NSR has shared more details from its ‘UltraHD via Satellite’ report (More Satellite UHD Expected Over Next Decade), asking, “Will UltraHD boost the bottom line?”

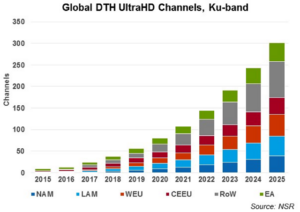

NSR previously forecast that there will be around 300 UHD channels on DTH platforms, using leased capacity, by 2025. This is in addition to satellite carrying UHD channels being distributed to cable and IPTV platforms, as well as dedicated DTH platforms such as Dish and DirecTV, which have their own satellites. Only some of these channels will have a direct revenue impact on their respective platforms in the short term.

The immediate response to NSR’s question is, “Yes, but success is not universal and depends on the implementation.” For example, Netflix has had difficulty convincing people to upgrade to its most premium package, which includes UHD programming; however, mature market consumers have proved willing to pay extra for content that they perceive as valuable. NSR expects that, over the next four years, most DTH platforms with UHD content will include it in their top-tier packages.

Towards the end of the decade, NSR expects ‘many’ DTH and pay-TV platforms to begin charging extra to access UHD, creating higher ARPUs.

Higher capacity for high bandwidth UHD channels is a ‘clear revenue boost’ for satellite operators. However, the short-term ROI for UHD on DTH platforms is less certain. Content acquisition costs are higher than SD or HD content, which is likely to result in net losses for the first few years of operation. Post-2020, however, NSR forecasts a direct positive revenue impact from the introduction of UHD linear TV channels on pay-TV platforms, worldwide.

High content acquisition costs will be ‘more than offset’ after a couple of years, by subscribers from the large UHD TV installed base. ARPUs are expected to be, on average, 10% higher than those of current high-end packages.

Although UHD ROI is expected to be modest in the long term, NSR believes that not investing in the technology is a greater risk.