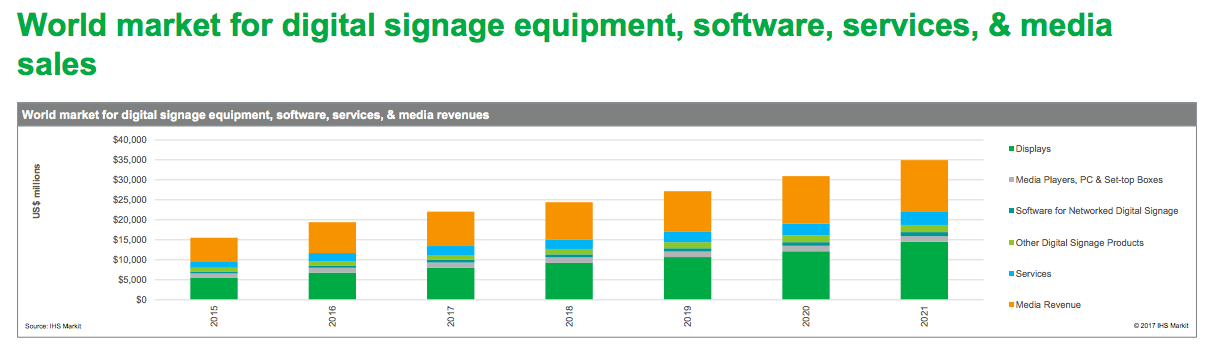

IHS Markit creates some data for the Digital Signage Federation members and we noted that this has been published by sixteen-nine.net. The blog reports:

- “All avenues of the digital signage ecosystem finished 2016 with double-digit increases, with revenues from media and software for networked digital signage systems generating the largest increases of 32% and 24.2% YoY, respectively. The DOOH advertising space will continue to constitute a large portion of the revenue generated each year for the near future. For 2017, IHS Markit expects an even greater number displays converting from static to digital, especially with the introduction of more affordable LED displays for outdoor use.”

- Sharp doubled its display shipments in Q1 2017, quarter over quarter;

- Samsung is the market leader by a sizeable margin, with LG and NEC neck and neck globally, and then it drops down to Philips and Sharp;

- Shipments for 75 and 82 inch displays are seeing a big growth spike – up 31% and 34% respectively – but 55-inch is still the dominant display size in digital signage;

- 49-inch displays are taking over from 46-inchers;

- 4K demand is growing but it was still less than 2% of the public display monitors market in 2016. However, that market share is expected to almost double to 3.5% by the end of 2017;

- Projected capacitive ( aka PCAP) touch displays are seeing a big uptick, with PCAP shipments comprising 4.7% of the touch displays market in 2016 but forecast to reach 12.8% of that market in 2017. PCAP is the touch experience you are used to on a smartphone or tablet, not the old school ‘boink-boink’ you experience on an ATM. Just about any interactive digital signage should be PCAP, as that’s what consumers expect and are used to;

Narrow Bezels Up

- Shipments of super narrow bezel displays (with a width of less than or equal to 1.99mm) had the largest increase in Q4 2016, reporting an increase of 58.1% QoQ, reaching 5,138 units. The 2.00–3.99mm and 4.00–5.99mm bezel width categories remain the bulk of the video wall market, with the former decreasing 7.2% and the latter increasing 12.5% QoQ, respectively. LG is the big dog, shipping almost half of all units in this category;

- High brightness displays with 3,000 nits and up were up significantly this quarter, increasing 198.8% QoQ. But transparent displays only constitute 0.03% of the total LCD digital signage displays market, shipping all of 758 units in the quarter;

- The average selling price of a public display monitor is expected to increase from $1,923 in 2016 to $1,952 in 2017, owing to things like brightness and slimmed bezels;

- High-brightness LCD public display monitors are forecast to continue dominating shipments at least until 2018. Compared with 2015, shipments grew by 38% YoY; shipments are forecast to continue increasing by 52% next year. Revenue grew 72% YoY compared with 2015 and should develop by 59% this year.

- LED video (less than 4.99mm) generates significantly more revenue than LCD; it is forecast to display stronger growth rates, as the average selling price slowly drops. Compared with 2015, shipments grew 107% YoY; shipments are expected to expand by 75% this year.

Analyst Comment

Interesting comments which, broadly, match the trends we have seen in the European market. The boost for Sharp’s share, now it has the backing of the Foxconn supply chain, is not a real surprise. (BR)

IHS data – click for higher resolution

IHS data – click for higher resolution