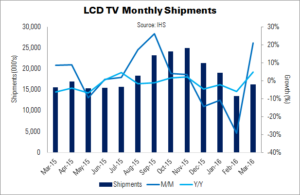

After three months of declines, LCD TV shipments returned to growth in March, says IHS. Largely thanks to the aggressive pursuit of export growth by Chinese brands, shipments rose 4.8% to 16.2 million units.

Ken Park of IHS said, “Major global TV brands have adjusted their strategy this year to focus on profitability, avoiding severe competition in pursuit of market share… Chinese brands, in particular, have started to play a more critical role in the global TV market over the last year.”

Chinese TV brand shipments fell 63.5% MoM in February, but climbed 88.9% in March – from 2.4 million units to 4.5 million. These brands accounted for 28% of the LCD TV market in March, up 11 percentage points on February.

Park said that Chinese retailers have now cleared their remaining stock from the Chinese New Year holiday in February, and are beginning to restock in preparation for new retail events. Additionally, eCommerce brands like LeEco, Xiaomi and FunTV have been aggressive in increasing both production and shipments.

The performance of South Korean brands contrasted with Chinese success. Shipments from these companies fell 7.8% YoY, with both Samsung Electronics and LG Electronics reporting contractions. However, their recorded operating margins in Q1’16 were up, relative to Q1’15. Samsung and LG benefited from falling panel prices and “relatively conservative sales targets,” said Park.

Large-size TVs continue to increase in popularity. The 50″+ segment rose more than six percentage points YoY in March, to a 22.4% share. The UltraHD TV share was also up, to a record 20.9% of unit shipments. Both large and high-resolution TVs are driving worldwide growth, as consumers upgrade from older models.