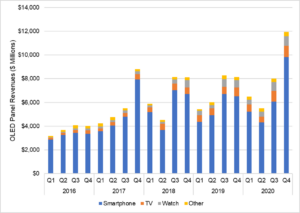

OLED panel revenues will increase by 49% sequentially to an all-time high of almost $12 billion in the 4th quarter of 2020, according to the latest update of the DSCC Quarterly OLED Shipment Report for Q4 2020, as increased panel shipments for smartphones are joined with revenue growth in TVs, smartwatches and other applications.

The Q4 update of this report gives the Q3 2020 actual shipments, plus DSCC’s updated estimates for Q4 2020 and our forecast for 2021-2025 for eleven different applications for OLED panels, with detailed figures for units, revenue, area, average selling price (ASP), and other parameters with splits by application, panel supplier, substrate (rigid/flexible/foldable) and brand. The report also provides a quarterly forecast for 2021 with the same detail. In this article, we will cover the actual results from Q3 and our estimates for Q4 and the full year 2020, and another article next week will cover the long-term forecast. Subscribers to the report, of course, can see all the results in the Excel file.

Like many other things in the electronics industry, the Q3 2020 and Q4 2020 numbers have been affected by the timing of Apple’s iPhone 12 model releases which were all OLED for the first time. Q4’20 also benefited from the pull-in of the Samsung S21 series by a month with panel shipments starting in November rather than December. The later Apple release dates depressed OLED panel shipment sales in Q3 and accelerated sales in Q4. OLED panel revenues in Q3 2020 totaled $8.0 billion, down 3.3% Y/Y, while our estimate for Q4 2020 shows revenues at $11.9 billion, up 46% compared to Q4 2019.

The pattern of OLED panel revenues is heavily weighted by smartphones, by far the largest application by revenues for OLED technology as shown in the next chart. OLED smartphone revenues were down 9% Y/Y in Q3 2020 with the iPhone launch delay, and are expected to be up 51% Y/Y in Q4 2020 to $9.8 billion.

Quarterly OLED Panel Revenues by Application, 2016-2020

Source: DSCC’s Quarterly OLED Panel Shipment Report

Although the smartphone revenues depend on Apple’s launch timing, in other applications the growth of OLED revenues continues at a steady pace. OLED TV panel revenues increased by 46% Y/Y in Q3 2020 to an all-time high of $917 million as LGD has added capacity at its Guangzhou, China fab. Q4 2020 OLED TV panel revenues are expected to increase 28% Y/Y to $959 million, another all-time high. Similarly, OLED smartwatch revenues increased 13% Y/Y in Q3 2020, and are expected to increase 34% Y/Y in Q4 2020 to $798 million, another all-time high.

For the full year 2020, DSCC expects OLED panel revenues across all applications to increase by 15% to $31.9 billion. Smartphone panels make up 80% of all OLED panel revenues, but revenue growth in OLED smartphone panels is slightly slower than the total at 13%. OLED TV panel revenues will increase by 18% Y/Y to $2.9 billion, while OLED smartwatch revenues will increase by 26% to $2.3 billion and the revenues for OLED panels in all other applications will increase by 24% to $1.2 billion.

