WitsView, a division of TrendForce, reports that global LCD TV panel shipments increased quarter-by-quarter in 2017. The first half of 2017 showed less momentum for holiday sales due to high prices, but shipments rebounded in the second half, as prices declined and TV makers prepared for year-end sales. Moreover, new production capacities at BOE’s 8.5G fab in Fuqing and HKC’s 8.6G fab in Chongqing have been focusing on middle-size TV panels—43″ and 32″ respectively—bringing annual shipments beyond expectation to 263.83 million pieces, an increase of 1.3% compared with 2016.

As for 2018, Iris Hu, research manager of WitsView, points out that panel makers will continue to increase production shares of large-size panels and Ultra HD panels to boost revenue and profit, saying:

As for 2018, Iris Hu, research manager of WitsView, points out that panel makers will continue to increase production shares of large-size panels and Ultra HD panels to boost revenue and profit, saying:

“The penetration rate of UHD panels is expected to reach 42% this year, an increase of 7.4% compared with 2017”.

Regarding new production capacity, BOE’s 10.5G fab produces mainly large-size TV panels (65″ and 75″), but CEC’s two fabs still prioritise medium-sized panels (32″ and 50″).

Meanwhile, the replacement of CRT TV sets with 32″ and 23.6″ LCD panels is still ongoing in emerging markets, slowing average panel size growth to 45.8″, only 1.3″ up from 2017. Overall, global TV panel shipments in 2018 will have the chance to reach 269.49 million pieces, the second-highest figure of all time and an annual increase of 2.2%.

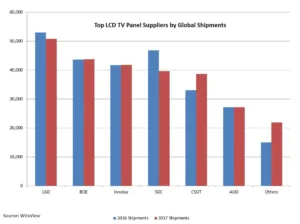

In the global TV panel shipment ranking for 2017, LG Display (LGD) came first place with shipments of around 50.85 million pieces, a decrease of 3.9%. LG expanded its production capacity by 50,000 sheets with its Guangzhou fab but, in terms of panel size, increasing the production capacity share of panels 65″ and above has been the trend.

LG’s shipments of 65″ and 75″ panels have increased significantly by 38.5% and 132.7% respectively, indicating that the company has been making efforts to retain its market share in the large-size TV panel sector before BOE’s 10.5G fab enters mass production.

BOE deliberately slowed down its 32″ TV panel production growth in 2017, so shipments increased by only 0.4%, totalling 43.81 million pieces. The company’s total shipments climbed up to second place for the first time, as Samsung’s closure of its L7-1 fab influenced its production. With BOE’s 8.5G fab in Fuqing entering mass production in the second quarter of 2017, BOE’s shipments of 43″ TV panels grew by 247.6% last year.

Innolux’s 8.6G fab entered mass production in early 2017, but the yield rate and output were lower than expected in the first half of the year. In the second half, high pricing of panels led to shrinking demand, resulting in excess stocks. In addition, the company announced plans to enter the TV assembly market, which made its clients more conservative with their orders. Fortunately, Innolux figured out solutions for pricing and stock problems, and ended up with shipments of 41.8 million pieces, an increase of 0.2%, ranking third.

Samsung’ Display Corporation’s (SDC) shipments saw a substantial decline of 15.4% last year, since the closure of its L7-1 fab. Its overall TV panel shipments dipped to 39.6 million pieces, the highest decline among the six major panel makers. Although the company has dropped out of the top three, Samsung has improved capacity utilisation by simplifying its product mix, and has invested in production equipment for UHD and large-size panels to increase the value of its products. As for its product portfolio, the company took initiatives to develop UHD panels, which represented 54.6% of all Samsung products, and also remained a major supplier of large-size panels (55″, 65″ and 75″). Particularly, its market share in the 65″ sector was as high as 36.3%.

China Star Optoelectronics Technology (CSOT) increased shipments after the capacity of the second phase of its second 8.5G fab was expanded to 140,000 substrates. The company recorded shipments of 38.64 million pieces, an increase of 16.8% compared with the previous year. Particularly, 55″ panels recorded a 19.4% shipment growth, as CSOT’s capacity expansion focused on this size. The company recorded a 19.6% year-on-year increase, the highest among the six major panel makers.

TV panel shipments for AU Optronics (AUO) in 2017 came to around 27.21 million pieces, 0.1% down from the previous year. AUO continued to optimise its product portfolio and increased its proportion of large-size panels, recording a 5.1% growth of shipment area. In addition, the company also focused on increasing its proportion of UHD products up to 44%, the third-highest number following LG and Samsung.