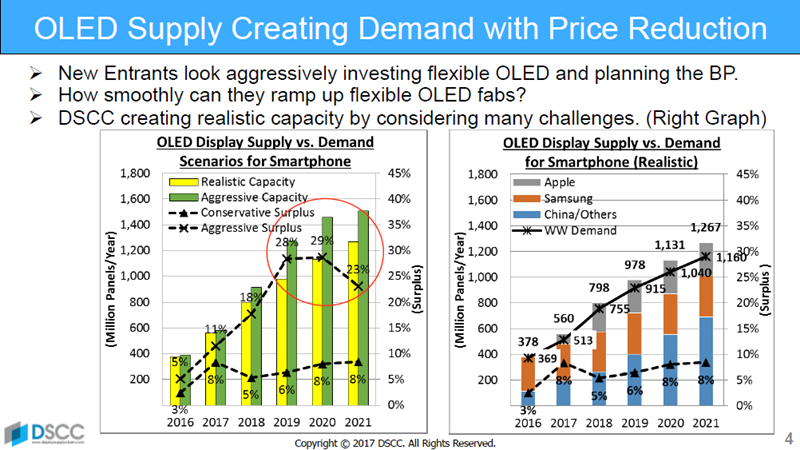

Yoshio Tamura is from DSCC and said that the OLED supply demand could follow a similar path to the LCD business. However, he said, there are many challenges in engineering and patents. DSCC has developed a capacity and supply chart that suggests that there will be a small surplus in supply over demand in OLEDs for smartphones, but not enough to allow everyone that wants to use OLEDs to do so.

Yoshio Tamura is from DSCC and said that the OLED supply demand could follow a similar path to the LCD business. However, he said, there are many challenges in engineering and patents. DSCC has developed a capacity and supply chart that suggests that there will be a small surplus in supply over demand in OLEDs for smartphones, but not enough to allow everyone that wants to use OLEDs to do so.

Samsung has dominated the supply and purchase of OLEDs in smartphones so far, but Apple is joining the market as a buyer. Later, China, especially Huawei, will grow from 2019 to absorb Chinese OLED production and China will become the main region taking OLEDs in 2019.

OLED Supply and Demand is subject to a lot of variables but DSCC expects a small surplus of OLEDs for smartphones

OLED Supply and Demand is subject to a lot of variables but DSCC expects a small surplus of OLEDs for smartphones

Apple and Samsung will be heavily dominated by AMOLED use in their smartphones, but if LCD prices fall, some of the Chinese brands will take a relatively low level of OLED. However, overall LCD volume will drop in the smartphone market.

The Chinese OLED fabs will start to really start to ship volume in a couple of years and that will mean that Samsung’s share will be diluted by the others. However, the Korean company may have the capacity for 850 million panels by 2020. Much will depend if it is capable of developing foldable production, Tamura believes.

Looking by form factor, inside foldable (where the display surface is on the inside of the fold) is very difficult, but outside foldable is easier because it usually has a higher radius. Samsung may start to supply foldable display-based products by 2019. Tamura said that early phones with foldable displays might cost three times the current level of costs – and that might mean pricing of, maybe, $1500 for a smartphone. However, new classes of device might come into the market based on the new form factor.

Looking at notebooks, perhaps only 10% of the market is in the premium segment and the same is true of tablets and it’s in the premium segment that OLED has an opportunity to penetrate.

“Can LCD compete?”, Tamura asked. LTPS LCD makers are struggling to win the fight with OLED in small displays and there may be structural changes in the industry with further fabs closing.

In the past, Apple used JDI, LGD and Sharp as suppliers for its LCDs. For flexible OLEDs, initially it has to buy from Samsung but it will try to help others to develop their supply chains.

Looking at the rumours about Apple’s designs, Tamura believes that around 92% of the front of the body will be display – even more than Samsung. Apple will switch to 18:9 aspect ratio or even 18.5:9.

When will there be enough capacity for Apple to eliminate LCD? Maybe next year. Apple is expected to use a 6.6″ display on this year’s 5.5″ body size. Supply is likely to be tight so Apple really needs some capacity from China and Japan. Because of this, Apple will probably continue to supply some LCD-based phones, as will Samsung for the same reason. The critical factor will be what happens in China. Demand from China is likely to be for more than supply side for several years.

LCD will take the low end of the smartphone market for some time.

VR Displays – an Opportunity for OLEDs

Turning to VR displays, Tamura said that OLED could be good for this application. There are other applications such as automotive and the Apple touch bar that will be able to exploit the features of OLED, but they are very small compared to smartphones.

OLED TV will increase, DSCC believes that much depends on OLED inkjet printing. Chinese companies will join the OLED TV market if they can make panels using inkjet and there is a possibility that the Chinese government will invest to enable this.

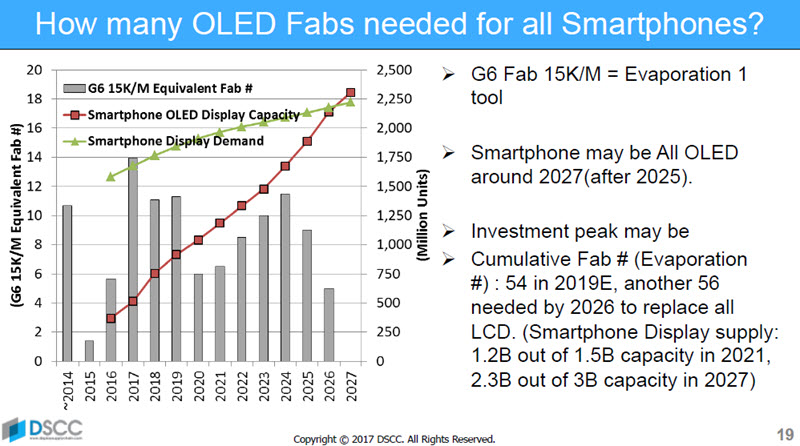

Finally, DSCC believes that it will be after 2025 before there will be enough capacity for AMOLED to supply all the smartphone market.