DSCC released the Q2’20 edition of its Quarterly Display Capex and Equipment Market Share Report last week which reveals the latest outlook for display equipment spending as well as which suppliers are gaining and losing share.

One major addition this quarter is the inclusion of move-in timing for all fabs in its fab schedules and equipment spending forecasts. As a result, the user can now choose how they prefer to look at the market in terms of move-in timing or install (sign-off) timing for revenue recognition.

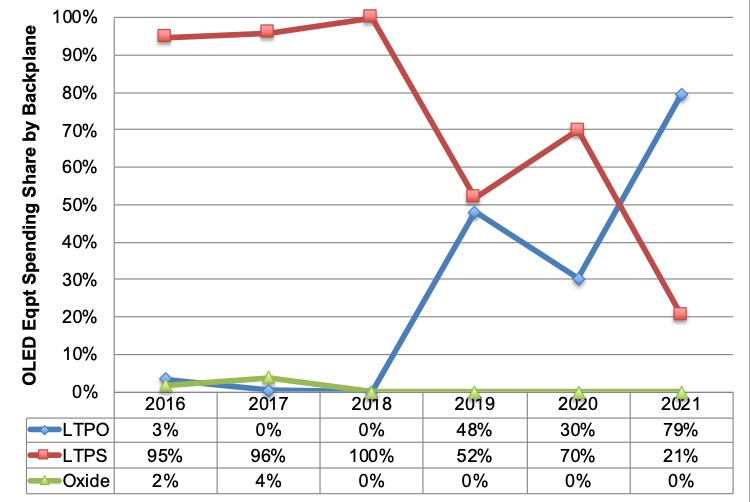

This quarter’s report reveals that the LCD fab closures in Korea will dramatically tighten LCD TV supply/demand and extend the investment period for LCDs relative to our previous report. This quarter’s report also includes details on all the new processes being developed in OLEDs including Y-OCTA, LTPO, color on encapsulation and micro light control (MLC) pattern process which are being implemented in 2020.

The report also reveals the impact of COVID-19 on equipment move-in and install timing. In general, Wuhan fabs are being delayed around 6 months and most installs in other parts of China are delayed 3 months as engineers returned to Japan and Korea in Q1’20. In addition, it has been challenging to get them to return to China as they are quarantined for 2 weeks in China and then quarantined in their home countries upon their return. On an install basis by year, this impacted the last phase of BOE B17, pushing it from 2020 to 2021 and reducing 2020 equipment spending by $1.1B.

There were a number of investments added and a few removed as their probabilities diminished which ended up reducing 2018-2024 spending by 3.2% to $131B.

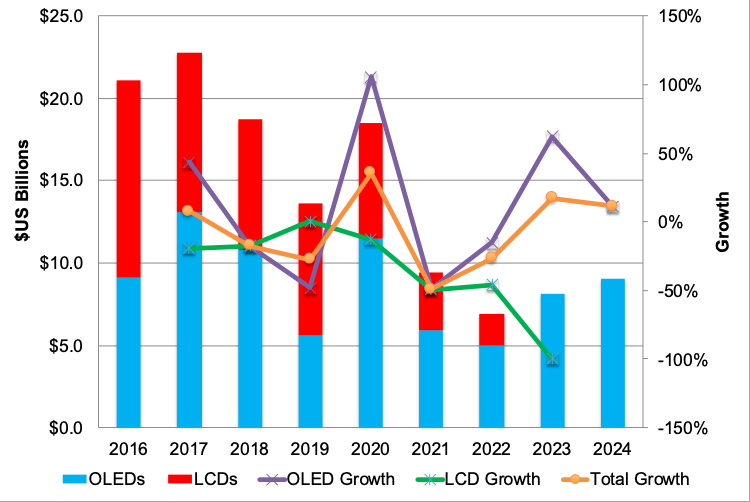

Our forecasts on both a move-in and install basis are shown in the figure below. As indicated, the trend is relatively the same with the market growing in 2017, falling in 2018-2019, rising in 2020, falling in 2021 and 2022 and rising in 2023 and 2024. There can be significant differences in a given year however which is the case in 2020 due to tool deliveries for a number of fabs moving to Q4’20. In fact, 66% of equipment revenues on a move-in basis will occur in 2H’20 due to COVID-19 delays. If tool shipment delays are extended beyond current expectations, it will smooth out 2020 and 2021 more.

2016-2024 Display Equipment Spending: Move-In vs. Install (Sign-Off)

