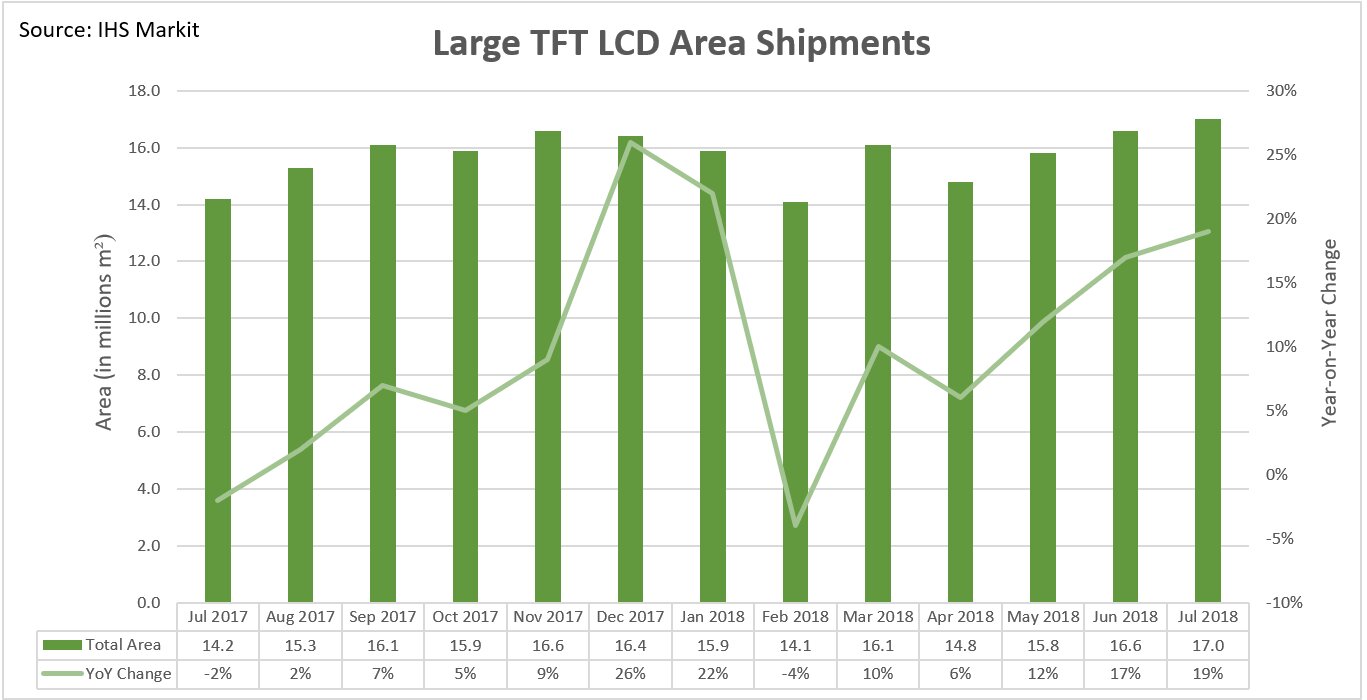

FT LCD panel shipments hit a record monthly high in July 2018 in terms of unit and area shipments. Unit shipments increased by 10% in July compared to a year ago, to reach 64.3 million units, while area shipments jumped 19% during the same period to 17 million m², according to IHS Markit. Principal analyst Robin Wu remarked:

“N

ew facilities from China, such as BOE’s 10.5G, CHOT’s 8.6G and CEC-Panda’s 8.6G, started mass production in the first half of this year. The production at these fabs has increased since the second quarter of 2018, as their glass inputs and production yield rates have improved.

Despite the growing production, panel makers have maintained the utilisation rate and instead tried to push out panel shipments by lowering panel prices in the first half of 2018. That’s one of the reasons that panel shipments are continuously growing”.

The LCD TV panel contributed to record-high shipments of larger-than-9″ LCD panels in July. Unit shipments of LCD TV panels increased by 15% in July year-on-year to 24.6 million units and area shipments jumped 21% to 13.3 million m².

Panel makers suffered from high TV panel inventories in the first half of 2018 due to growing production capacities. Panel prices have been weak for a year and panel makers’ profit margins have plunged. Wu added:

“Therefore, panel makers wanted to clear up the inventory before the third quarter, high-demand season, when they aim to raise the panel price back again. That has led to the fast growth in TV panel shipments lately which, as a result, pulled the total large panel shipments to a historical high in July”.

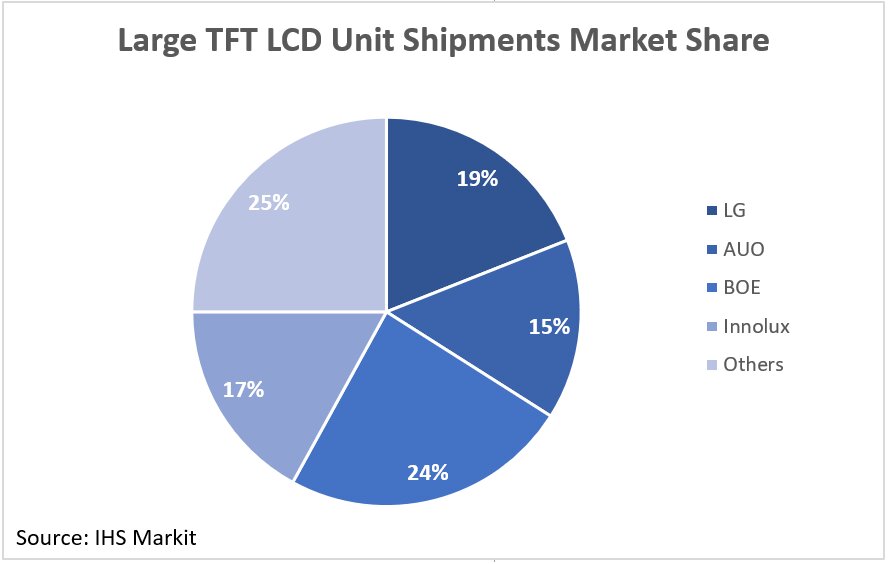

As the panel makers hoped, LCD TV panel prices rebounded in July 2018. Chinese panel maker BOE led the large TFT LCD market in July 2018 in terms of unit shipments with a stake of 24%, followed by LG with 19%. However, in terms of area shipments, LG continued to lead with a 20% share, followed by BOE with 18%.