Universal Display Corporation (UDC) remains bullish on the long-term growth prospects for organic light-emitting diode (OLED) displays, even as the company braces for ongoing unevenness in the near-term outlook. During its Q3 earnings call, UDC highlighted positive OLED adoption trends in several key markets, including foldable phones, IT devices, automotive, and TVs. However, the Ewing, NJ-based company said quarterly results will likely remain choppy over the next few years as emerging OLED applications slowly gain traction.

| UDC ($ thousands) | 3 months ending Sept. 30 | 9 months ending Sept. 30 | ||

| 2023 | 2022 | 2023 | 2022 | |

| Revenue | ||||

| Material sales | $92,492 | $84,182 | $239,789 | $242,742 |

| Royalty and license fees | $45,915 | $71,450 | $165,524 | $191,530 |

| Contract research services | $2,670 | $4,924 | $12,796 | $13,315 |

| Total revenue | $141,077 | $160,556 | $418,109 | $447,587 |

| Cost of Sales | $34,248 | $37,396 | $99,357 | $97,798 |

| Gross margin | $106,829 | $123,160 | $318,752 | $349,789 |

| Operating Expenses: | ||||

| Research and development | $33,099 | $30,414 | $96,840 | $85,156 |

| Selling, general and administrative | $18,084 | $18,442 | $50,557 | $59,373 |

| Amortization of acquired technology and other intangible assets | $4,557 | $3,562 | $11,442 | $14,562 |

| Patent costs | $2,572 | $2,018 | $7,056 | $6,075 |

| Royalty and license expense | $81 | $261 | $414 | $596 |

| Total operating expenses | $58,393 | $54,697 | $166,309 | $165,762 |

| Operating Income | $48,436 | $68,463 | $152,443 | $184,027 |

| Interest income, net | $7,136 | $2,432 | $20,301 | $4,306 |

| Other loss, net | -$1,693 | -$804 | -$3,180 | -$749 |

| Interest and other income, net | $5,443 | $1,628 | $17,121 | $3,557 |

| Income before Income Taxes | $53,879 | $70,091 | $169,564 | $187,584 |

| Income Tax Expenses | -$2,363 | -$16,636 | -$28,531 | -$42,657 |

| Net Income | $51,516 | $53,455 | $141,033 | $144,927 |

For the third quarter, UDC posted revenues of $141 million, down from $161 million a year ago but exceeding analyst estimates. Net income came in at $52 million with tat number disappointing but the earnings per share beating expectations. The revenue mix was unusually weighted toward materials versus licensing at a 2:1 ratio. UDC said it expects the mix to return to the normal 1.5:1 range in Q4.

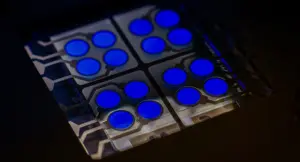

On the call, UDC narrowed full-year guidance to $565-590 million from $570-610 million previously. Management said sales of blue OLED materials reached $1.5 million in Q3, and noted that 2024 will be a pivotal year for OLED adoption in IT devices like tablets.

Regarding new technologies, UDC reiterated plans to launch new phosphorescent blue materials commercially in 2024. It also continues to develop its OLED printing platform OB-JP Alpha, although launch is still multiple years away.

In Q&A, UDC said it recorded $2 million in underutilization charges at its Shannon, Ireland facility in Q3, down from over $4 million last quarter, reflecting improving utilization. The company also disclosed a $37 million increase in deferred revenue due to a customer contract milestone payment.