A weakening in global TV set demand, coupled with continued LCD capacity expansion, caused TV panel oversupply in the second half of last year. IHS says that the shift to oversupply has led to ‘extremely steep’ panel price declines – however, it has been difficult to pass these savings on to consumers.

Inflation and currency depreciation in emerging markets have offset the cost reductions enjoyed by set makers. Due to this, annual TV set shipments fell 4% YoY, to 226 million units. Plasma and CRT shipments were negligible, while OLED TV is still in the early stages of growth. LCD TV shipments fell less than 1%, to 224 million units, compared to a 7% rise in 2014.

While overall TV shipments were down, UltraHD sets enjoyed impressive growth. Unit shipments were up 173%, to 32 million units; ASP erosion (falling almost 30% YoY) also aided this result.

TV screen size growth slowed in 2015, with the average size growing just 2%, to 39.3″: about half the growth rate of 2014. However, the mix of UltraHD TVs at even mid-range (40″ – 50″) sizes was better than expected. UltraHD TVs accounted for half of all 55″+ TV shipments last year, and 30% of 48″ – 50″ sets.

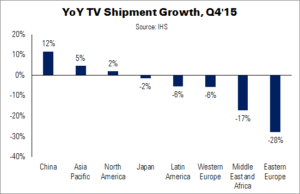

Global TV shipments fell 2% YoY in Q4’15, while North American shipments rose 2%. The USA enjoyed the benefit of a strong dollar, leading to slow but steady growth – although inventory management remains a concern.

In emerging markets, shipments were down 6%; but China surged 12% thanks to sell-in for the Chinese New Year holiday. LATAM was down also, but only 6%, thanks to a subsidy programme in Mexico; however, Brazil shipments fell 18%.