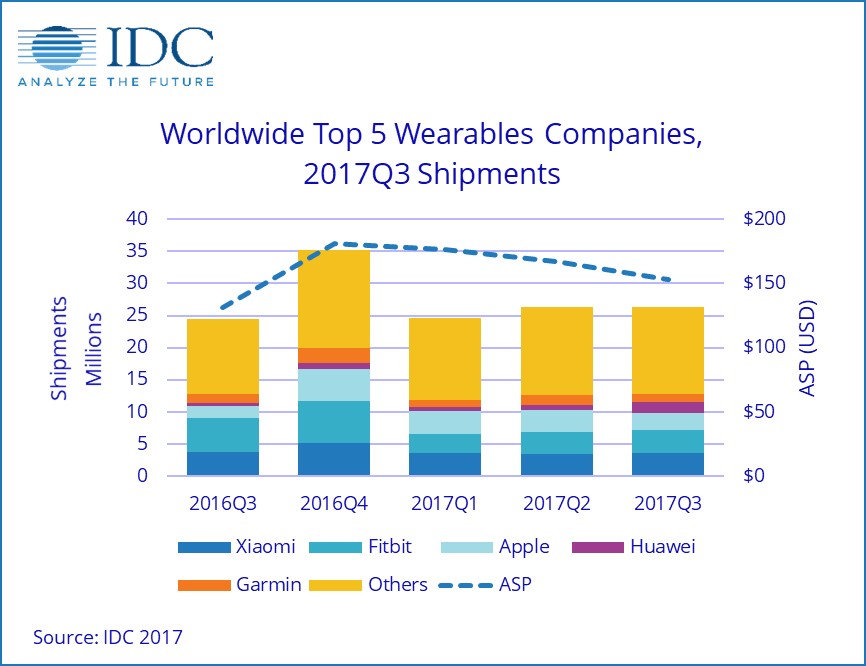

The worldwide wearables market took another step forward in the third quarter of 2017 (3Q17) with total shipment volume reaching 26.3 million units, up 7.3% year over year, according to the International Data Corporation (IDC) Worldwide Quarterly Wearable Device Tracker.

But while the overall market showed continued growth, it also showed a growing trend towards smart wearables (devices capable of running third party applications) and away from basic wearables (devices that do not run third party applications).

“The differing trajectories for both smart and basic wearables underscore the ongoing evolution for the wearables market,” said Ramon T. Llamas, research manager for IDC’s Wearables team. “Basic wearables – with devices coming from Fitbit, Xiaomi, and Huawei – helped establish the wearables market. But as tastes and demands have changed towards multi-purpose devices – like smartwatches from Apple, Fossil, and Samsung – vendors find themselves at a crossroads to adjust accordingly to capture growth opportunity and mindshare.”

“Along with a change in the types of devices being sold, there’s also in a change in where the devices are being sold,” said Jitesh Ubrani senior research analyst for IDC Mobile Device Trackers. “Traditional tech outlets still play a huge role in distribution but companies like Fossil and Movado are pushing forth fashion-oriented channels. Meanwhile, Apple’s recent introduction of cellular connectivity, and Samsung’s longstanding relationship with telcos are also helping provide an uplift to sales and awareness of wearables.”

Wearables Company Highlights

Fitbit and Xiaomi finished the quarter in a statistical tie* for first place, but showed different routes getting there. Fitbit, while showing a notable decrease in shipment volume, debuted its first smartwatch – the Ionic – a decidedly fitness-oriented device that plays to the company’s rich fitness heritage. While its early responses and reviews have been encouraging, Fitbit’s fitness trackers posted their fourth consecutive quarter of year-over-year decline. Xiaomi posted a slight year-over-year decrease in volume with a diversification beyond fitness bands and watches and adding its own line of smart footwear. But as seen in previous quarters, the majority of Xiaomi’s shipments remained within its home country of China.

Apple’s results reflect the timing of its product refresh late in the quarter and this was evident in the overall shipment increase as the release of its Watch 3 was enough to buoy volumes and remain ahead of the competition. The introduction of a cellular-connected version should spur interest from would-be purchasers going forward, and its slow and purposeful approach to cellular-enabled capabilities (including voice, data, and streaming music) will give users time to acclimate to a smartphone-free experience.

Huawei posted the largest year-over-year growth among the leading vendors, showing a rededication to fitness bands with several new models (including the Sport Band 2 Pro, B19 and B29) and an introduction to smart earwear with its Sport Pulse Earphones that track heart rate in addition to audio. Like Xiaomi, the majority of Huawei’s shipments remained in China.

Garmin, though showing a year-over-year decline, continues its transition from basic wearables to smart wearables, with the two categories nearly balancing each other out. Still, Garmin boasts one of the most diversified product portfolios, with devices addressing multiple sports and lifestyle segments, and offering a smart wearable for nearly each of them.

|

Top 5 Wearable Companies, Shipments, Market Share, and Year-Over-Year Growth, 3Q17 (shipment volumes in millions) |

|||||

|

Vendor |

3Q17 Shipment Volumes |

3Q17 Market Share |

3Q16 Shipment Volumes |

3Q16 Market Share |

Year Over Year Growth |

|

1. Xiaomi* |

3.6 |

13.7% |

3.7 |

15.2% |

-3.3% |

|

1. Fitbit* |

3.6 |

13.7% |

5.4 |

21.9% |

-33.0% |

|

3. Apple |

2.7 |

10.3% |

1.8 |

7.3% |

52.4% |

|

4. Huawei |

1.6 |

6.0% |

0.6 |

2.5% |

156.4% |

|

5. Garmin |

1.3 |

4.9% |

1.3 |

5.4% |

-3.3% |

|

Others |

13.5 |

51.4% |

11.7 |

47.7% |

15.7% |

|

Total |

26.3 |

100.0% |

24.5 |

100.0% |

7.3% |

|

Source: IDC Worldwide Quarterly Wearable Device Tracker, November 30, 2017 |

|||||

*Note: IDC declares a statistical tie in the worldwide wearables market when there is a difference of one percent or less in the vendor shares based on shipments among two or more vendors.

About IDC Trackers

IDC Tracker products provide accurate and timely market size, vendor share, and forecasts for hundreds of technology markets from more than 100 countries around the globe. Using proprietary tools and research processes, IDC’s Trackers are updated on a semiannual, quarterly, and monthly basis. Tracker results are delivered to clients in user-friendly excel deliverables and on-line query tools. For more information about IDC’s Worldwide Quarterly Mobile Phone Tracker, please contact Kathy Nagamine at 650-350-6423 or [email protected].

About IDC

International Data Corporation (IDC) is the premier global provider of market intelligence, advisory services, and events for the information technology, telecommunications, and consumer technology markets. With more than 1,100 analysts worldwide, IDC offers global, regional, and local expertise on technology and industry opportunities and trends in over 110 countries. IDC’s analysis and insight helps IT professionals, business executives, and the investment community to make fact-based technology decisions and to achieve their key business objectives. Founded in 1964, IDC is a wholly-owned subsidiary of International Data Group (IDG), the world’s leading media, data and marketing services company. To learn more about IDC, please visit www.idc.com. Follow IDC on Twitter at @IDC.