Owing to a 20% increase in TV demand in North America, as well as the fact that TV brands had deferred their shipment schedules in 1H20 due to the COVID-19 pandemic, the effects of the third-quarter cyclical upturn were further compounded in 3Q20, according to TrendForce’s latest investigations. Quarterly TV shipment reached a historical high of 62.05 million units in 3Q20, which was a 38.8% increase QoQ and 12.9% increase YoY.

The upswing of panel prices is expected to continue in 4Q20. If market demand for TVs remains high throughout the quarter, TV brands will likely continue their efforts to reach their yearly shipment targets while simultaneously expanding their market shares. TV shipment is projected to increase by 4% QoQ in 4Q20, reaching up to 64.53 million units. This will in turn contribute to total yearly shipment for 2020, projected at 216.09 million units, a 0.8% decrease YoY.

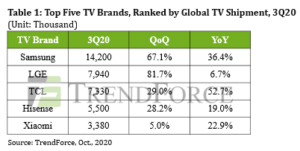

Major TV brands scored remarkable performances in North America, while TCL’s shipment increased by 52.7% YoY in 3Q20

With regards to TV sales in North America, the onset of COVID-19 in March resulted in unexpectedly longer stay-at-home times for the general public, in turn raising their engagement levels with (and demand for) TVs, starting in April. Total TV sales for the January-August period in North America grew by 20% this year compared to sales for the same period in 2019, thereby boosting the shipment performances of brands such as Samsung, TCL, Vizio, Hisense, and LG. In particular, TCL has been aggressively expanding in the overseas markets in recent years by optimizing its costs through the vertical integration of its in-house panel and TV production lines. TCL also benefitted from the stay-at-home economy brought about by the pandemic, which led to a massive growth of consumer demand for small- and mid-sized mainstream TV sets. As a result, TCL’s TV shipment in 3Q20 reached 7.33 million units, a 29% increase QoQ and 52.7% increase YoY, ranking it as the industry leader.

TV panel prices are likely to maintain their uptrend in 4Q20 following a 50% price hike for 32-inch panels in 3Q20, creating considerable cost pressure for TV brands

The major price hike of TV panels in 3Q20 saw 32-inch HD panels increase in price by more than 50% QoQ and 55-inch UHD panels by 41% QoQ. Conversely, the average retail price of TVs in North America dropped by 3-5% YoY this year, reflecting the fact that TV brands are willing to sacrifice profitability in order to reach their yearly shipment targets and increase their market shares. As TV demand is expected to continue rising in 4Q20, TV panel suppliers will become more consolidated next year after SDC terminates its LCD panel manufacturing operations, and BOE finalizes its acquisition of CEC Panda. At the same time, TV brands will have to accept the potential price hikes of TV panels in 4Q20, including a forecasted 15-20% QoQ increase for 32-inch and 55-inch panels, in order to secure a steady supply from panel manufacturers.