At IFA last week, every TV maker except Samsung and Sharp was talking about OLED, partly because of the good colour performance. However, LCD makers (especially those two) are not about to roll over and fail to react to the challenge.

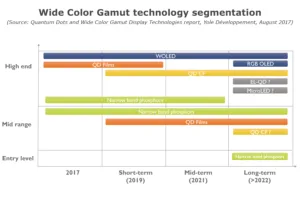

Yole Développement has a new report that covers quantum dots (QDs) and wide colour gamut (WCG) technologies which includes an interesting timeline for the development of the technology in LCD backlights.The company sees clear segmentation in terms of price and positioning between OLED and different QD and phosphor implementations.

“As TV makers struggle to trigger replacement cycles, WCG and HDR and their notable picture quality improvements are the next growth drivers for the TV industry and QDs and related technologies will take advantage of OLED TV capacity constraints”

said Eric Virey, Senior Market & Technology Analyst, LED, Sapphire & Displays at Yole Développement (Yole).

Yole believes that QD will take advantage of the window of opportunity left by a lack of capacity for OLEDs for TV to capture the lion’s share of the WCG and HDR TV market. Rapidly improving performance and decreasing cost is already enabling adoption of QD to spread into mid-range, sub-$1000 models opening a high volume markets still forbidden to OLED for cost and capacity reasons. Display makers will use QDs to keep extracting more value from existing LCD fabs. For the long term, many are hedging their bets and looking at both RGB printed OLED and electroluminescent QDs (EL-QDs).

In the mid-term however, QDCF (quantum dot colour filter) configurations represent an attractive opportunity, Yole believes, to close the gap with OLED in term of viewing angles and widen it in term of gamut and efficiency. QDCF however requires some LCD manufacturing process changes. Although moderate compared to a new OLED fab, not every LCD maker will want to commit the required CapEx or even develop the technology. (For, example, the polarising filter has to be moved from the outside of the LCD to the inside when you replace the colour filters with quantum dots as the QD emission loses the polarisation of the light. You also need to stop the QDs being excited by the ambient light as this would raise the black level which would reduce the competitiveness against OLED – Man. Ed.)

