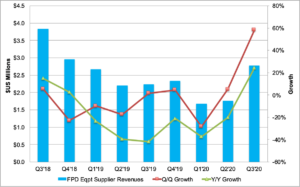

After a difficult Q1’20 and Q2’20 as a result of COVID-19 related travel restrictions to customers in China, the display equipment market rebounded in Q3’20, enjoying Y/Y growth for the first time since Q4’18 and higher margins.

In a survey of 36 publicly traded display equipment companies, we found that their display equipment revenues rose 58% Q/Q and 24% Y/Y to $2.8B, the highest since Q4’18, breaking a streak of 6 consecutive quarters with a Y/Y decline. The Q3’20 surge can be attributed to delays in installations in Q1’20 and Q2’20 which represented the lowest values since Q1’16. Importantly, the rebound won’t end in Q3’20. We see a strong Q4’20 as well, especially for Canon which is installing multiple high-priced VTE systems and litho systems to China and Korea.

36 Companies’ Display Equipment Revenues

Of the 36 publicly traded suppliers surveyed:

- Applied Materials remained #1 for the 6th straight quarter, with its share falling from 24% to 17% despite 14% Q/Q growth. Applied does well whether LCDs or OLEDs are growing.

- Canon surged to #2 helped by a FMM VTE system installed. In Q4’20, it could recognize more than $1B in revenues led by an open mask system at SDC, FMM VTE systems at CSOT T4 and Visionox V3 and litho tools at BOE, China Star, SDC and Visionox.

- Wonik IPS is believed to have surged to #3 in Q3’20 on a jump in dry etch and PI curing/furnace shipments most likely to Tianma TM17, CSOT T4 and SDC Q1. If it successfully acquires the SEMES business, it has the potential to become a regular in the top 5, especially in quarters where OLEDs are strong. It also gives them numerous bundling opportunities.

- TEL remained #4 on 100% Q/Q growth, mostly due to installs at BOE B17.

- V Tech remained #5 on 76% Q/Q growth likely due to installs at B17.

- 11 companies had over 90% Q/Q growth led by SEMES and Wonik IPS at over 600% growth followed by Canon, Charm, AVACO and SCREEN, YAC and YoungWoo DSP.

- 14 companies had over 100% Y/Y growth consisting of Viatron, Device Eng., Wonik IPS, Charm, ICD, Nissin, SEMES, KMAC, HB Tech, Toptec, Avaco, AP Systems, SNU and EO Technics.

Financial performance also improved for the display equipment businesses. Display equipment operating margins rose from 10% to 12% led by Korea’s Device ENG, Wonik IPS, Viatron and ICD as well as China’s Wuhan Jingce. The rebound in OLED spending is particularly benefiting Korean suppliers who are best positioned in OLEDs. Operating income rose 40% Q/Q and 44% Y/Y to the highest level since Q1’19.

Bookings for the 18 companies that provide this information rose 48% Q/Q while falling 30% Y/Y to $831M. Wonik IPS had the highest bookings after a record revenue quarter, likely due to wins at B12 and TM18 among others. Invenia, Charm, Jusung, Wonik IPS and YoungWoo DSP had the highest bookings growth, each up over 100% Q/Q.

After a strong revenue quarter, backlog fell 17% Q/Q and 21% Y/Y to $2.3B for the 21 companies that provide this info. SEMES saw the largest sequential percentage decline in backlog after delivering its IJP tools to SDC’s Q-1. Jusung had the largest Q/Q percentage increase on its LGD E6-3 frontplane orders. Toptec and Viatron also had triple digit Q/Q growth in backlog.

In terms of liquidity, five companies had over 100% debt/equity levels, down from 6 last quarter. The average debt/equity level improved from 28% to 26%. Two companies had greater than 75% net debt/equity levels, down from 4 last quarter. The average net debt/equity value improved from -6% to -8%.

Operating cash flow rose 35% Q/Q and 38% Y/Y to $3.2B, the highest since Q4’17 on a big jump at AMAT, SCREEN and SEMES. Free cash flow rose 45% Q/Q and 71% Y/Y to $2.3B, the highest since Q4’19. AMAT accounted for 50% of the total. The top 5 companies accounted for a 90% share.