Veteran display industry consultant Ian Hendy delivered a thorough technology landscape overview at the 2023 Phosphors and Quantum Dots Industry Forum in Seoul, Korea. It was an extensive market overview examining the state of technologies enabling wider color gamut (WCG) and high dynamic range (HDR) in displays.

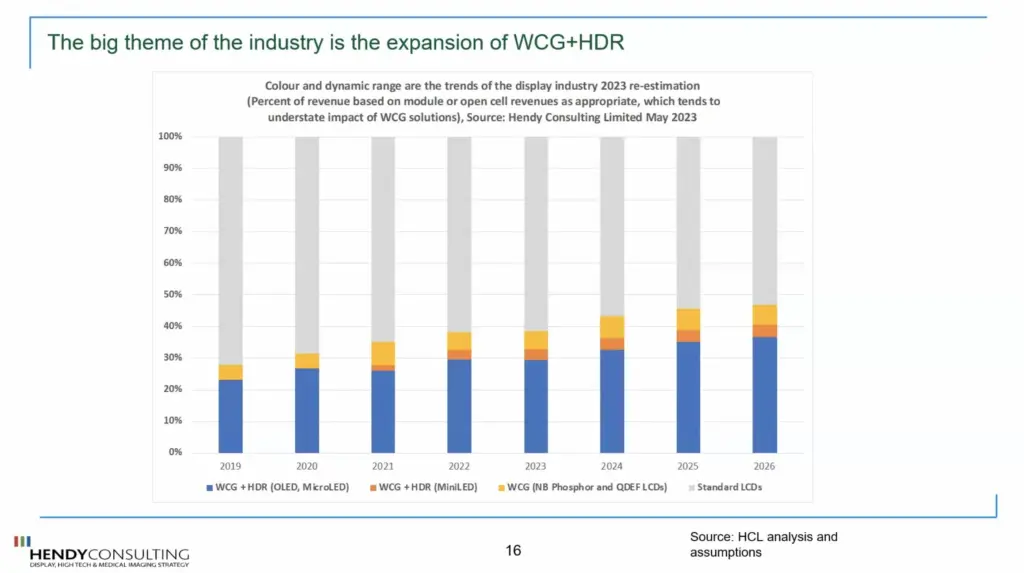

To illustrate point, and the importance of color gamut growth to the industry, Hendy use the following chart to illustrate his point.

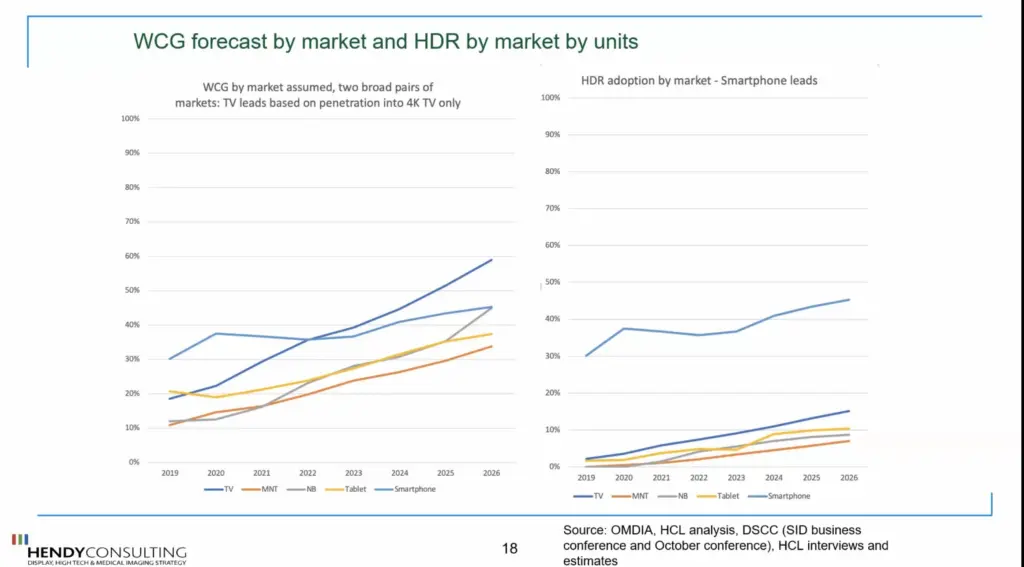

Addressing an audience filled with professionals across the display value chain, Hendy explained that while overall display industry revenues have remained relatively flat in recent years at around $125 billion, there are still significant growth opportunities being driven by WCG and HDR.

Color gamut growth and HDR are the core technical challenges driving innovation in the industry,

Ian Hendy, Hendy Consulting

Hendy stated that OLED displays remain the most important technology playing into these trends, even as OLED sales dipped slightly YoY. However, he highlighted Samsung Display’s massive new Gen 8 OLED factories as a major driver of future OLED growth, especially in IT products like laptops and monitors and the rapidly rising automotive display market.