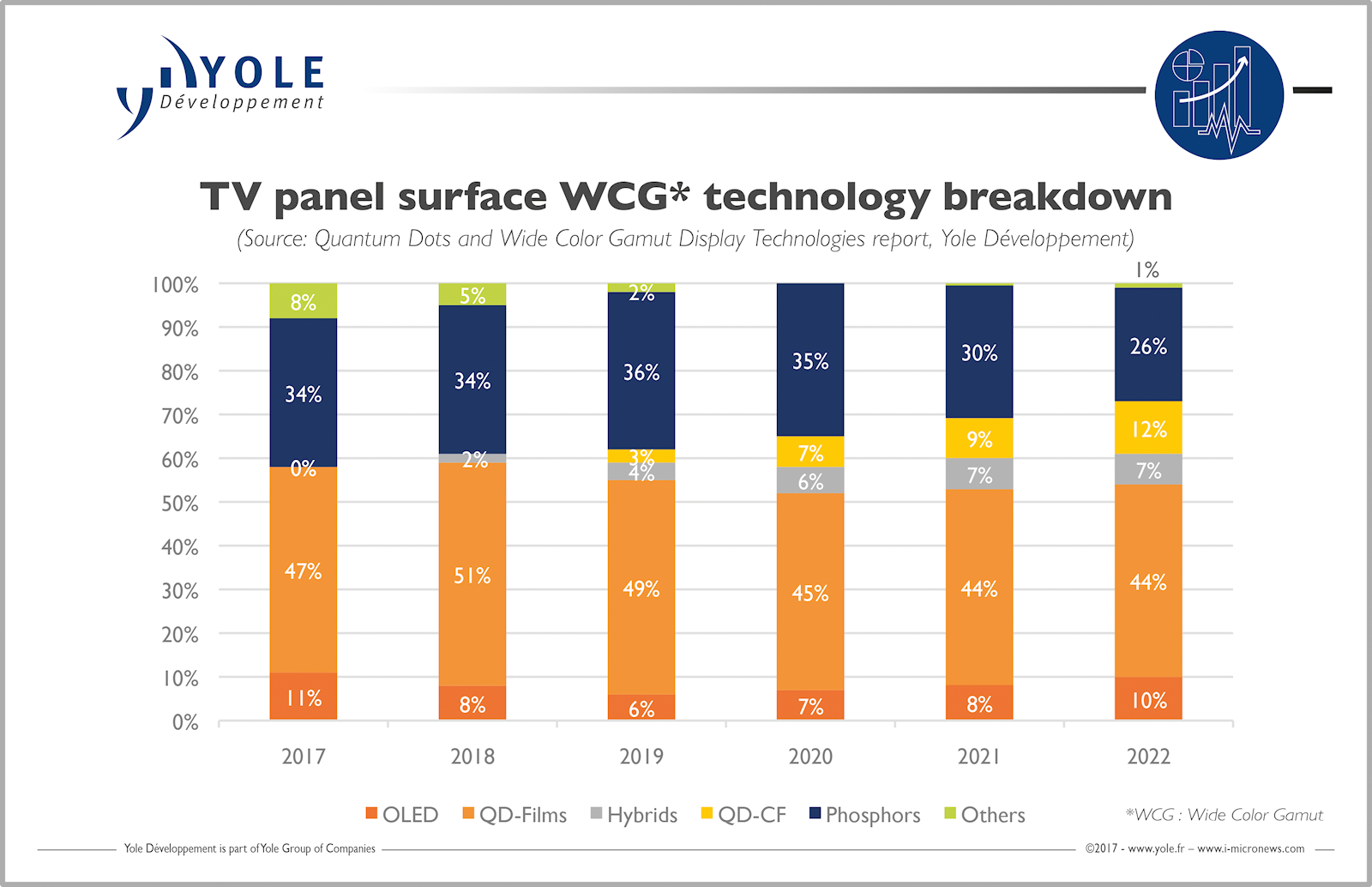

Yole gave us its forecast for the relative market shares that it sees for different WCG developments. OLED will drop back in share, although it will grow in absolute terms, because LCD-based developments will grow more quickly.

Yole sees a range of different WCG solutions being used in the TV market. Click for higher resolution.

Yole sees a range of different WCG solutions being used in the TV market. Click for higher resolution.

The use of QD films in the backlight (currently used by Samsung and TCL, for example) is expected to be the single biggest segment for the whole of the forecast period. QDCF is not expected to be in the market in any volume until 2019 (although I suspect that Samsung may show something at CES in January 2018 – Man. Ed.)

One of the questions we had was about the idea of ‘hybrid’ soluutions, which Yole expects to see, as QD makers and phosphor makers are clear that there are advantages (display makers, on the other hand are reluctant to reveal what they are doing, as usual, Virey told us). A hybrid solution would be based on using the PFS red phosphor that GE has developed in an on-chip LED configuration alongside green quantum dots in a film. That would give three advantages, Virey told us:

- The hybrid approach would be cheaper than red and green QDs (and the red has a very narrow FWHM which means wide gamuts)

- A hybrid approach should give better efficiency than a ‘pure’ QD solution

- No cadmium would be used in the red and that makes life much easier from an ROHS point of view.

Now, we have also reported on developments by Quantum Materials Corp in putting QDs on LEDs, but Virey told us that Pacific Light Technologies (More on Quantum Dots and QD Replacements) has recently made good progress in putting red QDs on medium power LED chips. However, display makers are increasingly turning to CSP technology (CSP LEDs Are the Next Step in Development) and that means higher flux densities that make the use of QDs challenging, especially if you can’t use cadmium.

The hybrid approach is working for red phosphors and Virey agreed that if phosphor makers could make a good green that would work on chip, it might cause some trouble for quantum dot suppliers.

In the longer term, Yole said that both OLED and QD-enhanced LCD could face competition from new, disruptive technologies such as the already mentioned EL-QDs or even microLEDs, which could drive a potential paradigm shift, offering alternatives to OLED in self-emissive display technologies. Other technological innovations could also disrupt the QD market. For example, commercialisation of a narrow-band green phosphor could eliminate the performance gap between phosphors and QD films and enable a more cost-effective solution, which would reduce the share from QD films. (for more on phosphors in WCG displays see There’s More than One Way to Make a WCG LCD and “We don’t need no stinking quantum dots.”) (BR)