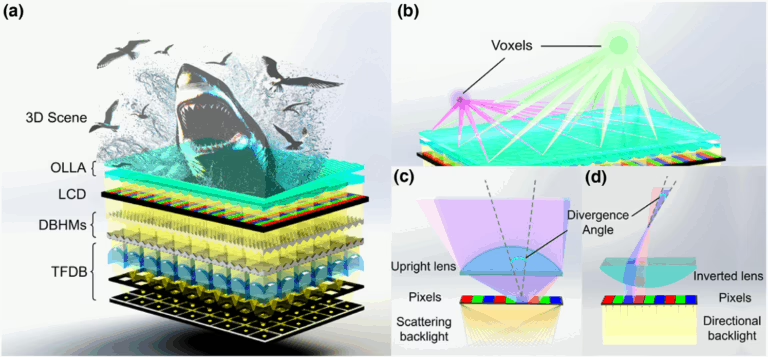

Ultra-slim light field panel brings miniaturized 3D pixels to life

Traditional 3D displays struggle with a fundamental trade-off. To create convincing depth, they must generate vast numbers of resolvable voxels without making the device bulky or losing image sharpness.