The final speaker that we heard was Ian Hendy of Hendy Consulting which looks at the finances and development of the supply side of the display industry. His talk was entitled “Race to the Bottom” – he had coordinated with Gray to make sure that they were covering broadly different topics.

The final speaker that we heard was Ian Hendy of Hendy Consulting which looks at the finances and development of the supply side of the display industry. His talk was entitled “Race to the Bottom” – he had coordinated with Gray to make sure that they were covering broadly different topics.

Hendy started by saying that there is pain in Asia in the panel industry but that can be good news for customers – although if you are buying displays as components, you have to be careful where you put your design wins for long term projects – especially if you want to be able to buy the product in the long term.

A couple of years ago, Hendy had set out five options for the development of the panel-making industry. He had hoped that the option “Display industry saves itself” would be the one that prevailed and that a new technology, oxide transistors, would add more opportunity for added value and profit.

Sadly , the option that the industry adopted was the “Race to the bottom” which saw prices fall and profits disappear.

Among the panel makers, Samsung has improved during the last year, but the rest have pretty well all gone down, although Sharp has narrowed its losses. Samsung’s main strength has come from its flexible OLEDs with a particularly good result in Q3 2015. However, Hendy believes that all the companies would see weak results by the end of Q1 2016.

Given what Sharp had in factories and investments, the firm has done as well as could have been expected, Hendy said. Sharp has done a lot of good things such as selling IP, equipment and premises as well as pursuing a deal with Foxconn, but it may not have been able to do enough.

JDI is closing fabs and its TDI subsidiary and CPT has also closed one fab (G4.5) and sold another (G4). LG Display had just a 1% profit margin on Q4 2015, with 5% profit in LCD, but continuing losses in OLED.

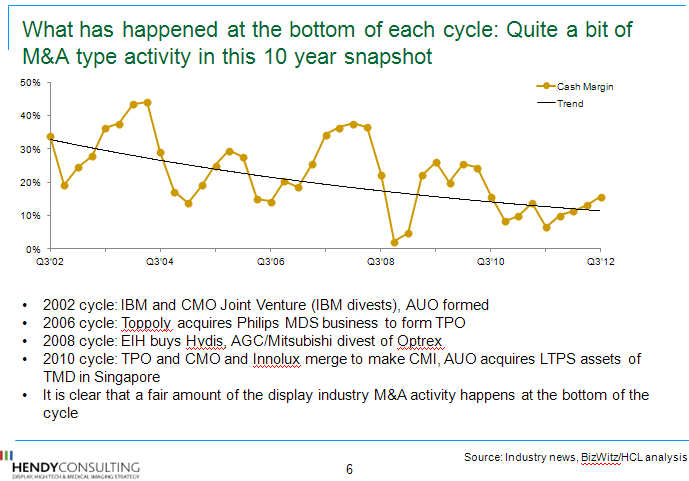

At the bottom of the “crystal cycle”, there tends to be an increase in merger and acquisition and restructuring. In 2002, IBM divested its panel business and AUO was formed. In 2006, Toppoly bought the Philips business to form TPO. In 2008, EIH bought Hydis and AGC/Mitsubishi divested itself of Optrex. In 2010, TPO, CMO and Innolux merged to make CMI and AUO bought the LTPS assets of TMD in Singapore.

However, these difficult cycle points also tend to force technology changes – for example the critical switch to One Drop Filling (ODF) in 2002 and column spacers in 2004 to help drive TV adoption. In 2007 and 2010, the interest was in smartphones and tablets with oxide and LTPS. In 2013/14, companies jumped on UltraHD TV panels and started to look at automotive as a new segment.

The action taken by companies depends a lot on the size and strength of the companies, with the strongest companies planning their next investments and just trimming their capex plans, while those at the other end of the spectrum may have to exit the business or get themselves acquired.

The difference this time is that there is no obvious big new market and the monitor and TV markets, where FPDs substituted for CRTs are saturated. Of course, autonomous cars with big entertainment displays could be a real opportunity.

Apple has been a big influencer of the display industry, but now the company has opened a display centre based on the old Mirasol fab and has hired engineers. It is also expected to move to AMOLED for iPhones in 2017. Hendy doesn’t think that Apple will become a fully vertically integrated display supplier, but its demands and requests may have a real impact on other players.

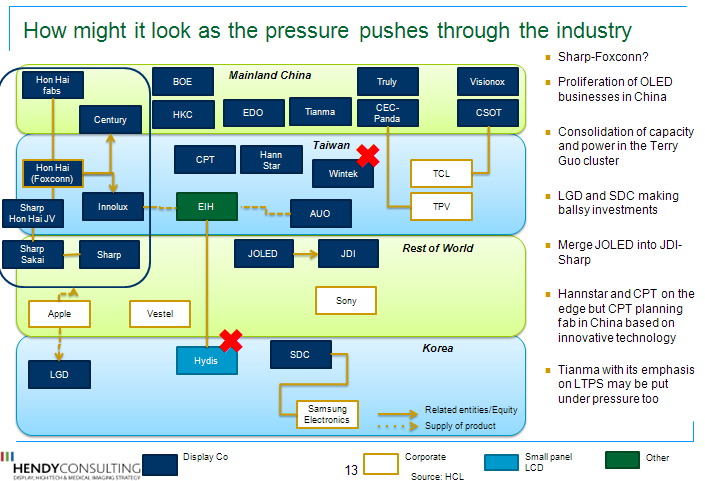

Looking at the “chess board”, since last year, the “Sharp/Foxconn” deal would consolidate Terry Gou’s capacity and industry power. LG Display and Samsung Display are making quite big and brave investments. There is also a lot of activity in OLED in China. However, Hannstar, CPT and Tianma may come under a lot of pressure.

Turning to the Sharp situation, Hendy sees Hon Hai/Foxconn as the most obvious deal for its display business, with Sharp selling its home appliance business to Toshiba or even Hitachi, while the solar business would be sold to Showa Shell Sekiyu. The main alternative would be a merger with JDI which would be strong in small panels (and might worry competition authorities). There might be practical challenges and the combined company would be weak in large panels and OLEDs. If Gou can’t acquire Sharp, he may try to acquire technology in other ways to help build up his Chinese LCD business, notably the Century J/V.

LG Displays is betting big money on OLED and both they and Samsung are looking at the implications of the forthcoming BOE G10.5 fab. BOE is still planning more fabs to bring its total to 12 eventually.

In conclusion, this cycle is going to see some more changes in company structures and technology.