One of the speakers that I always like to listen to is Eric Virey of Yole Intelligence (I guess they got fed up with people mis-spelling Développement the French way!). I would have expected to hear him speak at Display Week in the Business Conference, but perhaps the firm is too competitive with the organizers, DSCC, so Eric spoke about the development of the MicroLED industry in the main symposium (Session 45.1).

He started by explaining that more than $8 billion has already been invested in the initial development of the MicroLED industry and this level of spending will continue at around $1.5 – $2 billion per year although it could accelerate quite soon with around $3 billion additionally to be spent on the first manufacturing ramp-up. By the end of 2025, the cumulative expenditure will have been around $16 billion. That’s around 10% of the the total capex on OLED since 2006. So, it’s still small, but there is real momentum behind MicroLED.

Pretty well every single display maker has already shown samples and prototypes using the technology and the quality and range of different specifications and applications has been increasing rapidly. There are displays for pretty well every application – except smartphones which remain a realk challenge. There are some commercial products including transparent commercial displays and some TVs from Samsung. The promised 89″ Samsung MicroLED TV has not arrived as the smaller end of Samsung’s MicroLED TV line has been pushed back.

Real Products in Commercial AR

AR glasses have seen a number of real products using MicroLEDs from JBD. These are pretty well all commercial AR products and despite a lot of spending and R&D from major consumer companies, there is still not much to be seen in the consumer market. The display is one challenge, but there are many other technical and social barriers. However, Virey remains convinced that when high volume AR does arrive, MicroLED will be the display technology of choice.

Apple has made some noise about MicroLED in smartwatches with possible panel production in late 2024 or early 2025 and commercial release of a product in Q3 2025. It is working with ams Osram and LG Display (which now has a smartwatch task force). However, AUO will be in production of round smartwatch displays using MicroLED by late 2023 and Yole is betting on a brand such as Tag Heuer to introduce a product using the technology in a luxury watch.

Yole has been saying for three years that Apple would start with devices made on 8″ substrates by ams Osram and that was confirmed in 2022 when Osram announced an investment of $800 million to build a fab. Overall, the total investment will be around $2 billion and Virey sees this as an inflection point in the development of the industry.

JBD is investing $100 million+ in a 4″ fab and Aledia in France is investing around the same to make 8-12″ wafers. Sanan is investing $1.9 billion in multiple phases up to 6″ wafers and Epistar is starting next year with AUO and PlayNitride in an investment of around $130 million. BOE has taken control of HC Semitek and has a $300 million plan for production in 2025. Sitan is building a fab in China and many other small fabs and pilot lines are in construction.

Strong ecosystems are developing around AUO/Ennostar/PlayNitride and Hon Hai/Innolux in Taiwan and there is lots of work in Taiwan to support this. In China, LCD makers are aligning with LED firms to ensure some vertical supply.

There are still a lot of the same technical challenges that have faced the industry for many years but there is ‘progress on all fronts.’ Progress does not mean ‘we are there yet’ and the road is still long to get to final products with volume supply. We are probably at 90% to 95% of the way, but with issues such as dead pixels and uniformity, it is often the last few percent that are the most challenging (and if you doubt that, look at inkjet printing of OLEDs).

Cost remains a challenge and Virey still sees a ‘potential showstopper’ in developing a cost effective and efficient production yield and repair process. Without that, it will be hard to achieve the kind of 20x cost reduction that will be needed. Transfer and assembly has seen enough significant progress to be a small part of the overall cost in the end. You can’t really ‘shoehorn’ MicroLED into existing LED fabs, you need a paradigm change to use ‘semiconductor-style’ manufacturing with high automation, and better processes. It’s a challenge, but it’s not a surprise to see Apple and ams Osram go that way.

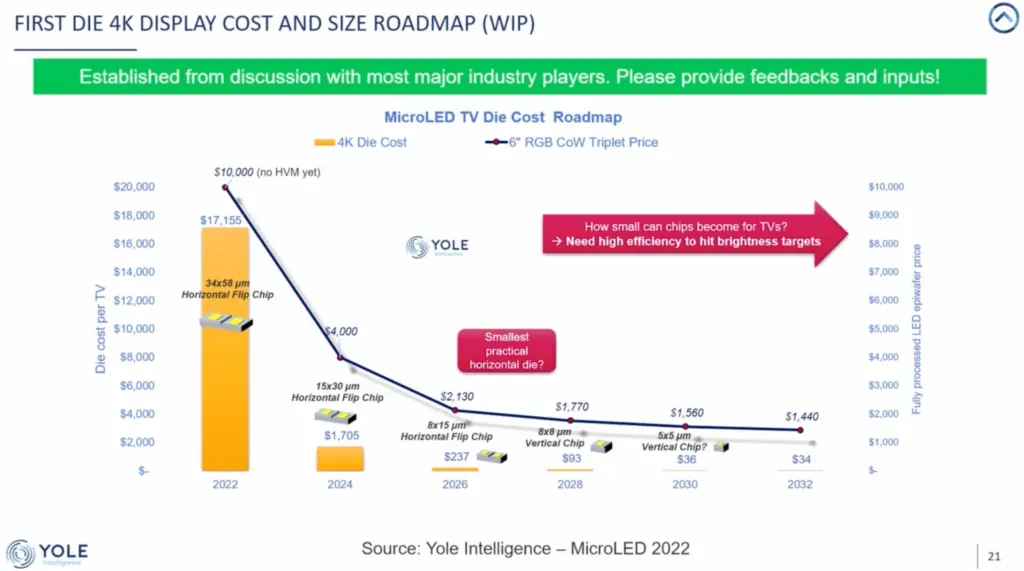

Virey showed the Yole roadmap for getting MicroLED down to the kind of cost needed to enter the TV market, but he emphasized that this is not an agreed roadmap and there will need to be some convergence on what is needed to develop a roadmap to get there.

In summary, there is a lot of momentum and a lot of turnkey tools for the manufacturing processes and there are some real ecosystems developing. There are many challenges and most display companies are still really viewing MicroLED development as a defensive position. There is a worry if the two big pioneers, Apple and Samsung, fail or give up. That makes the Apple development to be an incubator for the technology. There is a question of whether specialty markets can reach critical mass without big volume coming from consumer applications such as TVs? Virey is adding AUO to the list of two, as in his view ‘failing is not an option’ for the firm which is out of the race in OLED. Innolux is in a similar position. There is also a question of what will happen in China.

Virey presented two scenarios – in one, just smartwatches and AR/MR/VR are the only markets, but in the other, success in those applications will help push on other applications.

Bob Raikes is semi-retired from the display industry, but still edits the 8K Association newsletter and contributes to Display Daily. He reported from Display Week for Display Daily, the 8K Association and Information Display.