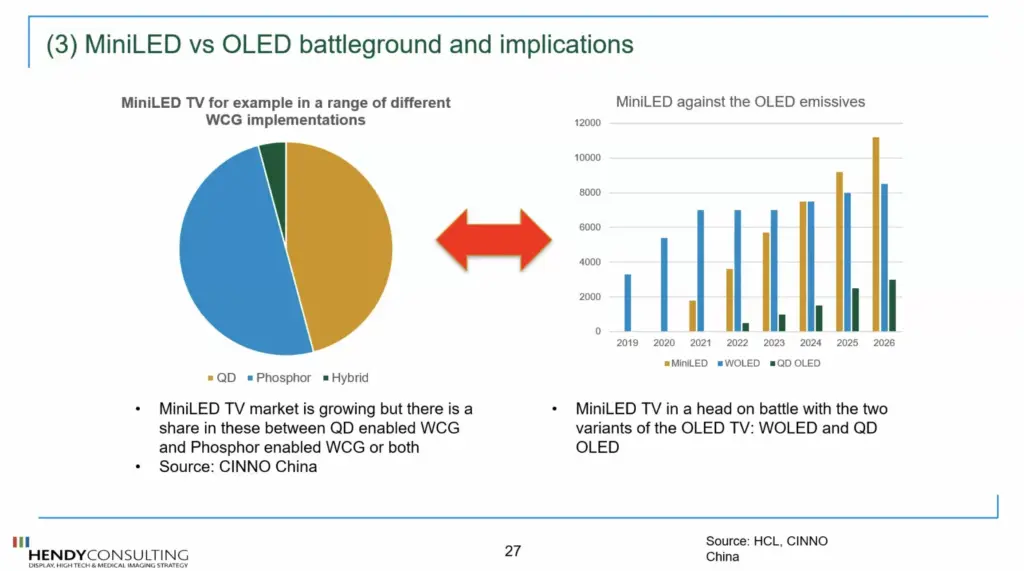

Beyond OLEDs, Hendy pointed to the emergence of MiniLED and MicroLED displays as a “fascinating battle” that will compete head-to-head with OLED displays in IT and other applications over the next 5-10 years. Hendy said he has a very positive outlook for both MicroLED and OLED technologies moving forward.

