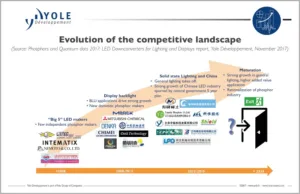

Yole Développement’s Eric Virey has released information on the market for phosphors and quantun dots and believes that the market is headed for rationalisation as there are a lot of suppliers, but little differentiation on cost or performance for most of them. Only the largest and strongest companies will be able to stay in the business.

There were many new entrants in China between 2012 and 2015 but competition is fierce. Yole said that

- A market can often be lost for a 1% difference in performance

- Phosphors need to be optimised and customised for each product: a phosphor delivering top performance for one package at one customer might underperform in another package

- The final performance of a phosphor in a LED package can vary based on parameters that are out of the control of the supplier: binder type, viscosity, mixing and dispensing method, procedures etc. To ensure optimum performance, close collaboration between the phosphor maker and the LED packager is required.

Yole sees MCC, Intematix and Denka as among the top companies and said that others including Grirem, Yuji and Shield may develop beyond the Chinese market to become global players.

Key patents held by Nichia and Osram have started expiring in 2017 and will continue to do so in 2018, Yole said. While both companies have since built on those patents and created broad families of intellectual property (IP), it will become much more difficult for them to prevent competitors from using garnet phosphors in their LED packages.

Analyst Comment

Of course, much of this phosphor will be used in LEDs in lighting and other applications. (BR)