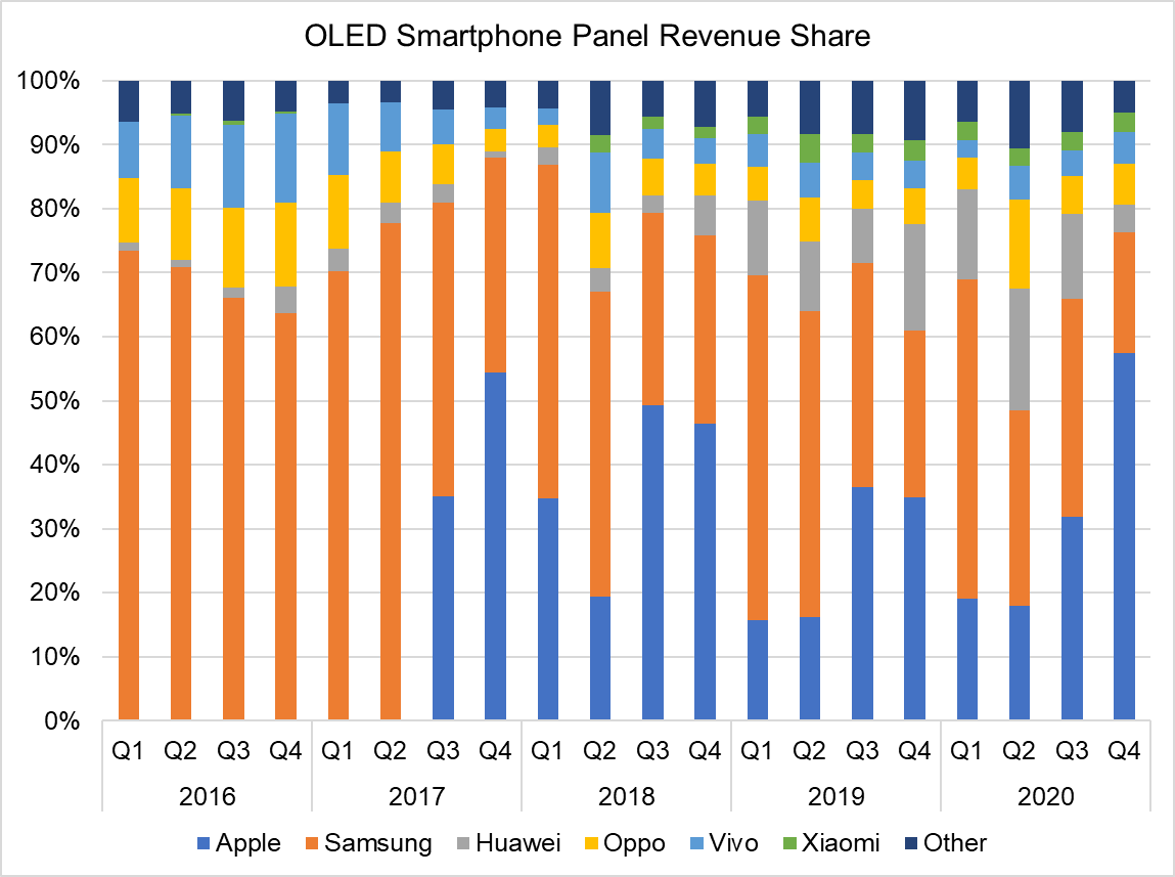

Within the smartphone category, the report allows analysis of brand trends with detail to the model level on major smartphone brands. (An expanded look at shipments across more models and parameters such as backplane, refresh rate, 5G, # of cameras, touch type, etc. can be found in our new Quarterly Advanced Smartphone Features Report.) The influence of Apple can be seen by the next chart on smartphone panel revenue share by brand. Since it first introduced OLED panels into iPhones in 2017, Apple has shown a persistent seasonal pattern of a weak first half and a strong second half. In 2018-2019, Apple’s earlier model launch meant its share peaked in Q3, while this year’s later launch causes that peak to shift to Q4. DSCC expects that Apple will account for a record-high 57% of OLED smartphone panel revenues in Q4 2020. While Apple is shown leading in OLED smartphone revenues for the 2nd time in Q4’20, it is expected to lead for the first time on a unit basis in Q4’20 with a 37% to 28% share advantage over Samsung on the robust launch of the iPhone 12 which brings 5G to iPhone users for the first time.

Quarterly OLED Smartphone Panel Revenue Share by Brand, 2016-2020

Source: DSCC’s Quarterly OLED Panel Shipment Report

Source: DSCC’s Quarterly OLED Panel Shipment Report

OLED panel unit shipments across all applications declined 4% Y/Y in Q3 2020 to 164 million, driven mostly by a sharp decline in smartphone units. OLED smartphone panel shipments were down 14% Y/Y to 115 million, while OLED TV panel shipments increased by 70% and OLED smartwatch shipments increased by 36%. In Q4 2020 we expect OLED panel shipments across all applications to increase by 37% Y/Y to 224 million, as the growth in smartphones, TV and smartwatch is nearly evenly spread at 38%, 50% and 34%, respectively.

