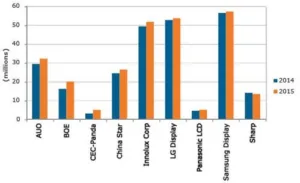

All LCD panel makers are increasing their business target for 2015, according to a survey by DisplaySearch, writes analyst Peter Su in a recent blog post (http://tinyurl.com/nzvumy9). Strong demand for LCD TV panels, rising TV variety and aggressive pushes of leading brands like Samsung, Sony and LG are behind the confidence.

Collectively, panel makers are aiming to ship 261 million units this year, up from 249 million in 2014. DisplaySearch increased its LCD TV set shipment outlook to 239 million units (up 7% YoY) earlier this month. Recent trends support sustainable growth. The panel growth target is lower, only up 5%, due to inventory adjustments at set makers and also because panel makers wish to focus on larger sizes.

In Q4’15, DisplaySearch expects AUO to expand its G8 capacity to produce more 21.6″ and 43″ panels. Innolux will expand its G6 (T2 fab) capacity to produce 39.5″ and 65″ TV panels. Both companies will increase 65″ panel production in G6, because neither is competitive at the 55″ size in G8, compared to their counterparts in China and Korea. AUO is a significant 42″ supporter, but will shift to 43″ this year. Both firms will shift some LCD monitor capacity to TV, in order to grow that business segment.

AUO will decrease 39″ supply and Innolux will phase it out completely this year.

BOE is preparing to fill capacity at its G8 fab in Hefei, and will have a new G8 facility by the end of 2015. BOE plans to increase TV panel shipments from 16 million last year to 20 million this year. The major increases are for 48″, 49″ (especially UltraHD units) and 55″ from G8. BOE is also producing 65″ in G8, but is said to be examining the possibly of using G6.

China Star is planning a second G8 fab, the T2 line, for the second half of the year; the company is targeting an 8% YoY increase in TV panel shipments. China Star is the largest 32″ panel supplier and will maintain its levels in 2015, while others decrease production.

LG Display plans to increase shipments 2% YoY. The company has shifted some capacity to G8 in Korea, for oxide backplane conversion and OLED TV panel production. a-Si capacity at the company’s Guangzhou G8 fab will also be increased. Some capacity will be reallocated to TV panels, especially in G6 and G7 (originally IT products).

Samsung Display has no new capacity in 2015, but is gearing up to fully utilise its Suzhou G8 fab in China. Product mix adjustments will increase shipments 1% YoY.

Sharp’s target is lower on a yearly basis, as the company plans to raise its shipments of 60″, 70″ and 80″ panels.