Universal Display Corp (UDC) just released the news that it is opening a new OLED manufacturing facility in Shannon, Ireland with its manufacturing partner, PPG. The investment level is €10 million ($10.8 million) initially with a subsequent plan to boost investment and production capacity. Around 100 jobs will be created in Ireland by the project.

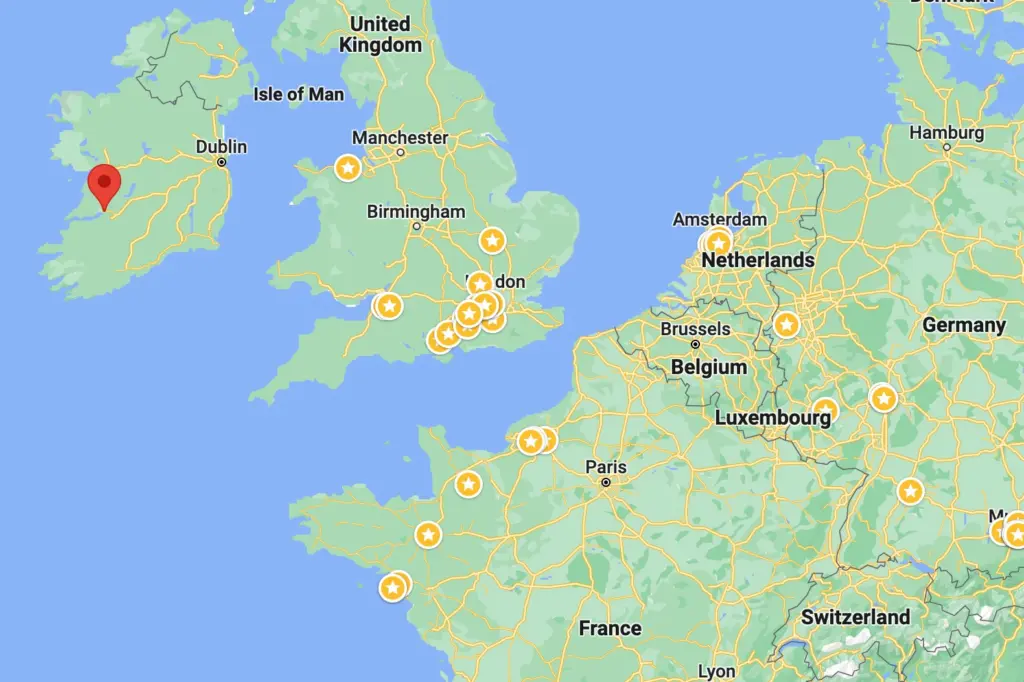

PPG is UDC’s production partner (UDC designs the molecules, while PPG makes them) and has been its partner since production started in 2000. It has existing facilities in Monroeville, Pennsylvania and Barberton, Ohio in the US. As usual with this kind of announcement, executives from both companies expressed their pride and delight (which at least makes a change from excitement!).

So, you might wonder, when all of the OLED panels are made in Asia, why would you have your production in the US and Ireland? Wouldn’t it be better to have your production closer to your customers? The reality is that OLED materials are spread incredibly thinly (which is one of the reasons why flexible OLEDs are a thing) and so you really don’t need much in the way of logistics to deliver them. In fact, I remember a Merck executive, some years ago, pointing out at a conference that the potential market for OLEDs at that time was measured in kilograms, while the market for LCD materials was measure in tonnes, if I remember correctly. “You’ll have to sell them by the molecule if you want to make any real money!”, he said.

When your products are so easy to transport at low cost, other factors come into play. Sadly, we weren’t able to co-ordinate our calendars to get a pre-briefing on this announcement, but there are, I think, three other factors. First is the cost and availability of the appropriate engineering and operational staff. Ireland should be well equipped there. Second is finance and the grants that might be available for the project – and Ireland has a good reputation for inward investment in that regard. However, given that this project represents just 0.15% of UDC’s current market capitalization of $7.0 billion and PPG’s annual sales of $17.7 billion, finance shouldn’t be a barrier to putting the facility anywhere the companies want to.

IP is a Different Issue

Intellectual property is a different issue and my guess is that it is no surprise that UDC and PPG have kept their manufacturing facilities in ‘the West’. UDC does, of course, license some of its molecules for others to make in Asia . However, the Monroeville facility is between UDC’s roots in New Jersey and PPG’s site in Barberton, Ohio, allowing relatively easy communications and a shared culture and the deal with PPG, I understand, makes them the exclusive supplier of the PHOLED high efficiency materials.

The ‘HOLED Grail of PHOLED’

And that brings me to one of the reasons for the announcement at this time, I think. For more than two decades, OLED developers have been chasing a really efficient blue, but with no success in achieving the right colour, efficiency and lifetime at the same time. UDC said last year that it was now in a position to supply sample materials that met its customer requirements for evaluation and that volume production would start in the next year.

That development was a game changing statement. An efficient blue has benefits all over for OLED and is probably even a factor in the decision, reported by Reuters, that Samsung would buy WOLEDs from LG Displays for TV use. A really good blue has a massive impact in improving the competitive position for OLED in TV and, in my view, Samsung’s TV business has realised that it has no choice but to enthusiastically attack the OLED market. The alternative is that the firm could lose its dominance at the premium end of the TV market.

The TV business will be immensely frustrated as OLED technology reduces the added value that the TV business can bring to the basic panel. Buying only cells, the TV business has been able to exploit its great backlight technology to differentiate its products. The OLEDs will look better, but will have less opportunity for added value and competitive differentiation.

I’m looking forward to next week’s Display Week 2023 to have more discussions on this topic!

Bob Raikes is semi-retired from the display industry, but still edits the 8K Association newsletter and contributes to Display Daily. He plans to be at Display Week for Display Daily and others