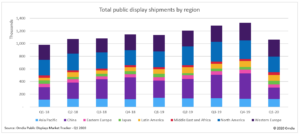

China’s public display market suffered the largest decline of any region due to the COVID-19 pandemic—a development that knocked the nation out of its worldwide leadership position.

Unit shipments of public-display products in China in the first quarter fell by 54.9 percent on a quarter-over-quarter basis and dropped by 34.6 percent year-over-year, according to the Omdia Public Displays Market Tracker – Country Level report.

Public displays are flat-panel displays intended to be used in out-of-home (OOH), public environments, and by multiple individuals simultaneously. These displays convey information, advertising, or other forms of messaging with full color and full motion. Such displays, including interactive flat panel (IFP) displays and videowalls, are used extensively in retail outlets and public spaces.

“With China’s economy taking the brunt of the impact of the COVID-19 pandemic in the first quarter, it came as no surprise that the country’s public-display market suffered as well,” said Kelly Lum, principal analyst, pro AV devices, at Omdia. “The notably sharp declines were driven by the extension of the Chinese New Year holiday, combined with extensive factory closures as many cities and provinces went on lockdown.”

China falls behind Western Europe and North America

The plunge in shipments caused China to lose its position as the world’s largest region for public-display shipments. In contrast, Western Europe attained 4.1 year-over-year shipment growth in the first quarter—helping it to take regional leadership in the public displays market for the first time since 2017. The region also surpassed North America to reach the top spot.

Western Europe reported only a mild decline in quarter-over-quarter shipments during the first quarter, due to the strong performance from leading brands in the region such as Samsung, LGE and Philips. North America remained the second largest market in terms of shipments, although the region suffered a 1.6 percent year-over-year decline in the first quarter.

Western Europe and North America recorded quarter-over-quarter dips of 4.7 percent and 15.4 percent in shipments for the first quarter.

“Both Western Europe and North America reported admirable performances given the onset of shelter-in-place and lockdown restrictions for many countries in these region,” Lum said. “However, because many industries are experiencing the negative impacts from COVID-19—including project delays and postponements—the current scenario suggests a dismal outlook for second-quarter results.”

Public display product shipments drop in Q1

Global IFP display and videowall shipments suffered 37.4 percent and 34 percent quarter-over-quarter declines respectively in the first quarter, largely due to China’s weak performance, particularly from key brands such as SeeWo, Hitevision and Hikvision.

Worldwide videowall shipments for nearly all bezel-to-bezel width categories reported double-digit quarter-over-quarter declines, with the largest dip of 37.7 percent coming from the 2.00mm-3.99mm category.

Shipments for projected capacitive and frustrated total internal reflection (FTIR) touch technology recorded noteworthy global lifts of 53.3 percent and 79.9 percent year-over-year, respectively. Infrared touch displays remain the preferred technology, with more than 175,000 units shipped in the first quarter of 2020. However, demand is showing signs of slowing as projected-capacitive and FTIR technologies become more prevalent.

Korean and Japanese brands find growth amid the pandemic

Korean brands increased their public-display shipments year-over-year in North America and Western Europe in the first quarter, despite demand dips in China and North America due to COVID-19 impacts.

As expected, many Chinese brands suffered severe declines in the first quarter of 2020 both domestically and overseas, with quarter-over-quarter decreases ranging from 50 percent to 65 percent.

In contrast, Japanese brands recorded single-digit growth in the first quarter, with Panasonic and Sony reporting 8.9 percent and 2.6 percent quarter-over-quarter increases. ViewSonic also benefited from its strong performance in IFP/Touch displays, with an overall increase of 12.8 percent quarter-over-quarter.