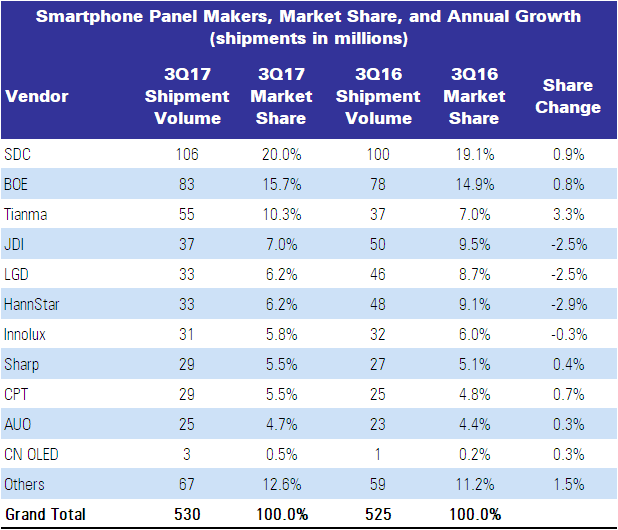

Sigmaintell has released its data on the supply of panels for smartphones in Q3 2017. The total volume was around 1% on last year and Q3 is typically the peak volume quarter of the year, but Sigmaintell said that the need to move to bigger 18:9 panels has slowed demand slightly.

Samsung was the top supplier, buoyed by the successful Galaxy S8 and the iPhone X. BOE is the second largest with volumes going to Oppo and Vivo. The company has also moved to try to accelerate its OLED production capacity.

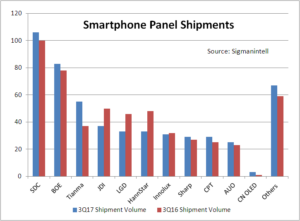

Smartphone panels Q3 17 – Data:Sigmaintell. Image:Meko

Smartphone panels Q3 17 – Data:Sigmaintell. Image:Meko

Tianma had a good Q3 and was up from 7% to 10.3% share and Sigmaintell said that the firm’s LTPS shipments were up by 180% on an annual basis. Although LTPS is in oversupply, Tianma’s high yield and good quality is enabling it to work with full loading.

JDI is down partly because of the success of Samsung, where the LCD and AMOLED factories are fiercely competing with each other. The company has also been too dependent on Apple as a single customer.

LGD has lost some of its competitive advantage compared to China and is trying to move to AMOLED to stay away from this competition. Chinese OLEDs were just 2.5 million, with Visionox shipping 1.2 million in Q3.

The analyst expects Taiwanese makers (HannStar, Innolux, CPT, AUO) to come under increasing pressure from Chinese makers.

Smartphone Panels Q3 17 Data:Sigmaintell. Image:Meko