According to the latest IHS Markit Monthly Large Area Display Market Tracker, combined shipments of large-area and small/medium TFT LCD panels were up by 2% MoM and 14% YoY to reach 249 million in December 2019. Shipments of large-area panels were flat MoM in December 2019 but decreased by 2% YoY to 67.5 million while the monthly shipments for large-area panels in 2019 averaged 63.5 million.

Further, shipments for small/medium panels increased by 2% MoM to 181 million.

With an early Spring Festival in East Asia, many TV brands, especially Chinese TV brands, were intent on securing their orders before then. This has led the supply/demand situation and the panel price situation to improve recently, and it continued in December 2019. Also, with the expected capacity shutdown and restructure of Korean panel makers, the general supply/demand situation in 2020, at least for the first half of the year, might be better than formerly pessimistic expectations. Furthermore, with the reduced production of the entire supply chain caused by the current coronavirus situation, a tighter supply/demand situation is likely to occur in the coming months.

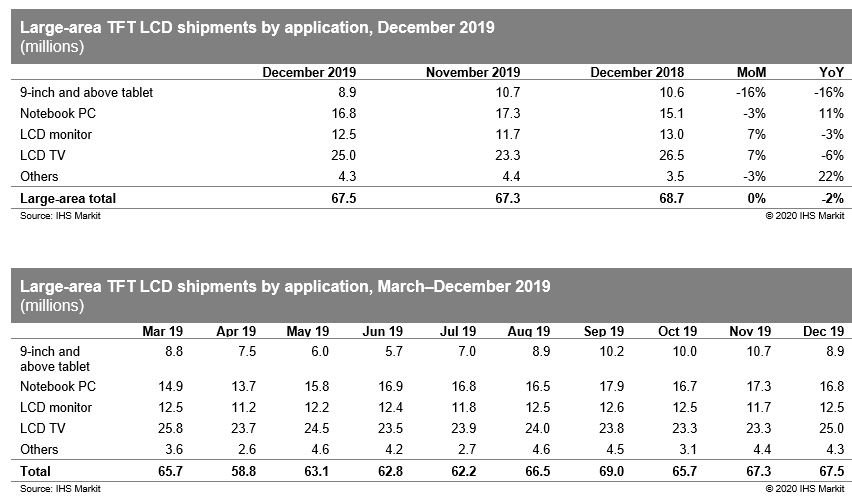

Shipments for applications in December 2019 were as follows:

- The 9-inch and above tablet panels were down by 16% MoM and 16% YoY.

- Notebook PC panels were down by 3% MoM but up by 11% YoY.

- Monitor panels were up by 7% MoM but down by 3% YoY.

- TV panels were up by 7% MoM but down by 6% YoY.

On an area basis, large-area panel shipments were up by 7% MoM and 4% YoY in December 2019. With new capacity being released gradually in China in the near future but capacity restructure and shutdown occurring in Korea, further shipment area performances might fluctuate in the following months.

Total TFT LCD revenue decreased by 2% MoM and 6% YoY in December 2019. Revenue from large-area panels was down by 1% MoM and 11% YoY, while revenue from small/medium panels was down by 6% MoM but up by 20% YoY. With prices forecast to rise in the coming months, revenue performances might get better then.

Shipments by application

In December 2019, shipments of tablet PC panels (5-inch and above) decreased by 13% MoM but increased by 9% YoY to reach 19.7 million, while shipments of 9-inch and above tablet PC panels decreased by 16% MoM to 8.9 million.

Shipments of LCD monitor panels increased by 7% MoM to 12.5 million, while shipments of LCD TV panels were up by 7% MoM to 25 million in December 2019. With TV brands’ orders being secured before the Spring Festival, the supply/demand situation for TV displays have been tightening over the past few months. Meanwhile, as a result of the reduced production caused by the coronavirus in China, further supply/demand tightness is expected in the short term.

