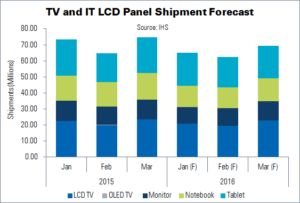

TV and IT display shipments are expected to face their first Q1 decline since 2009, according to IHS. Prices are falling for these displays, due to inventory adjustments by LCD makers and continued slowing demand, says IHS. This is affecting profitability for panel makers. IHS expects Q1’16 shipments to decline 8% YoY, to 196 million units.

Although LCD display unit shipments fell last year, shipment area was up due to the rising popularity of large TV sets – which helped to sustain the display industry. Large-area TFT LCD display shipments rose 5% YoY in 2015, while unit shipments were down 4% (to 694 million units). Yoonsung Chung, director of large area display research for IHS, said that global TV display demand was lower than initially forecast due to “global currency exchange issues and slower demand from emerging markets”.

Large display analyst, Linda Lin, expects TV panel demand will “continue to falter” in early 2016, due to excess inventory carried over from last year. Panel makers will have to reduce fab utilisation to control the deficits caused by overproduction, since ASPs are nearing manufacturing costs.

The sharpest YoY decline in panel shipments is expected to hit notebook PCs, with a 14% fall to 40.9 million units in Q1. OLED TV panels will be the only display segment to record growth in the period.

LCD TV panel oversupply will continue into the first quarter, said IHS. The leading six Chinese TV makers are expected to lower their panel purchasing by 37% QoQ, and 15% YoY. Samsung and LG Electronics will ‘slightly’ reduce panel purchases.

“Leading display manufacturers have not dramatically reduced fab utilisation in the fourth quarter of last year, but the situation will change in the first quarter of 2016, as they will be pressed to reduce the loading,” said Lin. “The Chinese New Year holiday, planned fab maintenance and repairs and the transition to thinner glass will also reduce output. BOE, ChinaStar, CEC-Panda and other leading Chinese manufacturers that are ramping up new Gen8 fabs will have to reduce their capacity utilisation in the first quarter to fight declining panel prices and shipments.”