Rear-view and side-view mirrors on new vehicles will begin to see major changes over the next decade, according to new analysis from business information provider IHS Markit (Nasdaq: INFO).

Combining high-definition cameras and displays in place of – or to complement – traditional mirror designs offers a compelling case for automakers to improve on fuel efficiency and battery range, while increasing visibility and safety with high-value technology-driven content.

These technologies will catch on quickly over the next decade, according to the recently published Camera and Display Mirrors Report from IHS Markit.

Displays where a rear-view mirror once was? It’s possible!

The first production applications of rear-view display mirrors have been successful, with the substantially wider field of vision helping to eliminate blind spots from rear seat occupants or roof pillars. General Motors was first to market this technology in 2015 with the Cadillac brand before expanding to Chevrolet and upcoming Buick models. However, other automakers are taking notice and making plans to bring similar solutions to market soon. Nissan announced plans to introduce the technology on the 2018 Armada, and other automakers will soon follow.

A substantially wider field of vision also contributes to improved driver comfort and awareness. The device also appeases regulators and drivers alike with a toggle to switch between a traditional reflective mirror and the camera view. With regulatory approval and early signs of customer acceptance, rearview display mirrors are expected to reach nearly 1.8 million units produced annually in 2025, led by markets in Japan and North America, according to IHS Markit global forecasts.

Cost remains a major barrier to widespread implementation of this new design, however, as relatively inexpensive traditional rear-view mirrors are replaced with more complex camera display systems. While cost and complexity will limit the market to an extent, the opportunity for differentiation and improved visibility will attract a number of automakers.

Cameras recognized as viable replacement for traditional side mirrors

Aerodynamic improvements and enhanced visibility are the primary reasons behind emerging mirror replacement applications, while designers will welcome newfound freedom after having explored novel exterior mirrors in concept vehicles for decades. Now that the regulatory environment is taking shape to support this concept, production applications will soon follow.

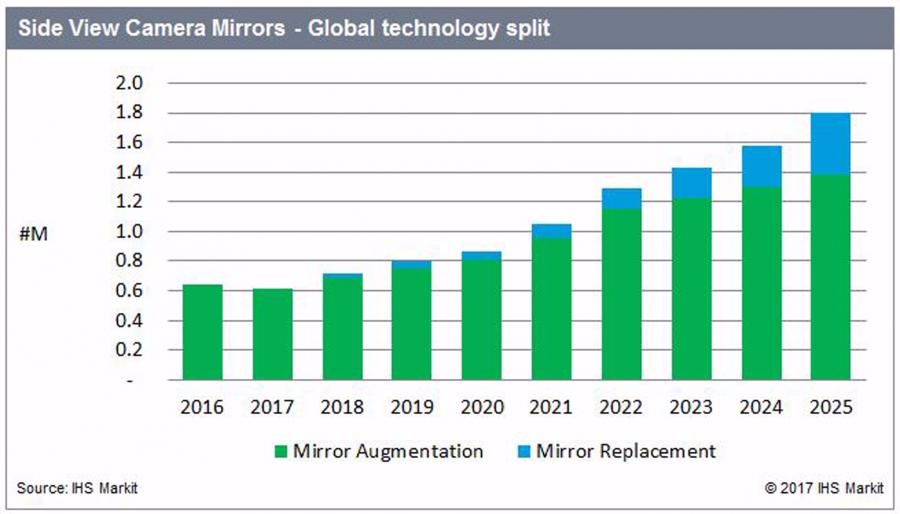

The market for dedicated side-view camera display mirrors will grow as a result, with initial production expected within the next 12 to 24 months, according to IHS Markit. By 2025, nearly a half million side-view camera display systems will replace side mirrors annually in new vehicles designed to support the added technology content. Implementation will not be uniform, however.

“Suppliers and automakers are investigating several different ways to replicate the camera view with an in-vehicle display. These side-view images could feed through an instrument cluster display of some sort, or even a traditional center stack display,” said Brian Rhodes, automotive technology analyst with IHS Markit. “However, the majority of concepts to this point have focused on new, dedicated side-view displays located either in the door panels or A-pillars because they offer the driver the most familiar line of sight for this safety-critical aspect of driving.”

From a driver assistance perspective, augmenting mirrors with cameras is already common today—from familiar rear camera park assist to applications such as Honda LaneWatch that enhance visibility.

“Current side camera systems merely enhance the driver’s view today and provide marginal added safety as a result, but there is much more opportunity,” said Jeremy Carlson, principal automotive analyst with IHS Markit. “Camera sensors allow machine vision software and artificial intelligence to constantly detect, track, and recognize objects over a wide field of view, and that can be important input to autonomous driving solutions.”

“Alongside the autonomous use case, which has varying levels of interest from different automakers, improving aerodynamics will improve fuel efficiency no matter the fuel used—and that should be of interest to every automaker given regulatory pressures around the world today,” Carlson said.

In 2025, more than 1.8 million vehicles will be produced with side-view camera sensors to support drivers or contribute to automated driving systems, while more than 23 percent of these systems will completely shed the traditional side-view mirror, according to IHS Markit forecasts.

New opportunities for content differentiation, suppliers

These mirror replacement solutions offer automakers a new opportunity to add value for consumers and to deliver content in an entirely new area of the vehicle. In addition, they create opportunities for a new set of suppliers to meet this demand—including those with expertise in automotive camera systems, display modules, system ECUs, and mirror modules, all of which could see new business opportunities take shape as this market develops.

“Automakers will have the flexibility to integrate safety features such as a pedestrian highlight or warnings for fast-approaching vehicles to bring the driver’s attention to these outside factors and allow them—or the vehicle itself—to respond accordingly,” Carlson said. “That next level of innovation will push this emerging technology beyond the ‘nice to have’ cost constraints and into an integral part of a comprehensive in-vehicle user experience, whether you’re driving yourself or watching your vehicle drive you.”

About IHS Markit

IHS Markit (Nasdaq: INFO) is the automotive industry’s leading source for market-wide insight, expertise and advanced planning solutions. With a reputation of enabling better decisions and better results for nearly a century, the world’s leading OEMs, suppliers and their transportation partners rely on IHS Markit to power growth, improve efficiency and drive a sustainable competitive advantage.

Automotive offerings and expertise at IHS Markit span every major market and, the entire automotive value chain — from product planning to marketing, sales and the aftermarket. Headquartered in London, the automotive team is part of the IHS Markit information and analytics powerhouse that includes 12,300-plus colleagues in 150 countries, covering energy, chemical, aerospace and defense, maritime, financial, technology, media and telecommunications. For additional information, please visit www.ihsmarkit.com or email [email protected].