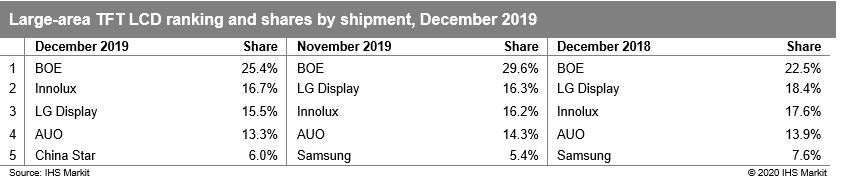

Supplier rankings: China Star became the third leading supplier of large-area display shipment area

With big capacity investments in mainland China in recent years, Chinese panel makers are gradually establishing themselves as leaders in the market. BOE is now one of the top five shipment suppliers and has remained the leader for large-area displays; however, on an area basis, Korean panel makers still dominate. Meanwhile, with newly invested capacity being released gradually, Chinese panel makers have also been performing well in shipment area in recent months, and with Korean panel makers’ capacity progressively decreasing because of the factory restructure and shutdown, Chinese panel makers are expected to capture more shares in 2020. The Chinese panel maker China Star has replaced AUO in the top five for LCD TVs and surpassed Samsung Display in the past several months. Further, China Star has, for the first time ever, become the third leading supplier of large-area display shipment area in December 2019.

- On a large-area panel shipment basis, BOE was first with 25.4%, Innolux was second with 16.7%, LG Display was third with 15.5%, AUO was fourth with 13.3%, China Star was fifth with 6%, and Samsung was sixth with a 5.8% share.

- On an area basis, BOE took the lead in large-area panel shipments with 19.8% of the market. LG Display followed with 14.4%. China Star was third with 12.6%, and Innolux was fourth with 12.5%. Moreover, Samsung was fifth with 11.1%, followed by AUO at sixth with 9.4%.

The top five’s shipments for large-area applications were 76.9% of the overall large-area panel shipments in December 2019 thanks to the increased shipments of panel makers such as CEC-Panda and HKC Display.

The following table lists the shares of shipments for the top five large-area suppliers. The shares for November 2019 and December 2018 are also included for comparison.

Additionally, the following two tables list the shares of shipment and shipment area for the top five large-area suppliers by application.

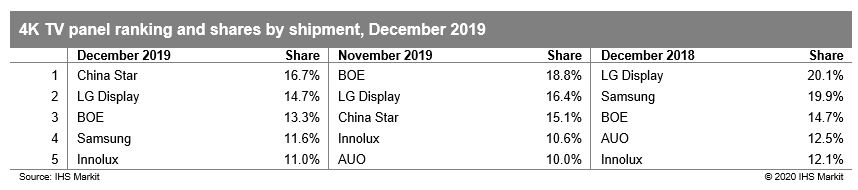

UHD (4K) LCD TV panel shipments increased by 4% MoM in December 2019

Makers shipped 11.8 million ultra-high-definition (UHD) (4K) LCD TV panels in December 2019, an increase of 4% MoM, for a 47.1% penetration of overall LCD TV panels shipped for the same month. In 2019, panel makers shipped a total of 129 million 4K TV displays and achieved a 45% penetration of all TV displays shipped for that year. With more Gen 8.6 and Gen 10.5 capacity gradually released in upcoming quarters, especially for larger sizes, further increases in the penetration of UHD LCD TV panels in 2020 are expected.

China Star became the top supplier of 4K LCD TV panels for the first time in December 2019 with 2 million units shipped for a 16.7% share of the market. LG Display, BOE, and Samsung followed with shares of 14.7%, 13.3%, and 11.6%, respectively. Innolux and CEC-Panda shipped 11% and 9.4% of the market, respectively, to rank fifth and sixth.

Makers shipped 3 million 55-inch 4K panels, making it the leading size for December 2019 with 25.6% of the 4K LCD TV panel market. Shipments of 43-, 50-, 65-, and 70-inch panels followed with 18.8%, 17.8%, 16.8%, and 4.9% of the market, respectively. The 75-inch was sixth in the market at 4.1%.

In addition, makers shipped 218,900 4K LCD panels for monitors and 16,000 4K notebook panels in December 2019.