The escalating coronavirus crisis is impacting production at display panel factories located in the semi-quarantined city of Wuhan, China, spurring a significant near-term reduction in the global supply of panels used in liquid crystal display televisions (LCDs) and other products.

The five factories in the city producing liquid crystal displays (LCDs) and organic light-emitting diode (OLED) panels will experience near-term slowdowns in production compared to expected levels, according to IHS Markit technology research, now a part of Informa Tech.

With the situation evolving quickly, IHS Markit technology research is still assessing the magnitude of the supply shortfall on multiple display types and markets. However, leading Chinese panel makers stated they believe that total capacity utilization for all LCD fabs in the country could fall by at least 10 percent and perhaps by more than 20 percent during the month of February.

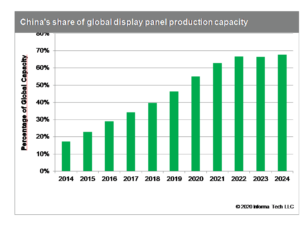

With China expected to own 55 percent of global display manufacturing capacity in 2020, the immediate impact of the production reduction has been a worldwide decrease in availability and an increase in pricing for LCD-TV panels. This has resulted in turmoil throughout the display supply chain as suppliers and purchasers alike scramble to adjust to swiftly changing market conditions.

“Display facilities in Wuhan currently are dealing with the very real impacts of the coronavirus outbreak,” said David Hsieh, senior director, displays, at IHS Markit technology research. “These factories are facing shortages of both labor and key components as a result of mandates designed to limit the contagion’s spread. In the face of these challenges, top display suppliers in China have informed our experts that a near-term production decline is unavoidable.”

The leading Chinese suppliers of LCD panels for TVs, notebook PCs and PC monitors now are planning to raise panel prices more aggressively. For example, the price for an open-cell LCD-TV panel was originally expected to rise by $1 or $2 per month in February. However, the actual increase may be $3 to $5 for the month.

Notebook and monitor makers might also face panel shortage as a result of coronavirus-related production challenges.

Disruption impacts supply and demand balance

The five display factories in Wuhan are:

- China Star Optoelectronics Technology’s T3 low-temperature polysilicon (LTPS) LCD fab

- CSOT’s T4 Gen 6 OLED fab

- Tianma’s TM8 Gen 4.5 LTPS LCD fab

- Tianma’s TM17 Gen 6 OLED fab

- BOE’s B17 Gen 10.5 LCD fab

Beyond the immediate production impact at these facilities, the coronavirus is also likely to trigger delays in the ramp-up of manufacturing at new display fabs during the first half of 2020. This will reduce overall panel availability during the next few months. It also could result in further panel supply tightness as TV display buyers hasten the pace of their panel purchases to build stockpiles for future shortfalls.

While major panel makers are rightly concerned about the coronavirus’s impact on consumer sales, demand for their products from TV makers has actually increased. TV makers are pulling in their panel demand and sometimes double-booking orders to shore up their inventories. The panel maker indicated that the demand surge for orders delivered in February is as large as 10 percent above the previous demand forecast.

Lunar Holiday gets extended

The labor shortage encountered by fabs in Wuhan is partly the result of the Chinese government’s move to extend the Lunar New Year holiday by three days, with the last day now scheduled for Sunday, February 2. The extension is designed to reduce travel and cut down on public gatherings to contain the spread of the disease.

However, even after workers return, many will have to undergo testing procedures to check for contagion. This will have a continued negative impact on productivity.

LCD module supplies fall to critical levels

China’s LCD panel suppliers may face an even more dire issue related to the coronavirus: an acute shortage of essential LCD modules.

LCD panel makers outsource much of the production of such modules. However, production at several key third-party module suppliers has now ceased, impacting panel production severely throughout the country. Key module supplier SkyTech is sharply reducing production until mid-February.

Panel makers maintain their own captive LCD module factories. However, these operations are also facing production bottlenecks amid the coronavirus crisis.

The module shortage potentially could expand the impact of the contagion beyond China—with a knock-on effect on production at display manufacturers worldwide.

IHS Markit technology research tracks the coronavirus

With the coronavirus situation developing on an hourly basis, the IHS Markit technology research Displays service is constantly tracking developments to determine the unfolding impact of on global technology products and markets. Stand by for further IHS Markit technology research updates on displays and other technology areas impacted by coronavirus.