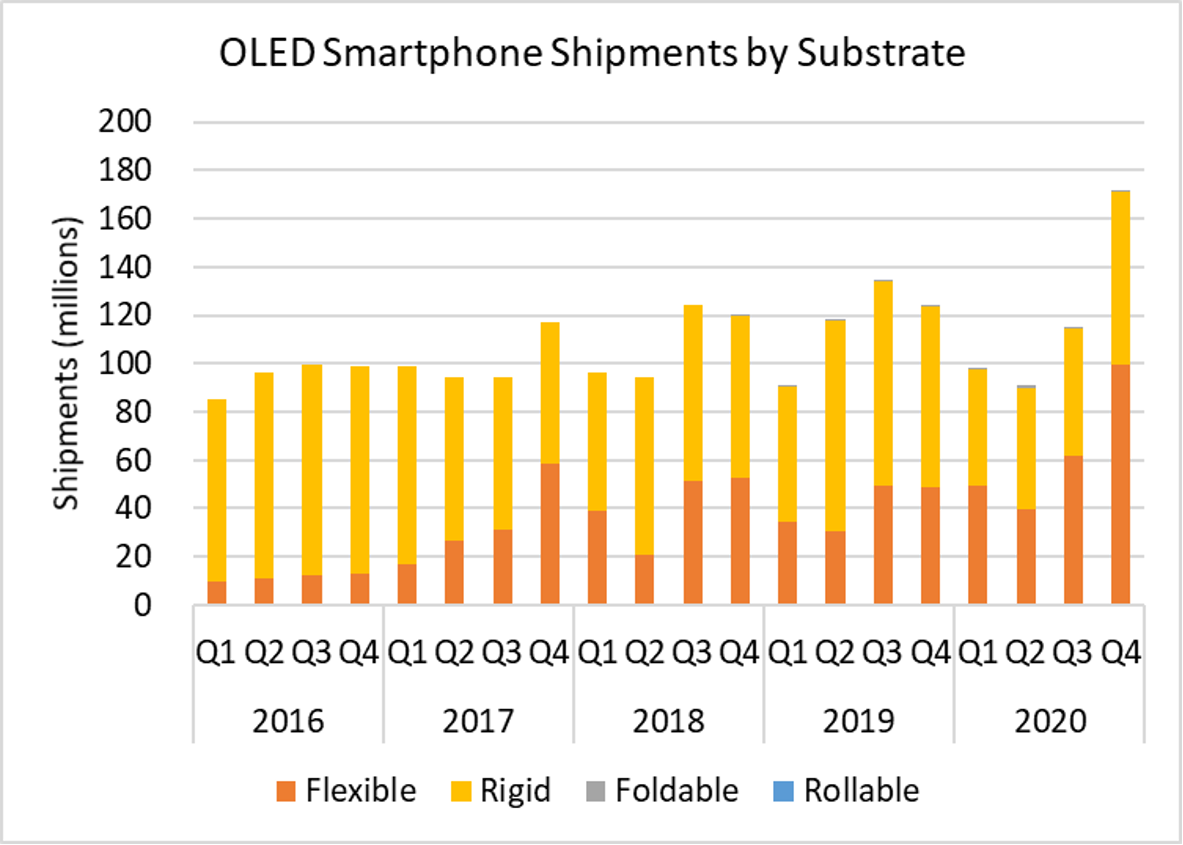

The report includes segmentation by substrate type, as shown in the next chart here. While rigid OLED panels were the majority of smartphone shipments though 2019, flexible OLED panels surpassed rigid panels for the first time in the full year 2020 as flexible panel shipments increased by 53% Y/Y while rigid OLED panel shipments declined by 26%. Foldable OLED panels represent less than 1% of the total in unit terms, but are expected to grow by 32% Y/Y in Q4 2020 to 573k units. The report also includes a detailed forecast for rollable OLED smartphone panels.