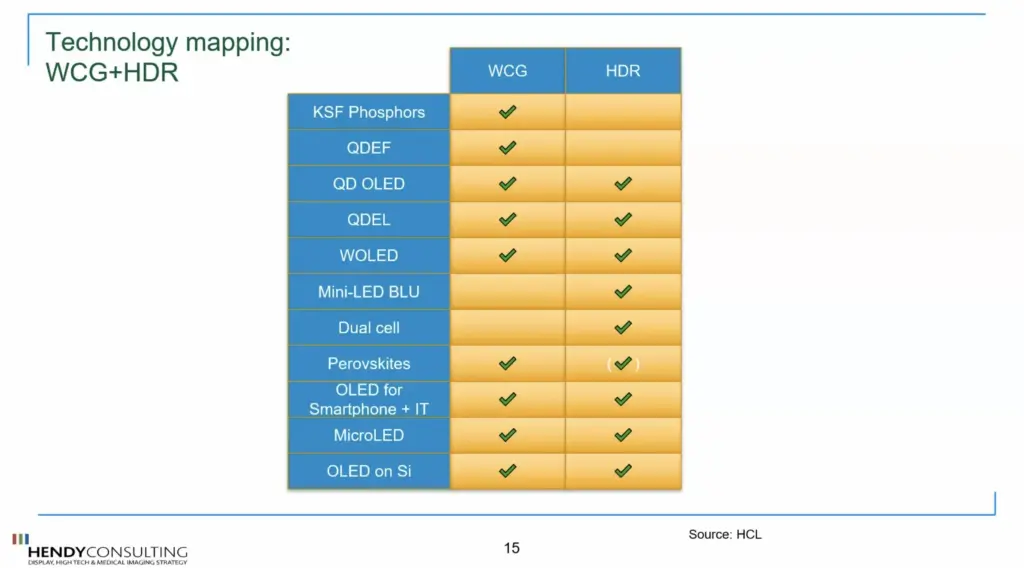

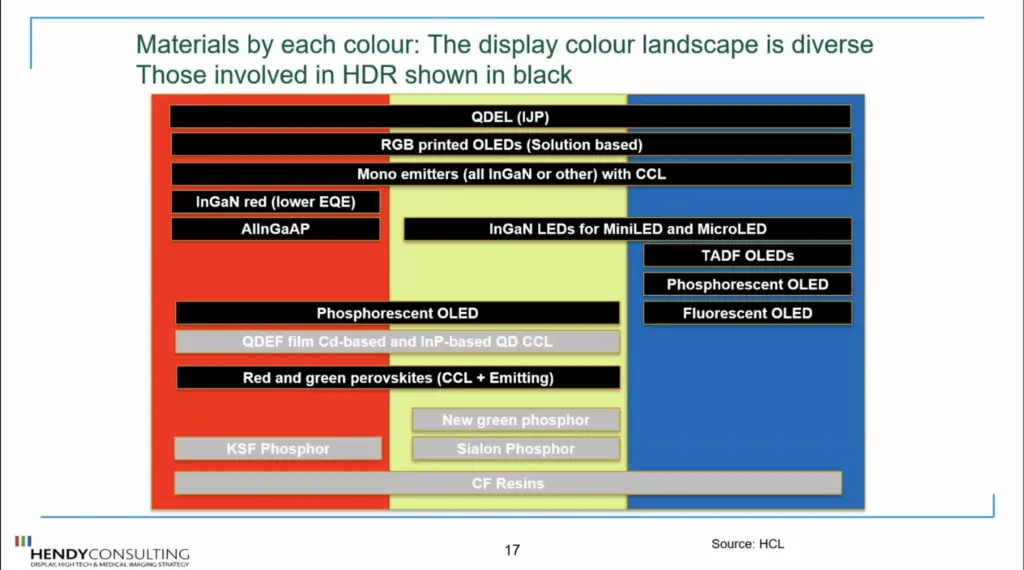

Delving deeper into color conversion materials, Hendy explained there are now many options beyond historical narrow-band phosphors and quantum dots, including emerging perovskite nanocrystals offering high efficiency and narrow peaks. But Hendy emphasized there is no single best technology yet, saying “We see a plurality of solutions being explored to meet the demands of next-gen wide color gamut displays.”

For example, while Samsung’s QD-OLED TVs currently use quantum dots, Hendy explained that phosphors and perovskites are actively competing to displace quantum dots as the color converter material in this promising new architecture.

Hendy is probably the best display consultant with a wide audience with a broad grasp of the industry, and the end-to-end supply chain. It is always interesting to hear him speak. He outlined a display industry actively innovating across a multitude of technologies to overcome lingering technical challenges and push the envelope on color gamut, dynamic range, efficiency, and more. In his view, the coming years will see robust competition between OLEDs, MiniLED/MicroLEDs, and color convertors to deliver the best overall display performances.

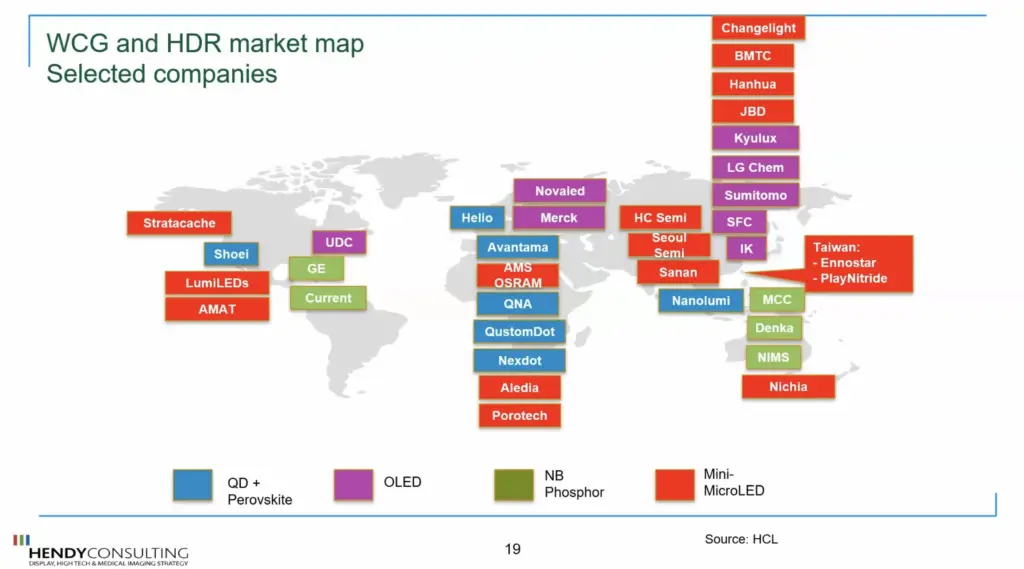

So, we have to take a look at one slide from the presentation, a select grouping of the companies involved by region. As you would expect, the Asian market dominates but, surprisingly, the US lags the rest of the world in many ways because, one thing you would expect, is greater activity, a bigger number of startups, and the one that was there, Nanosys, is now a Japanese company, Shoei Chemicals.

This is a technology business so, how is it that the US is being outspent in investment by almost every other region? It’s also shocking to think how far behind the curve both the US and Europe are in MiniLED and MicroLED investment. If, as Hendy contends, WCG and HDR are the meta drivers in the industry, why is there not a meta investment in these technologies in the US? You can probably argue about the level of government support and intervention in Asian countries, and also to some extent by European countries and the European Union, but that is the case for almost all aspects of technology investment so, it shouldn’t excuse the lack of impetus in North America.

Display Daily believes in competition, but it also believes in the general need to promote and evangelize the display industry in its totality. In the next decade, the reach of the display industry will grow beyond what we have come to expect because of innovations in MicroLED, transparent displays, flexible and folding displays, and to a greater extent, by integration with IoT devices, the connecting tissue of optics in everything from quantum computing to optical communications, and the integration with battery and electronics technologies in EVs. It can’t just be about TVs and IT displays. Not anymore.

The totality of the display industry goes beyond what we can see today. We should see more investment in realizing the future here in the US, as much as anywhere else.