Global TV set shipments experienced their steepest decline in five years in Q2’15, says IHS, declining 8% YoY to 48 million units.

The result follows a year of annual growth in 2014, and was the largest fall since Q2’09, when demand slumped due to the global recession. Most of the decline is attributed to slowing growth in LCD TVs, which have a 99% market share. Despite the high share, LCD TV sales have failed to fill the gap left by CRT and PDP TVs.

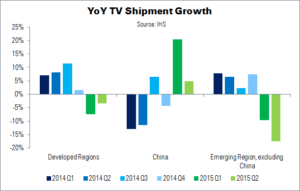

Total TV shipments rose 3% YoY in 2014, with developed regions rising more than 6%, said IHS’s Paul Gagnon. However, the TV set market in 2015 has been affected by a slowdown in the global economy – particularly the strong US dollar, which has caused a price rise in emerging markets.

Western Europe and Japan were both affected by the downturn, but it was most strongly felt in the emerging regions of LATAM, APAC, MEA and Eastern Europe. Shipments in LATAM were down 17% YoY – Brazil performed particularly poorly – and more than 9% in APAC.

North American TV demand returned to positive growth in Q2’15; however, demand in Western Europe was unexpectedly down. This led to a 3% YoY fall in overall shipments to developed regions.

China – still considered an emerging market – exhibited growth in the first half of 2015, but this is slowing. The decline has been very pronounced in large emerging markets outside of China – despite a government subsidy programme in Mexico, which added more than 2 million units in Q1 and Q2.

The single TV bright spot was UltraHD units, which grew 197% YoY, to 6.2 million sets. Price erosion and more affordable models being made available have been cited as reasons for the growth.

Worldwide, the top five TV brands had a combined 60% revenue share. Samsung led, with 29%, followed by LG (14%) and Sony (7%). Hisense (6%) and TCL (5%) closed out the top five.