Quarterly OLED Panel Revenues by Application, 2016-2020

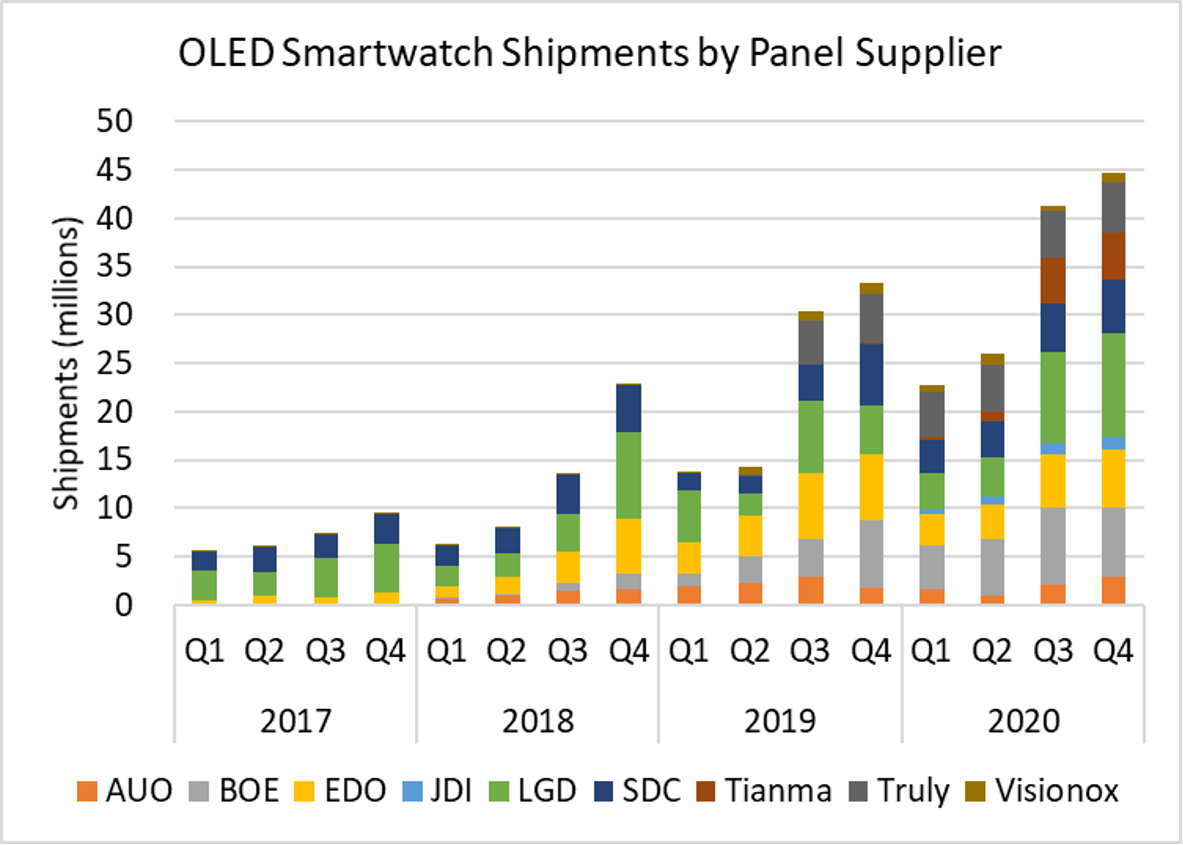

This report also provides a comparison of shipments by panel maker. Both Samsung Display and LG Display are gaining share in OLED smartphones due to Apple’s surge. LG Display’s unit share jumped from 5% to 7% in Q3’20 and is expected to reach 9% in Q4’20. Samsung Display remains dominant with its unit share expected to rise from 74% in Q3’20 to 80% in Q4’20 helped by both the Apple iPhone 12 launch and the pull-in of the S21 series launch from February to January. While OLED smartphone shipments continue to be dominated by Samsung, and OLED TV shipments remain a monopoly for LGD, in the growing smartwatch segment there is healthy competition among many panel makers, as shown in the next chart. LGD has taken a leading share in 2020 with strong shipments to Apple for the Apple Watch, but five different panel makers – BOE, EDO, LGD, SDC and Truly – captured a double-digit % of the smartwatch market in 2020.

Quarterly OLED Smartwatch Panel Shipments by Brand, 2017-2020

Overall smartwatch units increased 36% Y/Y to 41 million, and are expected to continue that pace with 34% growth Y/Y in Q4 2020 to 45 million. Among panel makers, JDI and Tianma had huge percentage growth Y/Y from very small bases in 2019, but Everdisplay (EDO) smartwatch shipments declined by 20% Y/Y in Q3 2020 and are expected to decline 13% Y/Y in Q4.