Source: DSCC’s Quarterly Display Capex and Equipment Market Share Report

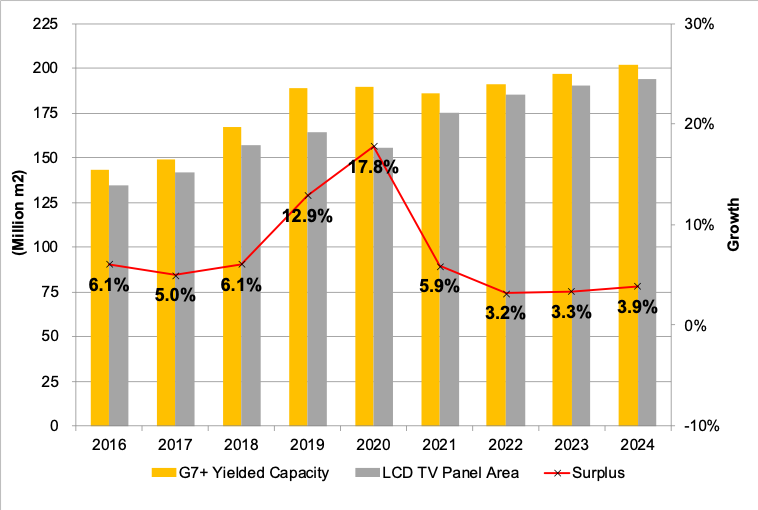

The report of course shows LCD vs. OLED spending. OLEDs are expected to account for 69% of 2019-2024 spending with OLEDs leading each year from 2020. We did add more LCD spending however this quarter at Sharp SIO, HKC H4 and H5 with LCD capacity falling 2% in 2021 and demand rebounding. Despite increasing LCD spending in 2021 and 2022, we still show the LCD TV panel surplus at just 3% – 4% from 2022 – 2024. The report also reveals OLED TV spending in terms of QD-OLED vs. WOLED and RGB IJP OLED.

2016-2024 LCD vs. OLED Equipment Spending (Move-In Basis)

Source: DSCC’s Quarterly Display Capex and Equipment Market Share Report

2016-2024 LCD TV Panel Supply/Demand

2016-2021 Mobile OLED Equipment Spending by Backplane Technology (Move-In Basis)

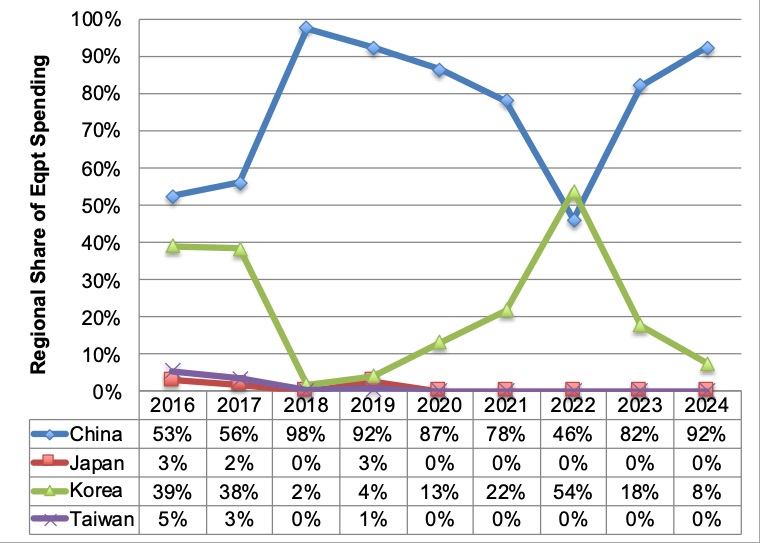

2016-2024 Display Equipment Spending by Country (Move-In Basis)

Source: DSCC’s Quarterly Display Capex and Equipment Market Share Report

By manufacturer from 2019 to 2024:

- BOE is expected to lead with a 23.9% share followed closely by China Star at 23.5%, SDC at 12.3%, HKC at 11.0%, Visionox at 7.8%, LGD at 7.6%, and Tianma at 7.4%. LGD’s drop to #6 reveals how they have changed their strategy.

- BOE led in 2019 and is expected to lead in 2021.

- China Star led in 2020 and is expected to lead in 2023 and 2024.

- SDC is expected to lead in 2022.

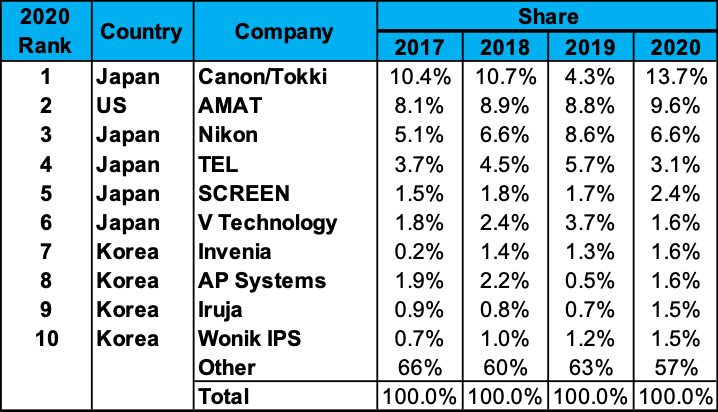

Market share is provided by supplier for over 65 different display equipment segments on both a unit and revenue basis. The top 10 suppliers for those categories are shown below on a move-in basis. In 2020, Canon is expected to reclaim the top position on massive growth in evaporation equipment and >100% growth in exposure equipment helped by gains in CF litho. AMAT is expected to gain share due to its strong position in both LCD and OLEDs. Nikon is expected to fall from #2 to #3 as G10.5 litho spending growth slows. TEL is expected to maintain the #4 position while losing share in both dry etch and coater/developers. SCREEN is expected to gain coater/developer share and rise to the #5 position. Other companies gaining share in the top 25 include AP Systems, Charm Engineering, HBT, ICD, Invenia, Iruja, Kateeva, LIS, Narae Nanotech, Top Engineering and Wonik IPS. Companies better positioned in OLEDs should gain share as OLED spending strongly rebounds. Of the top 25 suppliers, there are expected to be 13 from Korea, 9 from Japan and 3 from the US.

2017-2020 Display Equipment Supplier Share

Source: DSCC’s Quarterly Display Capex and Equipment Market Share Report