainly on a global basis, an affluent suburban area just 50 km from the centre of the capital of the UK, I still have terrible hassles with any mobile data or even SMS connections on my smartphone when I’m at home. So, even here, the technology is “not very evenly distributed”. Matt, whose contributions are missed, covered the challenges of mmWave 5G in, among others, this article. mmWave will, even in the long term, very unevenly distributed because of the short range and cost of infrastructure.)

The report includes case studies from Taiwan and Saudi Arabia and that highlights the growth in traffic when users switch to 5G. It also looks at how time to connect to websites varies with different technologies and there is a final big table of forecasts for growth in subscriptions and traffic for 12 regions.

In the end, it could be thought that the development of mobile data and subscriptions doesn’t affect the displays used, but it clearly does. The big driver of mobile data has been video content and the desire to see video when mobile drives the demands on image quality, power consumption and other factors of the display used. (BR)