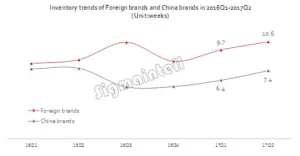

Sigmaintell of China said that shipments of TVs globally in the first half of 2017 were 100.69 million, down 6% on the first half of 2016. The company also said that inventories of the foreign brands (non-Chines) have built up to around 10.6 weeks, from a typical level of eight weeks, while the Chinese brands are up from six weeks to 7.4 weeks. That will mean some loss of demand in the second half of the year.

The company said that only Sony saw sales up in the first half, by 1%, while Samsung was 8% down. A big factor was the increase in the price of sets, which went up 43% in China compared to 2016. Coupled with weak economic conditions in China, the market fell 21% in the first half. That has led Chinese brands to focus more attention on export sales and they grew by 5% year on year. The brands are being very conservative in buying, so there will be strong pressure for panel prices to fall after the seasonal peak for TV making. Sigmaintell believes that buying by Chinese brands in Q3 will fall to 17 million sets and that is 9% down compared to Q3 2016, while foreign brands will be down 10% to 24 million.

The effect on panel prices is expected to vary from around $1 reduction at 32″, with most sizes up to 55″ dropping by $5 and 65″ dropping by $10.

Separately, the company said that the same kind of pressures will apply for monitor prices and the firm is expecting small price drops in July and August by up to $1 per month. However, notebook panels are broadly in balance and that will mean relatively little change.

In another release, the company said that curved monitors in China are proving very popular, with 50% growth quarter on quarter to achieve penetration in the market of 11%, with shipments of 472K pieces. 31.5″ FullHD monitors are proving especially popular in net cafes with volumes of as much as 6 million per year.