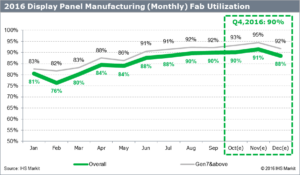

The overall utilization rate at fabrication plants (fabs) used for display panel production is expected to reach 90% in the Q4 of 2016, up 7 percentage points from the same period in the previous year, and up 1 percentage point from the previous quarter, according to IHS Markit.

One of the contributing factors for driving up the fab utilization rate has been the sudden rise in demand for larger TV panels, notably in 2016, when the average area size of overall TV panels increase by 1.9″ from the previous year, raising the unit area by about 10%.

TV display panels, which account for about 70% of overall display area demand, suffered a fall in unit demand in recent times, but the area demand is expected to increase by 6% in 2016. A rise in TV panel demand is now projected to raise overall display panel area demand by 5% in 2016 compared to a year ago.

As a result, display panel makers are increasing the utilization rate of Gen 7 fabs and later Gen fabs, used mainly to produce TV panels, and can be expected to stay high in the Q4 of 2016 and beyond.

“Such a high utilization rate would suggest that these fabs are running at full loading, considering the remaining capacity is already allotted for test runs and maintenance”, said Alex Kang, senior analyst of display research at IHS Markit.

“This increase in display panel area demand has allowed panel manufacturers to sustain inventory levels that are considered healthy, and has prevented a sharp drop in utilization rate this year”, Kang added.

IHS Markit expects that panel manufacturers’ year-end panel inventory level will remain healthy at under four weeks. This will allow panel manufacturers to maintain a high utilization rate for a certain period of time regardless of demand fluctuations with sufficient space to pile up extra production stock.

With a healthy inventory outlook, panel manufacturers are projected to reach a fab utilization rate of between 85 and 90% in the first quarter of 2017 after the year-end peak season, which is up by between 5 and 10 percentage points compared to the first quarter of 2016.

Analyst Comment

Given the issues on pricing and shortage, clearly it will be a little while before things improve for set makers. (BR)