Away from the show floor, Ericsson held an event for clients and press in Canary Wharf, the docklands area of London.

Away from the show floor, Ericsson held an event for clients and press in Canary Wharf, the docklands area of London.

Simon Frost, global Head of Media Marketing and Communications, said that Ericsson has been investing in TV for over 20 years with significant merger and acquisition activity. The company has 18 m subscribers using its TV platform (after the Mediaroom, Tandberg, Azuki and Fabrix acquisitons) and the firm is broadcasting 500 channels of linear TV. It has won five technology Emmys and as a company is active in 180 countries.

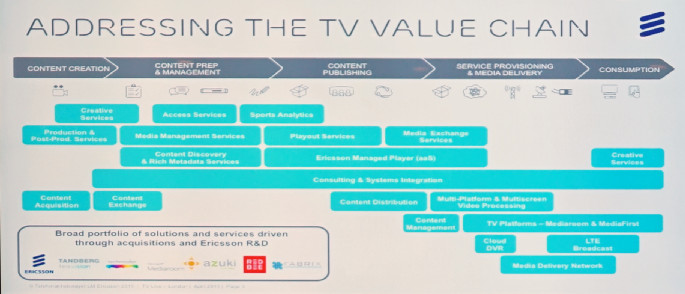

Ericsson is trying to cover everything from content acquisition up to the STB (but not including the STB and with no plan to get into that segment). It can provide a range of services to broadcasters including play out – it can process and provide metadata for content discovery and it also has expertise in cloud DVRs and delivery networks.

There have been a number of key acquisitions. RedBee was acquired in May 2014 and had 1500 employees. It supplies production services and play-out management for brands including the BBC, Sky, BT Sport, Canal Digital, Channel 4, EE and Virgin Media.

A significant technology acquisition has been Fabrix Systems, an Israel-based company that developed technology for powering CloudDVR applications. As well as developing VOD services, the company had significant network storage and Ericsson believes that the technology is behind 60% of cloud DVR technologies. The deal closed in September 2014. PVRs in the home are not so useful when you’re away and Ericsson thinks that a lot of the PVR/DVR functionality will move to the cloud.

Ericsson also provides consultancy and advice for customers, so develops three major market research and analysis reports in the year. It has published a report called Media Vision 2020 and an annual ConsumerLab TV report (September). It also looks at mobile network development as Ericsson is strong in mobile networking.

There are three big areas for Ericsson. The company claims to be the biggest player in IPTV, which it describes as “Pay TV at web speed” and with the potential to “enable OTT for all”.

The second area is video networks and Frost said that all networks are becoming becoming video networks. There will be an 8X increase in internet data by 2020 and, by then, 55% or more of mobile data will be video. Video processing is a critical part of the recipe and Ericsson has invested in developing its own video chip, which is said to have been a real advantage. The company is looking at the virtualisation of CDNs and network caching to further support the video networks.

The third area is managed services for clients. Ericsson manages more than 1 billion mobile customers on behalf of its customers and provides a lot of consulting services.

The firm has three target market groups.

- Content owners and broadcasters as well as TV Service providers (Cable/Telcos/Satellite). Content owners want to get access to usage and metadata and Ericsson can help with this.

- For broadcasters Ericsson is offering managed services

- TV Service providers need bigger networks and Cloud DVR is a target market for these customers. TV service providers remain the gatekeeper to the consumer.