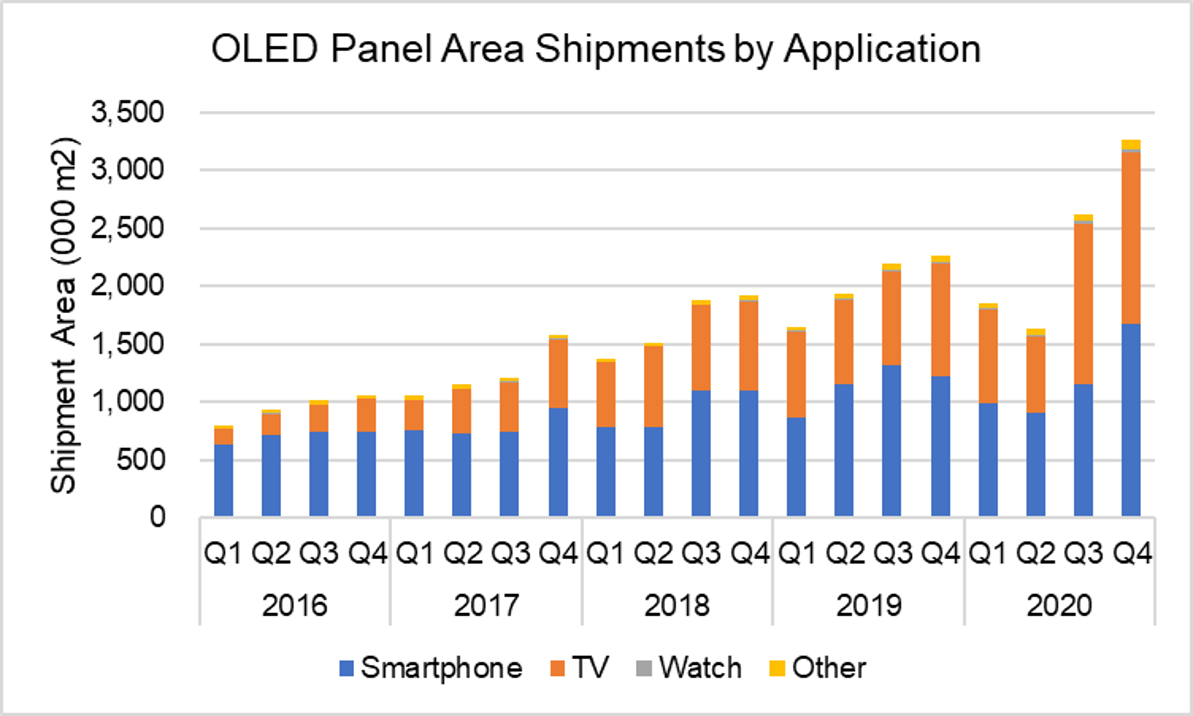

For the first time ever in Q3 2020, area shipments for OLED TV panels surpassed those of OLED smartphone panels, as shown in the next chart here. OLED shipment area across all applications increased by 20% Y/Y in Q3 to 2.6 million square meters, despite a 13% Y/Y decline in OLED smartphone panel area. OLED TV panel shipment area increased by 71% Y/Y in Q3 2020 to an all-time high of 1.4 million square meters to account for 53% of all OLED panel area. DSCC expects that smartphones will overcome TV in Q4 in area terms with 38% Y/Y growth to 1.7 million square meters compared with 1.5 million for TV. The total OLED panel shipment area is expected to grow 44% Y/Y in Q4 2020 to 3.3 million square meters, an all-time high.

Quarterly OLED Area Shipments by Application, 2016-2020

For the full year 2020, DSCC expects area growth across all applications of 17%, driven primarily by the 33% growth in OLED TV area. Smartphone area growth is expected to be only 4% Y/Y as smartphone screen size has plateaued, and Apple’s introduction of the iPhone 12 mini brings the average screen size down.

The DSCC Quarterly OLED Shipment Report also includes our forecast for OLED shipments by application by quarter in 2021 and by year from 2022-2025; we will cover the long-term forecast for OLED shipments in a future article.

As noted above, the DSCC Quarterly OLED Shipment Report provides a comprehensive listing of historical panels shipments for all applications, plus a forecast of units, ASPs, screen sizes, resolutions, panel suppliers and revenues for each application. Readers interested in subscribing to the DSCC Quarterly OLED Shipment Report should contact [email protected].